If you’re self-employed, getting a home loan often feels like you’re being judged more on your paperwork than your actual success. Your business might be thriving, but to lenders and underwriters, what really matters is how clearly your income, tax returns, and financial story are presented.

That’s where a CPA Letter for mortgage can quietly become your secret weapon.

In this guide, we’ll walk through how a cpa letter for self-employed mortgage borrowers works, why lenders ask for it, what it should include, and how to work with your CPA so the letter actually helps your approval instead of raising new questions.

Why Self-Employed Borrowers Face Extra Scrutiny

Traditional employees vs. self-employment

If you’re a salaried employee, your mortgage loan application is simple:

- Pay stubs

- W-2s

- Maybe a couple of bank statements

For self-employed borrowers, things are messier. You might be:

- A sole proprietor filing a Schedule C

- The owner of an LLC or limited liability company

- Operating under a doing business as (DBA) name

- Juggling multiple clients, contracts, or income streams

On paper, tax returns can make your income look smaller than it feels in reality, especially if you take legitimate business deductions. Lenders only see what’s reported to the IRS, not the effort, risk, or growth behind your self-employment.

Why lenders don’t rely on income alone

From the lender’s perspective, your ability to handle mortgage debt isn’t just about how much money you say you make. It’s about:

- Stability of income over time

- Nature of your business and ownership

- Existing obligations like loans and accounts payable

- Your assets and savings available for a down payment

A CPA Letter for mortgage acts as a bridge between your raw documents and your story, helping mortgage lending teams and underwriters interpret your situation correctly.

What Is a CPA Letter for Self-Employed Mortgage Borrowers?

Basic definition

A cpa letter for self-employed mortgage borrowers is a formal letter written by a certified public accountant confirming key details about your business and income. It’s usually printed on firm letterhead, signed by the CPA, and addressed to the lender, money lender, or mortgage company.

The letter doesn’t replace your tax returns, but it helps explain and verify them.

How it differs from tax returns and bank statements

- Tax returns

Show what you officially reported to the IRS. Lenders use them to calculate average income, but returns don’t always explain why numbers went up or down. - Bank statements

Show cash flow, deposits, and general activity, but they don’t confirm whether that income is business-related or personally sustainable. - CPA Letter for mortgage

Adds professional context: how long you’ve been in business, the type of entity (sole proprietor, LLC, DBA), how income is derived, and whether the business appears stable from an accounting and compliance perspective.

Common names you’ll hear

This letter is often called:

- CPA verification letter for mortgage

- Self-employment verification letter

- CPA income verification letter

- Accountant’s letter for home loan underwriting

They all serve the same core purpose: helping mortgage lending teams get comfortable with your self-employed income.

What Lenders and Underwriters Look For in a CPA Letter

Key information your CPA may include

A strong CPA letter doesn’t ramble, but it also doesn’t feel like a one-line form letter. Typically, it covers several important points.

Business structure and ownership

Underwriters want to know:

- Your business name and whether you’re doing business as another name

- Your business structure: sole proprietor, LLC, partnership, S-corp, etc.

- Your ownership percentage if it’s a multi-owner limited liability company or corporation

- How long the business has been operating

This helps lenders decide whether your self-employed income is likely to continue.

Income verification and stability

A CPA may:

- Confirm that they prepare your tax returns and/or financial statements

- State that your income is derived from self-employment in a specific industry

- Mention how many years you’ve reported positive income

- Sometimes provide an average income figure based on filed returns and financial records

This is where the letter supports the numbers the underwriter plugs into the mortgage calculator or home loan calculator to check your debt-to-income (DTI) ratio.

Compliance, IRS filings, and accounts payable

Lenders are wary of surprises. Your CPA might include statements like:

- Tax filings are current with the IRS

- Major accounts payable or business loans that could affect your cash flow are properly recorded

- There are no known issues that would compromise the going concern of the business (if true)

This reassures the mortgage lending team that your financial house is in reasonable order from a compliance standpoint.

Assets, liabilities, and mortgage debt

While the CPA letter is not a full financial statement, it may reference:

- Business assets (equipment, inventory, cash on hand)

- Existing mortgage debt or other obligations held by the business

- Whether the business is leveraged with significant loans

This all feeds into the underwriter’s broader picture: can you realistically afford a new mortgage loan on top of everything else?

How Underwriters Use the Letter Alongside Mortgage Calculators

Underwriters don’t just read your CPA letter and say “approved.” They combine it with tools and guidelines.

Debt-to-income ratio and mortgage calculator

Your loan officer or underwriter will:

- Take your average self-employed income (often from 2 years of returns).

- Add existing loans, credit card debt, and any current home loan or rent.

- Use a mortgage calculator to see what monthly payment keeps your DTI within guidelines (for conventional mortgages and other products).

The CPA letter increases their confidence that the income they’re using in the calculator is real, stable, and accurately presented.

