When self-employed borrowers apply for a mortgage, underwriting can feel like a detailed exam, one that tests not just finances, but documentation, consistency, and credibility. Unlike traditional W-2 applicants, self-employed individuals must rely on tax returns, business statements, and a CPA letter for mortgage underwriter review to demonstrate stable, verifiable income.

A well-prepared letter from a Certified Public Accountant (CPA) plays a crucial role in this process. It serves as an independent confirmation that the borrower is actively operating a business, filing taxes correctly, and maintaining financial records that align with lending guidelines. Underwriters must follow strict federal rules, investor requirements, and internal risk-management standards. A clear, compliant letter helps them make decisions confidently and efficiently.

This article breaks down the details underwriters look for, why the structure of a CPA letter matters, and how it ties into income analysis, tax law, and the broader ecosystem of mortgage lending.

Why Underwriters Rely on CPA Letters for Self-Employed Applicants

Mortgage underwriters rely on a CPA’s professional knowledge because self-employed income is inherently variable. Unlike an employee with predictable earnings, business owners often deal with fluctuating revenue, expenses, advertising costs, online marketing budgets, and industry-related risks.

A cpa income verification letter for mortgage provides context and clarity that raw documents alone cannot. Underwriters do not want subjective opinions, they want factual confirmations tied to tax preparation, accounting records, or auditing procedures that a CPA has personally handled.

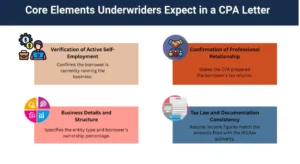

Core Elements Underwriters Expect in a CPA Letter

Underwriters follow strict checklists. While each lender may have slight variations, most look for the same foundational information.

Verification of Active Self-Employment

At its core, the CPA letter must confirm:

- The borrower is actively engaged in their business

- The business is legally formed and operational

- How long the CPA has worked with the client

- Whether the CPA prepared tax returns or provided accounting services

This reassurance helps the underwriter determine whether the business is stable enough to support ongoing mortgage payments.

Confirmation of Professional Relationship

Underwriters want clarity regarding the CPA’s role. A Certified Public Accountant cannot simply state they “know the borrower.” They must outline:

- Whether they provide tax preparation

- Whether they assist with bookkeeping or auditing

- Whether they have reviewed financial statements

- Whether the information is based on actual records, not estimates

This protects both the lender and the CPA, ensuring the letter remains factual rather than speculative.

Business Details and Structure

The letter must clearly define:

- Entity type (sole proprietorship, LLC, S-Corp, partnership)

- Industry and business nature

- Years in operation

- General financial consistency based on tax law and accounting principles

Underwriters compare this against bank statements, tax filings, and other data points to confirm alignment.

Tax Law and Documentation Consistency

Underwriters expect CPAs to confirm that:

- Tax filings have been completed in compliance with tax law

- Reported income aligns with submitted returns

- No contradictions appear between reported numbers and accounting records

A CPA cannot calculate qualifying income for the lender, but they can confirm the integrity of the tax documents provided.

What Underwriters Do Not Want in a CPA Letter

Many CPAs mistakenly add disclaimers or statements that cause underwriting delays. The following are red flags,

Subjective Assertions or Future Predictions

Statements like:

- The borrower is financially strong.

- The borrower will earn more next year.

Underwriters cannot use assertions based on subjective judgment, logic puzzles, or guesswork.

Income Guarantees

CPAs must avoid certifying specific income levels beyond what appears in prepared tax returns.

A mortgage file cannot rely on estimates, marketing projections, online advertising revenue predictions, CPC/CPM performance guesses, or any forecast that resembles “making money online” strategies.

Unverified Business Activities

Underwriters want confirmations tied to records, not to memory, assumptions, or second-hand information.

How CPA Letters Fit Into the Bigger Underwriting Picture

A CPA letter is just one piece of the underwriting puzzle. Underwriters cross-reference:

- Two years of tax returns

- Business bank statements

- Profit-and-loss statements

- Online advertising costs (if applicable), cost of goods sold, and general expenses

- Auditing notes (if any)

- Educational materials or financial worksheets the CPA used

The CPA letter is never a standalone approval tool, it’s designed to reinforce the credibility of other documents.

Why Self-Employed Applicants Should Prepare Early

Just as students prepare for the CPA exam. With courses, reading materials, and multiple-choice questions to build memory and knowledge, borrowers should prepare early before approaching a CPA for a verification letter.

Borrowers should ensure:

- Tax filings are up to date

- Business records are organized

- Advertising, marketing, CPM, and CPC expense logs are consistent

- Their CPA has access to accurate numbers

Preparation prevents delays and reduces back-and-forth communication with lenders.

What a Strong CPA Letter Ultimately Achieves

A strong CPA letter:

- Provides credibility

- Reduces underwriting questions

- Verifies business legitimacy

- Aligns with tax law and accounting standards

- Supports income analysis

- Helps the underwriter feel confident about risk

It is not meant to dramatize the borrower’s finances, it is simply a factual, professionally drafted confirmation.