Refinancing a mortgage as a small business owner or LLC member can feel more complicated than a traditional refinance. Lenders often need additional proof that your business income is legitimate, stable, and well-documented. One tool many underwriters rely on is a cpa letter for mortgage underwriter, a formal statement prepared by a Certified Public Accountant to verify self-employment details and confirm that your financial information is based on accurate records.

If you’re navigating the refinance process and want to understand what lenders really expect, this guide breaks down the purpose of a CPA letter, what it should include, and how to prepare for it as a business owner.

Why a CPA Letter Matters in Mortgage Refinance for Small Businesses and LLCs

When you work for yourself, you don’t have the simplicity of W-2 income. Underwriters need a reliable source to confirm your financial standing, and a Certified Public Accountant (CPA) serves as that independent, trusted authority.

The Role of a CPA in Income Verification

A CPA brings a combination of knowledge, formal exam certification, and professional experience in accounting, auditing, and tax law. Lenders view CPAs as credible sources because their work is governed by standards of objectivity, risk management, and legal compliance.

A standard cpa letter for mortgage underwriter doesn’t offer opinion-based projections. Instead, it provides factual confirmation of your self-employment status and the accuracy of documents the CPA has prepared.

Why Lenders Rely on a CPA Instead of Business Owner Statements

Underwriting is about minimizing risk. Banks must verify income using reliable sources, not personal statements, estimates, or subjective claims. A CPA reviews your historical data, tax returns, and bookkeeping records using logic, analytical methods, and professional discipline.

This ensures lenders receive verifiable information, not assumptions or unrealistic forecasts.

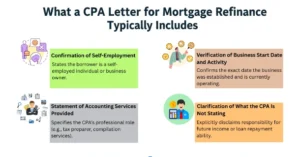

What a CPA Letter for Mortgage Underwriter Typically Includes

While wording may vary depending on the CPA’s style and the lender’s guidelines, most refinance letters include similar core elements.

Confirmation of Self-Employment

The CPA states the borrower is self-employed and identifies the business structure, such as:

- Sole proprietorship

- LLC or multi-member LLC

- S-corp

- Partnership

Verification of Business Start Date and Activity

Lenders want to know:

- How long the business has operated

- Whether it is currently active

- Whether the CPA has firsthand knowledge through tax preparation or financial reporting

Statement of Accounting Services Provided

This section helps underwriters trust the letter. It can reference:

- Tax preparation

- Bookkeeping

- Auditing

- Financial reporting

- Business accounting maintenance

This reassures lenders that the information is based on documented records, not memory or unsupported claims.

Clarification of What the CPA Is Not Stating

A compliant CPA letter avoids:

- Future income projections

- Guarantees of income stability

- Subjective assessments

CPAs operate under strict boundaries defined by tax law and professional ethics. They can confirm historical data but cannot speculate.

How Small Business Owners and LLCs Can Prepare Before Requesting a CPA Letter

Even a simple letter requires clear financial documentation. Preparing early can save time and prevent delays in underwriting.

Organize Your Business Records

Most CPAs will expect access to:

- Recent tax returns

- Profit and loss statements

- Balance sheets

- Business bank statements

- Entity formation documents (for LLCs)

Maintain Accurate Accounting

Lenders prefer financials that are up-to-date and supported by clean bookkeeping. Poor records lead to slower review times and additional questions.

Understand Your CPA’s Limitations

CPAs cannot:

- Manipulate numbers to improve loan chances

- Validate income that isn’t supported by records

- Confirm income from “making money online,” apps, or online advertising unless documented

If your business includes revenue from internet advertising (CPC, CPM models), digital marketing, or app-based earnings, be prepared to show proof.

Special Considerations for LLC Owners

LLCs With Multiple Members

Underwriters may request:

- K-1 forms

- Capital contribution statements

- Member distribution records

Single-Member LLCs

Income is typically reported on Schedule C, but lenders still require:

- Consistent tax filings

- Verified business activity

- Support from a CPA who has prepared your returns

Understanding Legal and Tax Law Requirements

LLCs may have pass-through taxation, which CPAs must explain clearly to make underwriter review easier.

How to Request a CPA Letter for Mortgage Underwriter

Step-by-Step Process

Schedule a Short Consultation

CPAs often require an initial review to confirm what the lender needs.

Provide Documents

The CPA cannot issue a letter without supported financial data.

Confirm Wording Requirements

Some lenders have specific phrasing they require in refinance letters.

Receive the Completed Letter

The letter is typically printed on firm letterhead, signed, and dated.

Why Strong EEAT Matters When Borrowers Search for CPA Support

Borrowers researching this process often rely on trustworthy sources, professional guidance, and clear explanations rooted in real accounting practices. A well-structured CPA letter helps underwriters trust the borrower’s financial history, ensuring a smoother refinance experience.