Down payment and reserves

The size of your down payment and any extra assets you hold in savings or investments matter a lot. While the CPA letter doesn’t replace asset statements, it can support the idea that:

- Your business generates reliable cash flow.

- You’re likely to maintain those reserves after closing.

The more secure you look on paper, the easier it is for a lender to justify approval.

When You’re Likely to Be Asked for a CPA Letter for Mortgage

Situations that trigger the request

You’re more likely to be asked for a CPA Letter for mortgage if:

- You’ve been self-employed for less than two full years.

- Your income fluctuates significantly from year to year.

- Your tax returns show a lot of write-offs and lower net income.

- Your business is an LLC or corporation with complex ownership.

- Underwriters see something in your bank statements they want clarified (large deposits, transfers from business accounts, etc.).

Conventional mortgages vs. other loans

With conventional mortgages, underwriting is often strict and very document-driven. Government-backed loans (like FHA or VA in some markets) have their own rules but similarly care about stable, documentable income.

In some cases, alternative or non-QM (non-qualified mortgage) loans may rely more heavily on bank statements than tax returns, but even then, a CPA letter can help explain self-employment income patterns.

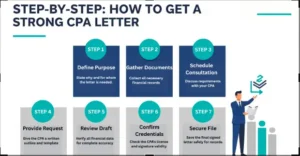

Step-by-Step: How to Get a Strong CPA Letter

Prepare your documentation first

Before asking your CPA for the letter, make their job easier by gathering:

- The last 2–3 years of tax returns (personal and business)

- Recent bank statements (business and personal)

- Up-to-date financial reports (profit & loss, balance sheet)

- Any existing mortgage loan or home loan statements in PDF format

This preparation shows you’re serious and helps your CPA write a letter that aligns with all the documents your lender will see.

What to ask your CPA to include

When you request the letter, be clear and polite. You might say (in your own words):

- That you’re applying for a mortgage or home loan

- The name of the lender or broker

- That underwriting has asked for a cpa letter for self-employed mortgage borrowers

- That the letter should confirm:

- Your business name and structure (sole proprietor, LLC, DBA)

- How long you’ve been in business

- Your ownership percentage

- That your CPA prepares your tax returns

- That your income appears consistent with the documentation provided

You’re not asking your CPA to “inflate” or misrepresent anything. You’re simply asking for a clear summary in professional language.

Reviewing the letter before it’s sent

Ask your CPA to send you a draft (often as a PDF) before they email or mail it to the lender. Check:

- Your name is spelled correctly.

- Business details, ownership, and structure are accurate.

- Figures or year ranges match your tax returns and bank statements.

- The letter has a clear signature, date, and contact information for the CPA firm.

A small typo won’t kill your deal, but obvious mistakes can slow down approval.

Sample Outline of a CPA Letter (Not Legal or Tax Advice)

This is just an example outline for educational purposes. Your CPA will have their own templates and professional standards.

Example structure

- Header

- CPA firm name, address, phone, email

- Date

- Subject line

- “Re: [Borrower Name] – Self-Employment Verification for Mortgage Loan”

- Opening paragraph

- Identify the CPA, their role, and how long they’ve served the client.

- Business details

- Legal business name and doing business as name (if any)

- Business type: sole proprietor, LLC, etc.

- Borrower’s ownership percentage

- Length of operations

- Income and compliance

- Confirmation that the CPA prepares tax returns and/or financial statements

- Statement that income is derived from self-employment in [industry]

- Confirmation that filings with the IRS are current based on information provided by the client

- Stability statement (if true)

- General statement that income has been reasonably stable over [X] years based on available records.

- Closing

- Disclaimer that the letter is based on information provided and is not a guarantee of future income

- CPA’s signature, printed name, license number, and firm details

Underwriters are used to letters like this. Clear, conservative language from a professional is much more persuasive than a borrower trying to explain everything on their own.

Common Mistakes to Avoid

Using a CPA who doesn’t understand mortgage lending

Not every CPA is familiar with how mortgage lending works. If possible, work with someone who has:

- Experience preparing letters for lenders

- An understanding of what underwriters actually look for

- Comfort referencing conventional mortgages and lending standards

A vague or unhelpful letter can slow your file down or lead to more conditions.

Leaving out ownership or self-employment details

If you own 100% of a limited liability company, the underwriter needs to know that. If you’re only a 20% owner, they need that too.

Missing details about ownership or self-employment can trigger follow-up questions or even re-calculation of your income.

Misalignment between CPA letter and tax returns

The letter must line up with your documents. Red flags include:

- CPA says you’ve been self-employed for 5+ years, but your schedule C only shows 2 years.

- Letter implies higher income than what appears on tax returns.

- The business type in the letter doesn’t match what’s on file with the IRS or state.

Underwriters will always side with the documents. The letter is there to interpret and confirm, not to contradict.