Self-employed borrowers often face tougher documentation requirements when applying for a conventional mortgage, especially when their income fluctuates or when tax returns alone don’t fully reflect actual business activity. This is where a fha mortgage cpa letter guidelines often comes into play. While Fannie Mae and Freddie Mac do not officially require CPA letters, many lenders, underwriters, and mortgage brokers rely on them as supplemental verification to support a borrower’s Ability-to-Repay (ATR) under FHFA guidelines.

This guide breaks down how these letters work, why underwriters ask for them, and what borrowers, and CPAs, should know before preparing one.

Why CPA Letters Matter for Conventional Mortgages

Conventional mortgages backed by Fannie Mae, Freddie Mac, and overseen by the FHFA require lenders to verify stable, ongoing income. For self-employed borrowers, documentation isn’t always straightforward, so lenders rely on CPA letters to confirm:

- Business legitimacy

- Length of ownership

- Ongoing business operations

- Accuracy and consistency of financial records

- Whether the CPA prepared the tax returns being used for underwriting

A fha mortgage cpa letter guidelines supports, rather than replaces, core documents such as IRS tax transcripts, personal tax returns (Form 1040), business tax returns (1120, 1120-S, 1065), and bank statements.

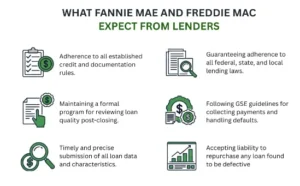

What Fannie Mae and Freddie Mac Expect From Lenders

Automated Underwriting Systems (DU and LPA)

Most conventional loans are run through:

- Desktop Underwriter (DU), Fannie Mae

- Loan Product Advisor (LPA), Freddie Mac

These systems analyze tax returns, P&Ls, bank statements, DTI ratios, residual income, and more to determine eligibility. A CPA letter does not influence DU/LPA directly, but underwriters may use it as a compensating factor during manual reviews.

Manual Underwriting and Additional Verification

In cases where automated approval is not granted, underwriters may require:

- Year-to-Date P&L Statements

- Year-to-Date Balance Sheet

- Business licenses

- Articles of Incorporation / Organization

- Bookkeeping records

- E-commerce and merchant processing statements

- Invoices and receipts

A CPA letter can help reconcile discrepancies or confirm business activity.

What a CPA Letter Can, and Cannot, Do

What It Can Verify

A compliant fha mortgage cpa letter guidelines may verify:

- Length of self-employment

- Entity type (LLC, S-Corp, C-Corp, Sole Proprietor)

- The CPA’s role in tax preparation

- Whether business activity is ongoing

- Historical revenue trends (without forecasting future income)

- Internal bookkeeping or internal control systems

- Whether documents provided to the lender match CPA records

What It Cannot State (AICPA Restrictions)

The AICPA, State Boards of Accountancy, and professional standards prohibit CPAs from:

- Guaranteeing future income

- Confirming that a borrower is “financially sound”

- Estimating future revenue

- Making promises about a borrower’s ability to repay

- Providing assurances beyond the data they prepared or reviewed

A professionally acceptable letter focuses on facts, not predictions.

Key Elements of a Strong CPA Letter

A thorough CPA letter should include:

CPA Credentials

- CPA name

- License number

- State Board of Accountancy registration

- Firm name & address

- AICPA membership (if applicable)

Borrower and Business Details

- Business name and address

- Ownership percentage

- Type of entity

- Length of self-employment

Documented Financial Verification

The letter may confirm:

- The CPA prepared the borrower’s tax returns

- Reviewed financial statements such as P&L and balance sheet

- Verified transactions using bookkeeping records, merchant statements, invoices, or bank deposits

Activity and Stability Indicators

Underwriters want verification of:

- Ongoing business operations

- Reasonable cash flow

- Consistency between tax returns and year-to-date financials

This supports the lender’s evaluation of debt-to-income (DTI) ratios and ATR requirements.

When Lenders Typically Request CPA Letters

Irregular Income History

Gaps, declining revenue, or fluctuating cash flow commonly trigger a request.

Missing or Limited Financial Records

If tax returns don’t tell the full story, underwriters may need confirmation of business activity.

Recent Business Changes

Business restructuring or formation may require clarification from the borrower’s CPA.

Used as a Compensating Factor

When DU/LPA findings are borderline, underwriters may request a CPA letter to strengthen the file.

How Underwriters Use CPA Letters in Credit Risk Assessment

Fannie Mae and Freddie Mac guidelines emphasize:

- Ability-to-Repay (ATR)

- Credit risk assessment

- Stability of income

- Qualified Mortgage (QM) guidelines

A CPA letter helps the lender complete a full 360-degree review of the borrower by providing insight into:

- Business sustainability

- Internal controls

- Accuracy of financial statements

- Consistency between reported and actual income

- Potential red flags (large one-time expenses, unexplained revenue changes, etc.)

Though it can’t replace tax returns or audited financials, it supports credibility and documentation quality.

Best Practices for Borrowers Requesting a CPA Letter

Request Early

CPA firms often need time to pull records, verify data, and ensure compliance.

Provide All Business Records

Helpful documents include:

- P&Ls

- Balance sheets

- Bank statements

- Merchant processing reports

- Invoices and receipt logs

Ensure Your Financials Match Tax Returns

Inconsistency triggers red flags, and often delays.

Avoid Pressuring Your CPA

They cannot write subjective opinions that violate AICPA rules.

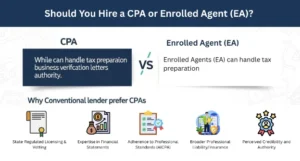

Should You Hire a CPA or Enrolled Agent (EA)?

While Enrolled Agents (EA) can handle tax preparation, only a Certified Public Accountant can issue certain business verification letters under state licensing authority. Conventional lenders often prefer CPAs because of:

- State Board oversight

- AICPA professional standards

- The CPA’s ability to assess internal controls

- Confidence in financial documentation

For a fha mortgage cpa letter guidelines. Using a licensed CPA increases lender credibility.