Self-employed borrowers often face a tougher path when qualifying for a mortgage, especially when applying for government-backed loans. FHA mortgages, insured by the Federal Housing Administration (FHA) and overseen by HUD, have flexible standards, but they still require clear, verifiable income documentation.

For business owners who do not have traditional W-2 income, a CPA letter can be an important piece of the puzzle. While FHA does not accept a CPA letter as a substitute for tax returns, FHA underwriters do rely on CPA verification when evaluating business operations, stability, and income legitimacy. Understanding cpa letter for mortgage without tax returns can help self-employed applicants prepare stronger, compliant loan files.

This guide explains why CPA letters matter, what FHA-approved lenders expect, and how to prepare clean documentation that aligns with HUD requirements.

Why Self-Employed Borrowers Face Stricter FHA Documentation Standards

Self-employed borrowers introduce more variables into a mortgage application. FHA underwriters must determine whether the income is stable, ongoing, and supported by financial records.

FHA Defines Self-Employment Clearly

Under HUD guidelines, a borrower is considered self-employed if they:

- Own 25% or more of a business, or

- Receive income from non-W-2 sources, such as small business operations, consulting, gig work, or contract work.

Why More Documentation Is Needed

Unlike W-2 employees, self-employed individuals must provide:

- IRS Tax Returns (personal and business)

- IRS Tax Transcripts (4506-C)

- Year-to-Date Profit & Loss (P&L) Statement

- Year-to-Date Balance Sheet

- Bank Statements (personal and business)

- Business formation documents

- Proof of business activity

This is where CPA involvement becomes valuable but must follow FHA rules.

FHA’s Stance on CPA Letters: What They Can and Cannot Do

A CPA letter is not an income replacement. FHA underwriters cannot use it instead of tax returns or audited financial statements. However, under the cpa letter for mortgage without tax returns, a CPA may verify several elements that help underwriters assess risk.

When an FHA Underwriter May Request a CPA Letter

Underwriters might ask for a CPA letter to:

- Confirm business ownership (percentage ownership)

- Verify business activity and time in operation

- Clarify business structure (LLC, S-Corp, Partnership)

- Support the legitimacy of income sources

- Confirm that the borrower’s financial statements were prepared using acceptable accounting methods

What a CPA Letter *Cannot* Replace

A CPA letter cannot take the place of:

- Business Tax Returns (Forms 1120, 1120-S, 1065)

- Personal Tax Returns (Form 1040)

- K-1 Statements

- Bank deposit verification

- Profit & Loss statements required for manual underwriting

FHA requires verifiable tax data, not just professional opinion.

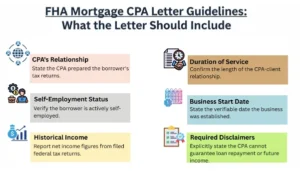

CPA letter for mortgage without tax returns: What the Letter Should Include

A valuable CPA letter, sometimes called a CPA Comfort Letter or CPA Verification Letter, must follow professional standards.

Key Elements FHA Lenders Expect

Business Verification

The CPA may confirm:

- Legal business name

- Type of entity (LLC, S-Corp, etc.)

- Date of formation

- Active status

- Business licenses

- Articles of Incorporation or Organization

Ownership and Management

HUD requires confirmation of:

- The borrower’s percentage of ownership

- The borrower’s role in daily operations

Financial Records Reviewed

The CPA must specify which documents they relied on, such as:

- Bookkeeping Records

- Bank Statements

- Year-to-Date P&L Statement

- Year-to-Date Balance Sheet

- Audited or unaudited statements

Professional Standards Compliance

The letter must avoid:

- Future income predictions

- Guaranteeing borrower’s loan repayment ability

- Unsupported statements

The CPA may only confirm information that is factual and documented.

Documentation FHA Lenders Require in Addition to the CPA Letter

Even with a CPA letter, FHA-approved lenders, mortgage brokers, and mortgage loan officers (MLOs) must follow HUD’s full documentation standards.

IRS Tax Documentation Requirements

Borrowers must provide:

- Personal Tax Returns (1040) for 1–2 years

- Business Tax Returns corresponding to their business type

- IRS Tax Transcripts via Form 4506-C

Business Financial Records

Depending on the complexity of the business, lenders may request:

- Year-to-Date Profit & Loss

- Year-to-Date Balance Sheet

- Bank Statements (business & personal)

- Audited Financial Statements, if applicable

Internal Controls and Stability Indicators

Underwriters also evaluate:

- Business internal controls

- Revenue consistency

- Cash-flow stability

- Declining or rising trends in income

This helps determine whether income is likely to continue.

FHA Underwriting: Automated vs. Manual Reviews

Automated Underwriting Systems (AUS)

When AUS approves the loan, documentation is still required, but sometimes fewer layers of review are needed.

Manual Underwriting Departments

If AUS cannot approve the loan, a manual underwriter may require:

- More detailed CPA verification

- More months of bank statements

- Additional financial clarity

Manual underwriting can be stricter, especially for self-employed applicants.

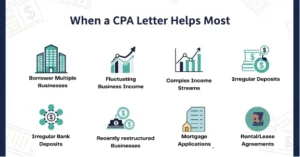

When a CPA Letter Helps Most

A CPA letter becomes particularly useful when:

- The borrower has multiple businesses

- Business income fluctuates

- Bank statements show irregular deposits

- The business is newly restructured

- Underwriters need confirmation of ownership or activity

Even though FHA does not use CPA letters to calculate income, underwriters rely on them to support the credibility of the financial file.