Bookkeeping vs. Accounting: Grasping the Core Differences

The fundamental difference lies in their focus: bookkeeping is about maintaining financial order, while accounting is about understanding financial meaning.

| Feature | Bookkeeping | Accounting |

| Primary Focus | Recording daily financial transactions | Analyzing, summarizing, and interpreting financial data |

| Main Goal | Ensuring accurate, organized, and up-to-date records | Providing insights and strategic advice for business decisions |

| Scope of Work | Day-to-day transaction recording (sales, expenses, invoices, payments) | Preparing financial reports, forecasts, tax strategies, and guidance |

| Impact | Verify financial data is accurate and current | Uses data to guide business strategy, tax planning, and financial forecasting |

The Accountant’s Role in Strategic Financial Insight

Accounting takes the accurate records compiled by the bookkeeper and goes a step further. It is the process of recording, summarizing, analyzing, advising, and reporting on a company’s financials. Accountants focus on the big picture of your company’s financial health.

An accountant’s responsibilities are more analytical and strategic:

- Reviewing data and financial statements prepared by the bookkeeper.

- Analyzing and interpreting financial data to provide strategic financial advice.

- Handling complex tax planning and preparation.

- Creating detailed financial forecasts and budgets.

- Conducting audits and ensuring compliance with financial regulations.

Exploring the Role of Bookkeeping in Business

Bookkeeping is the process of accurately recording, classifying, and storing all a business’s day-to-day financial transactions. It is the foundational, record-keeping part of the overall financial process.

A bookkeeper typically handles tasks that ensure financial records are correct and easy to access:

- Recording and classifying daily financial transactions.

- Managing accounts payable and accounts receivable.

- Processing payroll.

- Maintaining and balancing the general ledger.

- Generating basic financial statements or reports.

Where Bookkeeping Tasks End and Accounting Responsibilities Begin?

The Bookkeeper’s Role: The Foundation of Accurate Data

This role is all about the past and present. The bookkeeper is responsible for accurate and current data, ensuring every daily financial transaction is recorded and correctly classified. They Handle everything from accounts payable and receivable to company payroll. By the time they Generate basic financial reports, they’ve Maintained the meticulous records that make all subsequent analysis possible.

The Accountant’s Role: The Engine of Strategic Growth

This is where the financial baton is passed. Once the bookkeeper has established those accurate records, the accountant steps in to fulfill their responsibilities. As a financial expert, I know that an accountant’s value lies in their ability to look forward. They Review the meticulous financial statements and data prepared by the bookkeeper. Their main tasks are to Analyze and interpret this detailed financial data and then translate those numbers into actionable insights. They are deeply involved in tax planning and preparation , handling complex financial and legal compliance issues. The accountant will Provide strategic financial advice , Create detailed financial forecasts , and Conduct audits to ensure compliance

Choosing Smartly Between a Bookkeeper and an Accountant

When starting out, many small business owners ask me whether they need a bookkeeper or an accountant, or both. The answer is not one-size-fits-all; Selecting the right financial partner depends primarily on your business’s size, complexity, goals, and financial needs. A bookkeeper is ideal for handling your day-to-day financial tasks. They ensure your accounts remain accurate and updated by recording transactions, reconciling bank statements, and managing invoices.

The accountant, however, plays a more strategic role. They interpret financial data, prepare tax returns, create forecasts, and offer guidance to improve profitability. If your business is growing and you need deeper insights for decision-making or compliance, hiring an accountant makes more sense. The smartest approach is often a blend of both : a bookkeeper to keep records organized and an accountant to turn that data into actionable business strategies.

When to Hire a Bookkeeper vs. an Accountant

The smartest financial approach is often a blend of both professionals, but the right choice for your current needs depends on your business’s size, complexity, and specific goals.

Hire a Bookkeeper When:

A bookkeeper is ideal for handling day-to-day financial tasks and establishing a strong financial foundation:

- You are spending too much time on daily entries and basic financial tasks.

- Your business has straightforward transactions that need consistent, accurate recording.

- You need to establish and maintain an organized accounting system like QuickBooks.

- You are looking for help with the fundamental aspects of financial management while keeping costs manageable.

Hire an Accountant When:

As your business grows and becomes more complex, an accountant’s expertise becomes increasingly valuable for strategic guidance.

- You need deeper insights for major business decisions or compliance.

- You require strategic financial planning to guide your business’s financial future.

- You are dealing with complex financial structures, require sophisticated tax planning, or need to handle an audit.

- You are ready to take a deeper look at your financial health and future to improve profitability.

Key Factors to Help You Decide Between Bookkeeping and Accounting

Scope of Work, Transactional vs. Analytical

Bookkeeping focuses on the immediate details of the day-to-day running of the business, like managing invoices and payments. Accounting steps in to analyze and look ahead, providing insights.

