CPA Letter Requirements for Mortgage Lenders: What Underwriters Need to See

When a self-employed borrower applies for a home loan, mortgage lenders often ask for a CPA letter to verify income, business stability, and tax-related information the underwriter cannot confirm through pay stubs or traditional W-2 documentation. Over the past few years, these requests have become increasingly detailed as lenders tighten their risk-management standards and rely more heavily on accounting professionals to validate borrower-supplied financial data.

Understanding CPA letter requirements for mortgage lenders is essential, not just for borrowers, but also for CPAs, accounting firms, and advisors who provide tax planning, bookkeeping, payroll services, entity selection guidance, and broader business consulting. A well-prepared letter allows underwriters to assess income reliability, confirm the legitimacy of a business, and determine whether the borrower meets qualification standards for the loan program.

This guide breaks down the exact elements underwriters expect to see, why the request exists, and what CPAs are ethically and legally allowed to state.

Why Mortgage Lenders Request CPA Letters for Self-Employed Borrowers

Self-employed individuals operate differently from traditional employees. Their income fluctuates, expenses vary, and tax strategies may affect reported earnings. This is why lenders rely on a CPA letter for self-employed mortgage borrowers, a supporting document prepared by a certified public accountant who understands the borrower’s business structure, cash flow patterns, bookkeeping records, and tax filings.

Most lenders are not asking the CPA to verify income down to the dollar. Instead, they want reassurance that:

- The borrower has been operating the business for a certain number of years.

- The entity is legitimate, active, and producing revenue.

- The borrower has filed taxes appropriately and maintains proper accounting records.

- There are no red flags in management practices, payroll activities, or compliance history.

This letter becomes part of the underwriter’s broader review process, alongside bank statements, tax returns, financial statements, and third-party data sources.

What Underwriters Need to See in a CPA Letter

Underwriters follow internal lending guidelines, investor requirements, and in many cases, rules established by Fannie Mae, Freddie Mac, FHA, or portfolio lenders. While every institution has slightly different expectations, several core components appear consistently.

Verification of Self-Employment Status

A foundational element of CPA letter requirements for mortgage lenders is a clear statement confirming the borrower is self-employed. The letter should outline:

- Business name and entity type (LLC, LLP, sole proprietorship, S-Corp, etc.)

- How long the borrower has been operating the business

- Industry type and services offered

- If the CPA has prepared taxes, provided bookkeeping, reviewed payroll, or offered advisory services

Underwriters rely heavily on this because online information, public sources, and rating/review platforms do not always provide a complete picture of a small business.

Confirmation of Business Activity and Stability

Mortgage lenders want assurance that the business is real, active, and generating income. This typically includes:

- Frequency of financial statement preparation

- Existence of a bookkeeping or accounting system

- How cash flow management is handled

- Whether payroll services are used

- General financial trajectory (without projecting future income)

- Years in operation

CPAs cannot guarantee future profitability, but they can confirm that the business has maintained operations over time.

Acknowledgment of Reviewed Tax Documents

CPAs may reference tax returns, business tax filings, entity records, or financial statements they have prepared or reviewed. Common examples include:

- Federal income tax returns (IRS Form 1040 with Schedule C, 1120-S, 1065, etc.)

- Profit and loss statements

- Balance sheets

- Retirement contribution records

- Real estate activity notes

- Payroll summaries

- Accounting system reports

This does not mean the CPA is providing assurance or audit-level verification. Instead, they are confirming the existence and nature of the documents they have worked with.

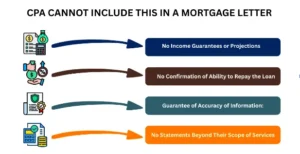

What CPAs Cannot Include in a Mortgage Letter

Because of AICPA guidelines and liability concerns, CPAs must follow strict boundaries.

No Income Guarantees or Projections

A CPA cannot state:

- Expected income for current or future years

- That the borrower “qualifies” for a mortgage

- Anything resembling a financial guarantee

This protects CPAs from acting as underwriters and ensures compliance with professional standards.

