Understanding Incentive Stock Options (ISOs)

From my professional experience, one of the most attractive features of ISOs is their ability to help employees build wealth through long-term capital gain treatment. When you exercise your stock options and acquire shares, you may qualify for this special tax benefit if you follow specific holding rules. A qualifying disposition happens when the employee-shareholder keeps the shares for more than one year after the exercise date and at least two years from the option grant date. By meeting these time limits, the gain you earn can be taxed at a much lower rate compared to ordinary income, a key advantage I often see professionals overlook.

Key Insights

- Inflation and rising wages can cause tax-bracket creep in 2025.

- Cut taxable income with retirement and health savings contributions.

- Use tax-loss harvesting, asset location, and charitable giving to lower taxes.

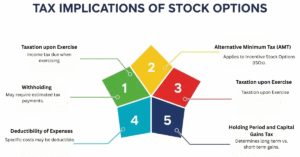

Tax Rules for Incentive Stock Options

Internal Revenue Code Sections 421-424 govern the tax treatment of ISOs, providing them with potentially lucrative benefits. The grant of ISOs is not considered a taxable event for regular tax purposes; only when exercised do ISOs trigger potential tax exposure.

Alternative Minimum Tax (AMT) Adjustment

While no regular taxable income occurs with an ISO exercise, a federal Alternative Minimum Tax (AMT) positive income adjustment on the Internal Revenue Service (IRS) Form 6251for the option spread amount occurs for that tax year. The spread amount is the difference between option “exercise” or “strike” price, and the market value of shares received at the exercise of the option and is often referred to as the “bargain element.”

For many taxpayers, a large AMT adjustment from ISO exercise can result in substantial federal tax in the exercise year. No adjustment occurs if ISO stock is sold in the same year as the exercise, due to the spread amount included in regular taxable income and thus, not a preference item for AMT. However, the AMT adjustment from ISO exercise also results in higher tax basis in the stock shares received from that exercise for AMT purposes than for regular tax purposes by the bargain element amount.

Best Timing Strategies for Exercising ISOs

Reducing AMT Exposure on ISO Exercise:

- Spread ISO exercises out over time to avoid large spikes in the AMT income in a single year. There may be limitations for various reasons, including vesting schedules imposed by the corporation, cash constraints, concentration risk concerns and other factors. Additionally, the general requirement is that ISOs must be exercised within 90 days of employment separation to retain ISO treatment.

- Implement ISO exercises during years when sales of other stock shares are acquired from earlier ISO exercises with AMT bases higher than regular tax bases. This should at least partially offset the positive and negative adjustments.

- Time ISO exercises occur in years when large ordinary income events occur, such as bonus income, Restricted Stock Unit (RSU) vesting and payout, or gain from Non-Qualified Stock Option (NSO) exercises. While the AMT adjustment from ISO exercise may be substantial, it might not be enough for the AMT to exceed regular tax that year.

- Avoid ISO exercises in years when large capital gains are triggered, as this can indirectly result in more AMT exposure in those years.

- Exercise ISOs when the stock price dips but is expected to recover. Such timing involves guesswork and can be very tricky.

- Consider exercising ISOs early in the tax year, when possible, in case the stock price declines or other factors dictate a stock sale earlier than expected. If the shares are sold within the same tax year as exercise, the sale should be a disqualifying disposition, meaning the bargain element is reported on the employee’s W-2 for that year as it would with an NSO and no AMT adjustment occurs.

Unlocking Long-Term Capital Gains Treatment

Venture backed startup companies are big fans of using incentive stock options to attract and retain employees. A company can issue large incentive stock option grants to its employees with no tax impact on the employee on the date of issue provided the strike price is equal to or exceeds the fair market value of the stock on the date of grant.

Funding & Financing Your ISO Exercise

Cash requirements for ISO exercises can pose challenges when the strike price or number of options is substantial, and the employee wants to buy-and-hold the shares to obtain long-term capital gain treatment. Several potential financing solutions exist, including:

- Loans, which are often secured by the stock shares and available from third-party lenders. These may often come at high interest rates, fees or other offsets.

- Partial cashless exercise, where enough shares are immediately sold to cover the strike price of the ISOs. This results in a disqualifying disposition for those shares and ordinary income is immediately triggered for the bargain element amount on that sale.

