For self-employed borrowers, qualifying for a mortgage can feel more complicated than it does for traditional W-2 employees. Instead of pay stubs and employer records, lenders must evaluate tax filings, business activity, and long-term income stability. That’s where a CPA income verification letter for mortgage underwriting comes into play.

A Certified Public Accountant (CPA) acts as a trusted third-party professional who can confirm key details about a borrower’s business operations, financial history, and documentation. Mortgage underwriters rely on this information, not subjective opinions, but verified data the CPA has worked with, to assess risk, determine income consistency, and ensure the file meets cpa letter requirements for mortgage lenders.

This guide breaks down how the process works, what banks are actually looking for, and how a well-structured CPA verification letter helps self-employed applicants navigate a system built primarily for traditional earners.

Why Mortgage Lenders Require CPA Income Verification Letters

Mortgage underwriting is a form of risk management, and for self-employed borrowers, the risk is tied to income variability, tax deductions, and business fluctuations.

The Role of the Certified Public Accountant (CPA)

A Certified Public Accountant (CPA) is trained in tax law, auditing, accounting, financial reporting, and compliance. They pass rigorous CPA exams, requiring extensive knowledge, logic, reading comprehension, and even a degree of rote memorization. Lenders trust CPAs because their work is regulated by state boards and established law.

Why Lenders Cannot Rely Solely on Borrower Statements

Borrowers running a business can have complex financial situations:

- fluctuating yearly profits

- deductible expenses that reduce taxable income

- business entities with multiple revenue sources

- mixed personal and business transactions

A CPA reviews objective documentation, tax returns, financial statements, bookkeeping records, rather than subjective or promotional material (like advertising or online marketing claims, CPM earnings, or “making money online” sources that cannot be substantiated).

What Underwriters Want to Confirm

Mortgage underwriters use the CPA letter to confirm:

- the borrower is legitimately self-employed

- the business exists and remains active

- tax filings reflect real business operations

- income sources are consistent over time

- no misleading or unverifiable claims are being used as income

Their goal is not to evaluate the borrower’s engineering skills, STEM background, learning habits, or performance in online advertising platforms, but to verify stable financial documentation rooted in accounting principles.

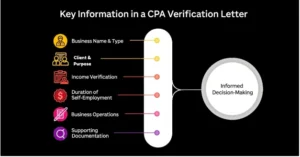

What a CPA Income Verification Letter for Mortgage Includes

While each bank sets its own standards, most of them expect the same core components.

Basic Professional Information

The CPA must clearly state:

- full name and title (Certified Public Accountant)

- licensing information

- accounting firm or practice details

- contact information (phone, email, SMS if applicable)

Business Details of the Borrower

Underwriters need confirmation of:

- the legal entity (LLC, S-Corp, sole proprietorship, etc.)

- years the business has been operating

- If the borrower actively participates in the business

- If the CPA prepares or reviews the tax returns

- Income categories and sources (but not future income predictions)

Compliance With CPA Letter Requirements for Mortgage Lenders

Mortgage lenders often specify that the letter may only confirm facts derived from tax law-compliant documents.

It cannot include:

- projected income

- statements guaranteeing future earnings

- subjective claims about business success

- unverified advertising revenue, CPM rates, or app-based income not reflected in tax filings

Verification Language Underwriters Prefer

Most lenders look for safe, factual language such as:

- I prepare the borrower’s federal and state tax returns.

- The borrower has been self-employed since 2015.

- The business is active and operational based on documents reviewed.

- This letter is based on information provided through tax preparation and accounting work.

Anything speculative is avoided to maintain compliance with CPA ethics and state board rules.

How Banks Use CPA Letters to Verify Self-Employed Income?

Banks use a mix of documents to cross-check income. The CPA letter is one piece of the puzzle, but an important one.

Combining the CPA Letter With Tax Documents

Underwriters typically pair the CPA letter with:

- the last two years of personal tax returns

- the last two years of business tax returns

- year-to-date profit and loss statements

- balance sheets

- bank statements confirming deposits

The CPA letter gives context to these records.

The Logic Behind Mortgage Calculations

Underwriters use logic-based calculations, not subjective judgment. They analyze:

- multi-year income averages

- non-recurring expenses

- depreciation

- business structure and revenue patterns

The CPA letter confirms the legitimacy of the financial sources they are analyzing.

Screening for Red Flags

Lenders also look for:

- businesses with large swings in income

- income from online advertising or internet marketing that isn’t reported to the IRS

- app-based or CPM revenue without proper documentation

- inconsistencies between tax filings and bank statements

A CPA’s involvement gives lenders confidence that the borrower’s financials comply with tax law, not informal self-reported income.

What CPAs Should Avoid When Drafting the Letter

A CPA must follow professional standards, meaning the letter cannot include content that falls outside accounting practice.

No “Guarantees” or Future Predictions

CPAs cannot state:

- projected earnings

- expected growth

- stability guarantees

- performance tied to online ads, CPC, CPM, or marketing plans

No Subjective Evaluations

Statements such as “The business is successful” or “The borrower is highly skilled in engineering, STEM work, or marketing” are avoided. The CPA focuses only on verifiable financial and tax records.

No Income Calculations That Aren’t in Tax Returns

If a borrower earns internet advertising income, app revenue, CPC/CPM monetization, or marketing income, it must be reflected on filed tax returns before a CPA will reference it.

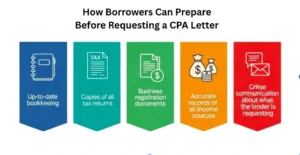

How Borrowers Can Prepare Before Requesting a CPA Letter

Borrowers should be ready with:

- up-to-date bookkeeping

- copies of all tax returns

- business registration documents

- accurate records of all income sources

- clear communication about what the lender is requesting

The better organized the borrower is, the faster the CPA can prepare a compliant letter.