No Confirmation of Ability to Repay the Loan

Underwriters, not CPAs, assess repayment capacity. CPAs only provide factual historical data, not lending opinions.

No Statements Beyond Their Scope of Services

If the CPA has never provided bookkeeping, payroll, entity planning, or tax preparation for the borrower, they cannot reference those items. Every statement must be grounded in work the CPA has actually performed.

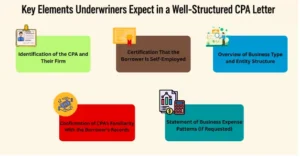

Key Elements Underwriters Expect in a Well-Structured CPA Letter

Below is a breakdown of what a fully compliant letter typically includes.

Identification of the CPA and Their Firm

Underwriters look for:

- CPA’s name and credential status

- Firm or practice name

- Services provided (tax planning, bookkeeping, accounting services, retirement planning, payroll, etc.)

- Contact information

- Duration of professional relationship with the client

A strong letter reflects the CPA’s expertise, credibility, and professional standing

Certification That the Borrower Is Self-Employed

Underwriters want proof that the borrower:

- Operates a legitimate business

- Has maintained operations for a specific number of years

- Files taxes for that business

- Is responsible for managing income, expenses, payroll, or subcontractors

Overview of Business Type and Entity Structure

This section may include:

- Entity selection (e.g., LLC, S-Corp, partnership)

- Nature of services or products offered

- Any advisory or planning services provided to the business

Entity structure often affects how income appears on tax returns, so underwriters review this carefully.

Confirmation of CPA’s Familiarity With the Borrower’s Records

A compliant CPA letter states how the CPA obtained knowledge of the borrower’s finances. Examples include:

- Tax preparation over multiple years

- Full-service accounting support

- Initial consultation and ongoing advisory

- Bookkeeping or payroll management

- Reviewing employee benefit plans

- Assistance during startup stages or raising capital

- Real estate investment guidance

- Estate planning or retirement strategy

- International taxation considerations

This context helps an underwriter evaluate the reliability of the information provided.

Statement of Business Expense Patterns (If Requested)

Some lenders request verification of an expense ratio. A CPA may confirm whether expense levels fall within typical ranges for similar businesses—but cannot provide certified audit figures.

Examples include:

- Marketing and advertising

- Payroll costs

- Contractor payments

- Equipment purchases

- Real estate expenses

- Inventory

- Insurance

- Professional services

Why CPA Letters Matter in Modern Mortgage Underwriting

As lending standards evolve, underwriters rely on multiple sources to assess risk. A CPA letter functions as a bridge between traditional financial verification and the complexities of small business economics.

CPAs understand how taxes, cash flow cycles, payroll, and entity structures influence reported income, areas the lender may not fully grasp. This is especially crucial for:

- Startup-stage companies

- Seasonal businesses

- Real estate investors

- Independent contractors

- High-growth entrepreneurs

- Firms with unique accounting needs or compliance issues

Mortgage lenders are not evaluating the quality of the CPA’s tax strategy or investment planning; they simply need accurate historical confirmation.

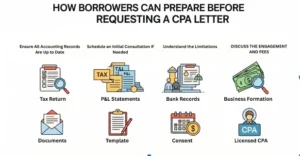

How Borrowers Can Prepare Before Requesting a CPA Letter

Self-employed individuals should approach the request thoughtfully.

Ensure All Accounting Records Are Up to Date

This includes:

- Bookkeeping

- Payroll reports

- Cash flow summaries

- Tax filings

- Financial statements

CPAs cannot issue a letter without reviewing accurate information.

Schedule an Initial Consultation if Needed

Borrowers who have not maintained a regular relationship with a CPA may need:

- Tax planning advice

- Entity selection guidance

- Accounting cleanup

- Business management review

- Estimated tax planning

- Retirement contribution strategy

Understand the Limitations

Borrowers should not pressure their accountant to make statements beyond the scope of professional standards. Underwriters reject letters that include inappropriate assurances.