Skills Required, Detail vs. Strategy

Bookkeepers need attention to detail for recording. Accountants require analytical and strategic thinking skills to advise management.

Impact on Business Decisions: Data Integrity vs. Guidance

Bookkeeping ensures your financial data is accurate. Accounting uses that data to guide business strategy and forecasting.

Education and Certification: Basic Training vs. Degree/CPA

Bookkeeping often requires basic training. Accounting usually requires higher education and professional certifications like a CPA.

The Role of Cloud Technology

Modern financial management increasingly relies on cloud-based accounting solutions, which affects how both bookkeepers and accountants work. This technology revolutionizes collaboration and security:

- Improved Collaboration: Cloud solutions provide real-time access to financial data, allowing bookkeepers and accountants to view and update information simultaneously, which minimizes errors and speeds up problem resolution.

- Enhanced Security: Cloud platforms offer advanced security, including firewall protection and high-level encryption, to safeguard sensitive financial data from unauthorized access.

- Disaster Recovery: Automatic, regular backups ensure that financial records are safe and accessible even in the event of hardware failure or a system crash.

Education and Certification Requirements

The difference in roles is reflected in the necessary education and professional credentials

Bookkeeper Qualifications

While bookkeepers can perform their job effectively with basic training or certifications , they generally do not need a degree in finance or a professional license. Key qualifications often include:

- Basic accounting or finance knowledge.

- Proficiency in bookkeeping software like QuickBooks or Xero.

- An understanding of financial regulations and compliance.

Accountant Professional Credentials

Accountants usually require higher education, typically a bachelor’s degree in finance or accounting. The most respected professional credentials include:

- Certified Public Accountant (CPA): CPAs have met state requirements, passed the challenging Uniform CPA Exam, and must meet ongoing education requirements. They specialize in areas like auditing or tax preparation and can represent clients before the IRS.

- Chartered Financial Analyst (CFA): This designation is highly respected globally and focuses on investment analysis, portfolio management, and ethical financial practices.

- Certified Internal Auditor (CIA): A CIA is certified in conducting internal audits, specializing in financial risk assessment and security monitoring processes.

Can Accounting Software Replace a Bookkeeper or Accountant?

In my experience advising companies on financial tools, I often get asked if automation means we don’t need people anymore. The truth is that not all businesses need, or can afford, the in-depth expertise of a hired accounting professional. If you’re handling accounting yourself or delegating this responsibility to a team member or department, accounting software can help you accurately and efficiently track and manage your business expense reports, invoices, inventory and payroll.

When choosing accounting software, you must consider your budget and business accounting needs. Many accounting programs have free versions that cover the basics, such as tracking income or generating financial reports. Trying a free solution can help you test an accounting platform and determine if an investment in a full-featured version is worthwhile.

Who Does Your Business Really Need?

Every business reaches a point where financial tasks become too complex or time-consuming to manage alone. That’s when the question arises: Who Does Your Business Really Need? In my professional experience, I’ve found that the right choice depends on the level of support your operations require.

A bookkeeper helps manage daily financial activities and ensures your records are in order. This professional focuses on recording transactions, reconciling accounts, and maintaining accurate ledgers. Their meticulous work gives you the essential, foundational data that keeps your operations running smoothly, providing the raw material for financial understanding.

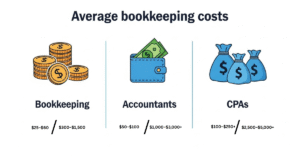

How do bookkeeper fees compare to accountant fees?

The difference in cost reflects the difference in qualifications and complexity of work performed. Accountants make more because of their educational background and certified public accountant (CPA) certification, which allows them to handle complex matters like tax law and auditing.

The US government keeps track of these averages: According to the U.S. Bureau of Labor Statistics, in 2023, the national average hourly rate for bookkeepers was $22.81 per hour and for accountants $38.41 per hour. While these numbers are averages, they clearly show that the hourly rate for the strategic, certified expertise of an accountant is significantly higher than that of a bookkeeper.

What are the key differences between a staff accountant and a bookkeeper?

Qualifications and Scope: The True Divide

Bookkeepers and staff accountants differ mainly in credentials and the complexity of their work.

Education and Certification

Bookkeepers don’t need an education in finance or certification, though licensing is available. Staff accountants typically have a bachelor’s degree in finance or accounting and often pursue professional credentials like a CPA.

Specialization and Expertise

CPAs are more specialized in tax codes and can represent clients before the Internal Revenue Service. Other accountants with CFA or CIA credentials offer focused expertise in areas like investment analysis or financial risk assessment.

Role in the Business

A bookkeeper handles the daily recording of transactions. An accountant uses that data for high-level tasks like tax planning, strategic guidance, and compliance, which a bookkeeper is generally not qualified to do.