- Stock swap (plan-permitting), in which the employee-shareholder can swap existing shares in a tax-free exchange with the corporation for newly issued shares in the ISO exercise transaction, defraying some or all of the strike price amount. This can also tax-efficiently reduce concentration risk in that stock, when an employee-shareholder has accumulated a large position but still wants to utilize existing ISOs. This strategy results in zero basis on the additional shares issued from the ISO exercise, which are always deemed to be sold first in a disqualifying disposition. The shares received from the swap portion of the exercise transaction will have carryover basis from the old shares relinquished.

What Is an Early Exercise and Why Does It Matters?

Early exercising stock options refers to the act of purchasing company shares before they fully vest. This allows employees to acquire ownership of unvested stock at an earlier stage. By early exercising, employees take advantage of the opportunity to buy shares of the company while the valuation is low. Worth noting, if the employee leaves the company, any unvested shares will be bought back at cost.

This decision can offer potential advantages such as favorable tax treatment and greater long-term returns. However, it also carries risks and considerations that individuals need to carefully evaluate before proceeding. In order for this to be an option, your company must support early exercise, which is not always the case.

Filing an 83(b) Election, What You Need to Know?

Filing an 83(b) election with the IRS within 30 days of your early exercise date is crucial. This establishes your actual purchase date and recognizes the taxable value of your assets. This proactive step ensures that your exercise remains tax-efficient and positions your investment for long-term capital gains treatment.

If you do not file an 83(b), the IRS doesn’t recognize un-vested shares as income until they vest. You do not have to pay taxes upfront, but rather as the shares vest over time. This protection works against your ability to recognize future income as long-term capital gains and subjects. This essentially defeats the purpose of exercising early.

How to file an 83(b) election:

Here is a link to the IRS 83(b) election sample form.

Since IRS rules are subject to change, you are cautioned to review this with your tax advisor to ensure compliance with your particular situation. Send 2 copies to the IRS along with a self-addressed stamped envelope for them to return acknowledgment. Also file one with your actual tax return in addition to keeping one copy for your records.

Exercising stock options early can require a lot of capital and time to liquidity can be lengthy. As your shares vest, you may be tempted to sell to recover your original investment or fund other financial needs. However, a sale truncates any possibility of future upside on the shares being sold.

An alternative solution for partial liquidity is to get funding from ESO Fund. This is an attractive solution since you retain ownership of the stock plus the ability to achieve unlimited upside. Furthermore, if the stock becomes worthless, ESO Fund absorbs the loss, not you. Feel free to reach out using our contact form below if you have any questions. NOTE: We cannot work with 100% of early exercise situations but we’re always happy to have a conversation about your equity to see if there is a fit.

When to Exercise Options Before Year-End?

While this last minute exercise may seem rational by conserving cash and avoiding loss, in many cases it is not. Why? Because the option holders have failed to consider the taxes they will have to pay and the huge difference between ordinary federal income tax rates (in 2018 a maximum rate of 37%) and federal long term capital gains rates (in 2018 rates generally ranging from 15% to 20%). There can be additional state tax savings depending on where the employee lives.

An option holder who exercises at the time of a company liquidity event and immediately sells his stock pays up to 37% in federal income tax plus medicare and social taxes on the gain between the strike price and the sales price of the stock. In contrast, had the same option holder exercised a year earlier (to comply with the long term capital gains rule that shares must be held for 1 year from the date of exercise and 2 years from the date of grant), the federal income tax could have been at the lower capital gains rate.

How Stock Options Are Taxed, The Fundamentals?

Many times, employees wait to exercise their stock options until a sale or IPO of the company is within sight. Then they exercise and sell the stock. Their reasoning is that they don’t want to invest their hard earned cash in a stock that may, like many venture investments, become worthless.

Incentive Stock Options: Step-by-Step Tax Guide

There can be clear advantages with early exercise of incentive stock options – sometimes the earlier the better – but the risk and cost associated with exercising stock options can be burdensome for many individuals. Where to get the funds? How much risk to take?

ESO Fund can help alleviate these risks by providing the funds to exercise stock options and to pay applicable taxes such as AMT. No repayment is due unless and until there is a liquidity event involving the company that issued the shares, such as a sale or IPO. See this link for a summary of other methods to save on taxes. For more information regarding how working with ESO Fund can benefit you, please contact us.

Reporting AMT When Exercising ISOs

Another benefit to exercising private company incentive stock options early comes from minimizing Alternative Minimum Tax (AMT) arising from an exercise after the fair market value has appreciated significantly higher than the original strike price of the grant. But if not thoughtfully considered as a part of overall strategy, early exercise to avoid the AMT can backfire. For example, during the late 1990s dotcom bubble many employees exercised early in an effort to qualify for long term capital gains only to have the stock value collapse during the one year holding period. These optionees were left with a huge AMT bill with the IRS but with no money to pay it.

