Securing a mortgage as a Self-Employed Borrower often feels more complicated than it should be. Unlike traditional W-2 employees, self-employed individuals must provide additional documentation to help lenders understand the stability of their income. That’s where a CPA comfort letter for self-employed borrowers becomes essential.

Mortgage lenders, underwriters, and even automated systems such as Desktop Underwriter (DU) and Loan Product Advisor (LPA) increasingly rely on these letters to fill information gaps and confirm the legitimacy of a borrower’s financial activity.

This article breaks down why lenders ask for these letters, what a CPA is allowed to verify, and how the process works behind the scenes, from the perspective of CPAs, Mortgage Loan Officers (MLOs), loan processors, and self-employed applicants themselves.

What Is a CPA Comfort Letter?

A CPA comfort letter, sometimes called a “verification letter” or “third-party letter”, is a written confirmation prepared by a Certified Public Accountant, enrolled agent (EA), or accounting firm verifying factual financial information about a borrower.

For mortgages, it’s most commonly referred to as a CPA comfort letter for mortgage lenders and is used to:

- Confirm the borrower’s self-employment

- Verify the start date or length of business activity

- Confirm that the CPA prepared the tax returns and/or financials

- Validate the legitimacy of documents already provided

It is not a guarantee of future income. CPAs must follow AICPA professional ethics standards, State Board of Accountancy rules, and IRS third-party verification restrictions.

Why Mortgage Lenders Request Comfort Letters

Mortgage lenders want accurate, verifiable financial information so they can quantify risk. For conventional lenders, portfolio lenders, and even Non-QM lenders. The challenge with self-employment is the variability and complexity of income.

Reasons Lenders Often Require CPA Verification

- Tax returns may show deductions that lower net income

- Bank statements may not clearly represent business revenue

- Automated Underwriting Systems (AUS) may issue a “verification of business” requirement

- Business ownership details may be unclear

- Underwriters need confirmation that the business is legitimate and active

Both Fannie Mae (FNMA) and Freddie Mac (FHLMC) guidelines allow lenders to request third-party verification when needed, especially when a borrower’s finances involve complex deductions or fluctuating profit.

Who Is Involved in the Verification Process?

A CPA comfort letter creates a bridge between several industry professionals working to complete the loan:

Financial Professionals

- CPA (Certified Public Accountant)

- Enrolled Agent (EA)

- Accounting Firm Staff

- Business Partners / Co-Owners

Mortgage Industry Professionals

- Mortgage Loan Officer (MLO)

- Loan Processor

- Underwriter

- Mortgage Lender

Each has a different responsibility, but all rely on the CPA’s notarized verification to satisfy regulatory, investor, or underwriting conditions.

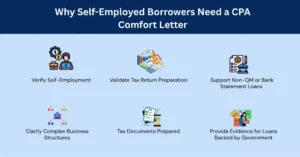

Why Self-Employed Borrowers Need a CPA Comfort Letter

For W-2 borrowers, a simple pay stub or written employer verification is usually enough. But for business owners, proving stable, documentable income is more complex.

To Verify Self-Employment

Lenders must confirm that the borrower is actively operating a business. They may request:

- A CPA comfort letter

- Business license copies

- Online presence verification

- Merchant statements

- Year-to-date income documents

This is especially common when DU or LPA flags “self-employment verification required.”

To Validate Tax Return Preparation

Underwriters may need confirmation that:

- The CPA prepared the borrower’s tax returns (personal & business)

- The numbers provided match IRS-filed documents

- The borrower’s business actually operates in the claimed industry

This reduces the risk of misreported or fabricated income.

To Support Non-QM or Bank Statement Loans

In Bank Statement Loan Programs, lenders may ask CPAs to confirm:

- The borrower’s business ownership percentage

- That deposits represent business revenue

- That expenses follow expected patterns for the industry

Non-QM lenders rely heavily on CPA letters as part of risk assessment.

To Clarify Complex Business Structures

Borrowers who own multiple entities or partnerships often need help explaining:

- Business structure

- Revenue streams

- Irregular or seasonal income

- Multi-account banking transactions

A CPA’s letter helps underwriters understand the full picture.

To Provide Evidence for Loans Backed by Government Agencies

While FH, VA, and USDA Home Loans don’t officially require CPA letters, lenders originating these loans may impose overlays that ask for:

- Verification of business activity

- Confirmation of financial record preparation

- Support for high loan amounts or complex profiles

Portfolio lenders often require even stricter documentation.

What a CPA Comfort Letter Must Verify

A properly written comfort letter follows AICPA guidelines, respects IRS rules, and avoids unauthorized “assurances.”

Here’s what it can include:

Information a CPA Is Allowed to Verify

Verification of Self-Employment

The CPA may confirm:

- Business name and legal structure

- Start date of business

- Length of time they’ve provided accounting or tax services

- That the business appears active based on submitted records

Tax Documents Prepared

CPAs may confirm they prepared:

- Personal & business tax returns

- IRS Tax Transcripts comparisons

- Profit & Loss Statements (P&L)

- Balance Sheets

- Bookkeeping records

Reasonableness Checks

They may confirm factual information such as:

- Business address

- Industry type

- Frequency of income

- Accounting method (cash vs accrual)

Supporting Financial Records Reviewed

A CPA may list the documents the borrower has provided, such as:

- Bank statements (personal & business)

- Invoices & receipts

- Merchant processing statements (PayPal, Stripe, Square)

- E-commerce reports (Shopify, Amazon, Etsy)

- Ad revenue statements (CPC, CPM, CPA payouts)

- General Ledger or accounting software exports

This reassures underwriters that the borrower’s business activity is legitimate.

What CPAs Cannot Legally State

CPAs cannot provide assurances that violate AICPA or IRS rules. They may NOT:

- Guarantee future income

- Confirm the borrower’s ability to repay a mortgage

- Estimate future business performance

- Certify undocumented cash flow

- Provide assurance-level statements without performing an audit, review, or compilation

Lenders are trained to understand this boundary.

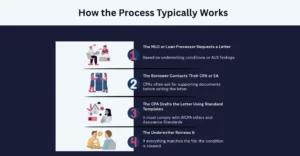

How the Process Typically Works

The MLO or Loan Processor Requests a Letter

Based on underwriting conditions or AUS findings.

The Borrower Contacts Their CPA or EA

CPAs often ask for supporting documents before writing the letter.

The CPA Drafts the Letter Using Standard Templates

It must comply with AICPA ethics and Assurance Standards.

The Underwriter Reviews It

If everything matches the file, the condition is cleared.