For many borrowers, especially those who are self-employed, one of the most uncomfortable parts of the mortgage process is figuring out cpa letter for conventional mortgage fannie mae freddie mac. Mortgage lenders often want extra verification that your income is legitimate, your business is active, and your financial records match what’s on your application.

Loan officers experience this problem from the other side as well: they know exactly what underwriters need, but borrowers aren’t always sure what to tell their accounting firm.

This guide explains exactly how to approach your CPA, what information they will need, how to make the request professionally, and provides ready-to-use email scripts for borrowers and Mortgage Loan Officers (MLOs).

Why Mortgage Lenders Request CPA Letters

Underwriter Verification Requirements

In today’s lending environment, whether it’s a conventional mortgage lender, an FHA / VA / USDA lender, or a portfolio lender, underwriters often need confirmation of:

- Business activity

- Income stability

- Years of self-employment

- Accuracy of tax returns and financial statements

- Ownership structure of the business

This applies when the borrower runs a company, operates as a sole proprietor, or uses merchant processors like PayPal, Stripe, Square, or Shopify to receive business income.

When Automated Systems Flag the File

Even if Desktop Underwriter (Fannie Mae) or Loan Product Advisor (Freddie Mac) approves the loan, underwriters sometimes want additional comfort, especially if bank statements, Profit & Loss statements, or bookkeeping records show fluctuations.

A CPA letter gives them confidence, but only if it’s written under proper AICPA ethics, state board standards, and with the right disclaimers.

Before You Ask Your CPA: What You Must Prepare

Your CPA will only issue a letter after verifying certain facts. To avoid back-and-forth delays, prepare the following:

Your Basic Mortgage Information

- Lender name

- Type of loan (Conventional, FHA, VA, USDA, or portfolio)

- Purpose (purchase or refinance)

- Your Mortgage Loan Officer’s contact information

Your Financial Documents

Your CPA may need access to:

- IRS tax returns / transcripts

- Business tax returns (Forms 1120, 1120-S, 1065)

- Personal tax returns (Form 1040)

- P&L statement, balance sheet, and year-to-date financials

- Business bank accounts and personal bank accounts

- Invoices, receipts, and merchant statements (Stripe, PayPal, Square, Shopify)

- Bookkeeping records or accounting software data

Business Legal Documents

If you are self-employed through a business entity:

- Articles of Incorporation / Organization

- Business license

- Operating agreement (LLC)

- EIN documentation

Authorization Forms

Some accounting firms require:

- Written authorization

- A signed engagement letter

- A small service fee

This protects them legally under AICPA guidelines.

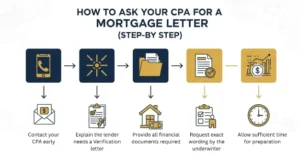

CPA Letter for Conventional Mortgage Fannie Mae Freddie Mac (Step-by-Step)

Step 1, Email, Don’t Call

Accounting firms operate on documentation, not verbal promises. Sending a written email ensures:

- The request is logged

- The CPA can assign it to the correct accounting staff

- The firm knows exactly what the lender needs

- You avoid miscommunication

Step 2, Be Clear About the Lender’s Requirements

Explain what type of letter your lender needs:

- CPA Letter

- Comfort Letter

- Verification Letter

- Self-Employment Verification

- Business Activity Verification

Underwriters do not want CPAs to estimate or project income. They only want factual confirmation.

Step 3, Provide All Documentation Up Front

Send your CPA:

- Lender’s sample letter

- Underwriter’s conditions

- Bank statements

- P&L or bookkeeping reports

The cleaner your package, the faster your CPA responds.

Step 4, Request the Letter Within Ethical Limits

CPAs must follow professional standards. They cannot:

- Predict future income

- Guarantee profitability

- State anything they cannot verify

This protects both you and your CPA legally.

Email Script Templates (Borrowers & Loan Officers)

Script 1, Borrower Requesting a CPA Letter

Subject: Request for Mortgage Verification Letter

Hi [CPA Name],

I hope you’re doing well. I am in the process of applying for a mortgage, and my lender has requested a CPA verification letter to confirm my self-employment status and the accuracy of my financial records.

Attached are the lender’s conditions and the sample letter they provided. I’ve also included my recent P&L, bank statements, and any documents that may help your review.

Please let me know if you need additional bookkeeping records, merchant statements (PayPal, Stripe, Square), or tax information.

Thank you for your help with this, please advise on the next steps, authorization forms, and your fee for preparing the letter.

Warm regards,

[Your Name]

Script 2, Mortgage Loan Officer Requesting a Letter on Behalf of Borrower

Subject: Verification Request for Borrower Applying for a Mortgage

Hi [CPA Name],

I’m working with our mutual client, [Borrower Name], on their mortgage application. To complete underwriting, we need a CPA letter confirming business activity, years of self-employment, and any financial documentation you have prepared.

Attached are the underwriting conditions and a sample letter format.

We greatly appreciate your assistance and can answer any questions you may have.

Best,

[Loan Officer Name]

[Company + NMLS Number]

What Your CPA Can and Cannot Say in the Mortgage Letter

Allowed (Factual Statements)

- Years of self-employment

- Entity type and ownership

- Whether the CPA prepared the tax returns

- Whether financial statements were prepared by the CPA

- Whether the business is active

Not Allowed (Due to AICPA Standards)

- Predictions of future income

- Guarantees of business stability

- Statements they cannot independently verify

- Misleading assurances to the lender

A properly structured letter protects the CPA’s license and your mortgage application.

Tips for Getting Your CPA Letter Faster

- Send your request early, accounting firms are busiest during tax season.

- Provide clean financial documents.

- Ask your MLO to give you a copy of exactly what the underwriter wants.

- Avoid rushing your CPA; quality verification takes time.

A respectful approach goes a long way when you’re learning cpa letter for conventional mortgage fannie mae freddie mac.