Had they exercised even earlier, when the spread between the strike price and fair market value was less or nonexistent, they could have spared themselves this issue. Or if they sold the same year as the exercise, they could have gotten an AMT Disqualifying Disposition.

Taxes After Selling Your ISOs

When it’s time to sell your ISOs, there can be significant tax savings if you qualify for long-term capital gains, versus short-term capital gains.

Let’s build on the example above — remember, in this example, you’re a tech worker in California, earning a six-figure salary at a pre-IPO startup:

- You’ve exercised 15,000 ISOs, paying a total of $206,000 in exercise costs and taxes

- When you exercised your shares, they carried a total assumed value of $525,000

- Your startup goes public, and you decide to sell your shares for $150 each, for a total pre-tax value of $2.25 million

If you’ve held your shares for less than a year, you’ll owe an estimated short-term capital gains tax of $831,250. If you hold your shares for more than a year (and more than two years after the ISOs were initially granted), you’ll owe long-term capital gains tax of $500,500.

Depending on your specific numbers, you could end up saving thousands of dollars (and in some cases, hundreds of thousands of dollars) by taking advantage of long-term capital gains.

How to Report ISO Sales on Your Tax Return?

Exercising NSOs triggers a tax withholding requirement at your company — just like if they were paying out a cash bonus. The company collects payment from you to submit taxes to the government on your behalf.

When you exercise NSOs, your company will send you an estimate of the withholding tax that they are required to send to the government. You’ll need to pay the company your exercise costs, as well as the estimated tax withholding, to exercise your NSOs.

Note: Companies are only legally required to withhold the minimum amount of taxes when you exercise NSOs. You’ll want to double-check that amount with the help of a tax professional, to make sure you don’t inadvertently owe a surprise tax bill when it comes time to file.

When you file your tax return, you’ll calculate your actual tax bill against what your company withheld. You could be required to make estimated tax payments throughout the year to supplement your employer’s withholding. Make sure you’re paying your taxes on time to avoid future penalties.

Smart Ways to Reduce ISO Taxes

If you’re earning ISOs, there are three main strategies to minimize your tax liability: Exercising your ISOs early, exercising a small number of ISOs each year, and performing a cashless exercise.

Exercising your ISOs early starts the clock on long-term capital gains

Some startups allow their employees to exercise some or all of their ISOs before they vest, giving employees the chance to pay little or no AMT. This is called “early exercising.”

Buying shares in certain early-stage startups can qualify you for the Qualified Small Business Stock (QSBS), a special tax exemption that allows people to sell millions of dollars worth of shares tax-free if the company is small enough, and the person holds onto their shares for long enough.

Exercising a small number of ISOs each year to stay under the AMT threshold

Startup employees earning ISOs can always decide to exercise (i.e. purchase) just enough ISOs each year to remain under the AMT threshold. This strategy works best when an ISO’s strike price and 409A valuation is still relatively near one another in value. If you’d like to explore this strategy, check out Secfi’s free AMT Calculator.

Performing a cashless exercise to reduce upfront taxes

In a cashless exercise, you sell some or all of your shares, and then use the resulting funds to cover any exercise costs and associated taxes, in what the IRS effectively treats as a single transaction.

8 Strategies to Stay Ahead of Tax-Bracket Creep

Maximize retirement contributions

Fortunately, you can reduce your taxable income dollar-for-dollar with yearly contributions to your 401(k), traditional IRA, and other retirement accounts.

People who have access to a workplace retirement plan can contribute up to the maximum of $23,500 for 2025 (up from $23,000 in 2024). People aged 50 and older can make catch-up contributions of $7,500. And starting this year, those between the ages of 60 and 63 can make catchup contributions of $11,250 in place of the $7,500 limit.

Contribution limits to IRAs remain $7,000 for 2025, the same as for 2024. (Catch-up contributions also remain $1,000 for 2025.) 401(k) contributions do not have income limits for contributing but IRAs do.

The tables below can help you figure out how much of your traditional IRA contribution you may be able to deduct based on your income, tax-filing status, and your and your spouse’s access to a workplace retirement plan.

