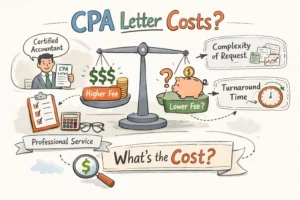

How Much Does a CPA Letter Cost? Complete Pricing Guide

How much does a CPA letter cost? If a lender, landlord, or investor asks for a CPA letter, knowing typical ranges and requirements helps you avoid surprise fees and underwriting delays. A CPA letter is an accountant’s statement about financial information, but the term covers several different services. A comfort