Remember your health savings account (HSA)

If you’re eligible to contribute to an HSA because you have a high-deductible health plan, contribution limits are now $4,300 for individuals and $8,550 for families for 2025, with an additional $1,000 in catch-up contributions for those over 55 and not enrolled in Medicare. If both spouses are covered by a family high-deductible health plan and share an HSA, they are eligible for one catch-up contribution of $1,000 if one of them is 55 or older and not enrolled in Medicare. If both are 55 or older and both are not enrolled in Medicare, however, and they each want to make a catch-up contribution, they must do so in separate HSAs, resulting in a $10,550 limit.

Defer payouts and payments

If you sold a house, collected severance from a job after a layoff, or sold anything of value where you expect a taxable gain, it’s worth considering whether you can collect the money the following year if the additional income pushes you into a higher tax bracket, or you expect to be in a lower tax bracket the following year. Similarly, if you plan to sell stock that has increased in value, you could think about splitting the sale over 2 years if the full amount will push you into another tax bracket, or subject you to the NIIT surtax. Relatedly, if you’ve done contract work in addition to your regular job to make ends meet, you might consider delaying payment until the following tax year if the extra income will push you into a higher tax bracket.

Make the best use of a Roth conversion

While Roth conversions from a traditional IRA are typically fully taxable, you aren’t required to take money out of a Roth once the funds are in the account, as you would need to do with a traditional IRA, where required minimum distributions must begin at age 73. After that, payouts aren’t subject to taxes when you withdraw funds, assuming you’ve met all conditions for the account, including the 5 year aging rule and are 59 1⁄2 years old or older or have met some other exemption.

Tax-loss harvesting

You might also want to consider year-round tax loss harvesting where you use realized losses to offset realized gains elsewhere, plus up to $3,000 of ordinary income depending on filing status. If you’ve got investments that are below their cost basis, and there’s another investment that’s similar (but not a substantially identical security), you could use it to replace the sold asset without a material impact to your investment plan. Consult your tax advisor about your situation and beware of the wash sale rule.

Make full use of asset location

You’re likely to have different types of accounts that can be aligned with specific financial goals. Some accounts, like brokerage accounts, are subject to income or capital gains taxes every year on any income earned or capital gains realized, while others (retirement accounts) can have tax advantages, such as tax-deferral or tax-exempt withdrawals (Roth accounts). At the same time, some types of investments—think bonds, bond funds, and high-turnover, actively managed stock mutual funds—can have bigger tax consequences.

Deductions for charitable contributions

If you have extra money to give this year, you may be willing to donate to charity. Charitable contributions are generally tax-deductible but require that you itemize deductions, as opposed to taking the standard deduction ($15,000 for single filers and $30,000 for those who are married filing jointly in 2025). If your donation amount, along with your other itemized deductions, typically falls below the standard deduction you might consider bunching, which involves concentrating charitable deductions in a single year, and skipping the following year, or even several years. The following year, you likely wouldn’t claim charitable deductions, but you’d still qualify for the standard deductions. And if you put your contributions into a donor advised fund, you can take the charitable deduction in 2025, but spread your giving out over many years. If you want to itemize, this strategy can help. Itemizers can also donate appreciated assets held longer than one year to a qualified public charity and deduct the fair market value of the asset without paying capital gains tax.

Qualified charitable distributions (QCDs)

For individuals in retirement who have to take required minimum distributions, donating to charity can help reduce tax-bracket creep. You can make a QCD from an IRA of up to $108,000 per individual (or $216,000 total if you’re married and filing jointly), as long as the charity receives your donation by December 31. The money you donate is not deductible, but it’s not subject to federal taxes, qualifies as your RMD for the year, and you can use one even if you don’t itemize. QCDs are also allowable starting at age 70 1⁄2, so you don’t have to wait until RMDs begin to take advantage of one. Important to know: Payment must be made directly to a charity and not all charities qualify.

How Our Experts Help You Build an ISO Tax Strategy?

Our dedicated team can help find solutions for your specific situation, address important tax matters and assist with financial planning. If you have questions, concerns or want assistance implementing Incentive Stock Options strategies, please contact our Private Client Services practice or your team advisor.

| Step | Action | Purpose | Outcome |

| Assess Your Stock Options | Review incentive stock options (ISOs) and vesting schedules | Understand your potential tax exposure | Creates a clear tax overview |

| Plan Exercise Timing | Strategically choose when to exercise ISOs | Minimize Alternative Minimum Tax (AMT) impact | Reduces unexpected tax liabilities |

| Optimize Holding Periods | Evaluate long-term vs. short-term gains | Maximize favorable capital gains treatment | Increases after-tax profits |

| Monitor Tax Law Changes | Stay updated with IRS and state tax updates | Maintain compliance and efficiency | Sustainable, future-proof tax strategy |