For many self-employed borrowers, proving stable and verifiable income can feel more complicated than running the business itself. Mortgage lenders rely heavily on documented financials to assess risk, and when tax returns alone do not tell the full story, lenders sometimes ask for additional verification from a Certified Public Accountant (CPA).

One such tool is the CPA comfort letter for income verification, a document that can clarify details, confirm the scope of a CPA’s work, and help lenders understand a business’s financial history.

However, it’s equally important to understand that lenders, regulators, and the AICPA (American Institute of Certified Public Accountants) place strict limits on what a CPA can verify. This guide breaks down what lenders accept, how comfort letters work, and what information can, and cannot, be included.

What Is a CPA Comfort Letter for Income Verification?

A CPA comfort letter is a formal written communication issued by a licensed Certified Public Accountant describing factual, historical financial information about a borrower or their business.

It is not a guarantee of income or a projection of future earnings. Instead, it summarizes information already available through tax filings or accounting records.

Mortgage lenders, such as Conventional Lenders, Portfolio Lenders, FHA, VA, USDA Rural Development, and Non-QM Lenders, may request one when:

- A borrower is self-employed and their income is complex

- There are variations in revenue that require clarification

- Tax returns need supporting context

- Automated Underwriting Systems (AUS) flag the file for additional documentation through DU (Desktop Underwriter) or LPA (Loan Product Advisor)

Why Lenders Request a CPA Comfort Letter

Self-Employed Income Can Be Hard to Interpret

Unlike W-2 employees, self-employed borrowers may have income from multiple sources, such as:

- Sole proprietorships

- LLCs

- Partnerships

- S-Corporations or C-Corporations

- Online businesses

- E-commerce (Amazon, Shopify, Etsy)

- Payment processors (PayPal, Stripe, Square)

- Digital ad revenue

A CPA can confirm the preparation of certain financial documents and provide factual clarification.

AUS Findings Require Additional Verification

When DU or LPA run a file through an Automated Underwriting System, they may require:

- Verification of business existence

- Verification of business income stability

- Supporting statements aligned with lender guidelines

Portfolio or Non-QM Lenders Have Flexibility

Unlike Fannie Mae (FNMA) and Freddie Mac (FHLMC), Portfolio Lenders and Non-QM lenders may accept additional CPA-verified documentation, while still following professional ethical rules.

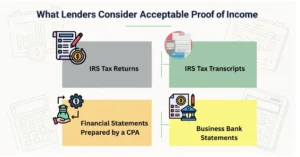

What Lenders Consider Acceptable Proof of Income

Every Mortgage Lender must follow the broader oversight of the FHFA (Federal Housing Finance Agency) and their own internal risk guidelines.

Most lenders will accept the following as reliable income proof:

IRS Tax Returns

Historically filed federal returns including:

- 1040

- 1120

- 1120-S

- 1065

IRS Tax Transcripts

Used by lenders to confirm the legitimacy of filings.

Financial Statements Prepared by a CPA

This may include:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Reports

These must comply with Audit, Review, or Compilation Standards.

Business Bank Statements

To confirm deposits that align with claimed revenue.

Bookkeeping and General Ledger Records

Often sourced from QuickBooks, Xero, or FreshBooks.

Merchant and Platform Statements

Essential for online businesses:

- PayPal

- Stripe

- Square

- Amazon

- Shopify

- Etsy

A CPA may incorporate these into a comfort letter if they have examined the records directly.

What a CPA Can State in a Comfort Letter

CPAs must comply with:

- AICPA Code of Professional Conduct

- Third-Party Verification Standards

- Non-Assurance Reporting Standards

- State Board of Accountancy rules

A CPA may include factual statements such as:

- Dates when the tax return was prepared

- The business’s existence based on records on file

- Confirmation that financial statements were compiled, reviewed, or audited

- Verification that they have seen profit and loss history

- Summary of documents reviewed (bank statements, ledgers, invoices, etc.)

The key is that all statements must be historical and based on work already performed.

What a CPA Cannot State in a Comfort Letter

No CPA can:

- Predict future income

- Provide assurance that the borrower will repay the loan

- State that income is “stable” or “sufficient”

- Confirm the borrower’s character or creditworthiness

- Validate business success projections

- Offer opinions outside the scope of actual CPA work

These limitations protect the CPA and ensure compliance with professional ethics.

CPA Comfort Letter Template (Example)

Below is a simple, compliant cpa comfort letter template. CPAs can adapt it based on the scope of work and lender requirements.

Sample CPA Comfort Letter Template

[CPA Letterhead – Accounting Firm Name, Address, License Number]

Date: [MM/DD/YYYY]

To: [Mortgage Lender / Loan Processor / Underwriter]

Re: Income Verification for [Borrower Name]

Dear [Lender Name],

I am a Certified Public Accountant licensed in the State of [State], and my firm has prepared the federal income tax returns for [Borrower] and/or [Business Name] for the years ending [Years]. These returns were prepared from information provided by the client and in accordance with IRS regulations.

Based on work previously performed, I can confirm the following factual information:

- I prepared the following tax returns: [list forms: 1040, 1120, 1065, etc.]

- I have reviewed supporting financial documents including: [Profit & Loss, Balance Sheet, bank statements, general ledger, merchant statements, etc.]

- The business has been in operation since approximately [Year], according to records on file.

- Financial statements for the period [dates] were prepared under [Compilation/Review/Audit] standards, as applicable.

This letter does not provide assurance, opinion, prediction of future income, or any guarantee of repayment. It is solely intended to confirm the historical information described above.

Sincerely,

[Name], CPA

License No: ______

State Board of Accountancy: ______

Firm Name: ______

How Lenders Use CPA Comfort Letters During Underwriting

For Mortgage Loan Officers (MLOs)

MLOs use the letter to clarify irregularities in income and present a stronger file to underwriting.

For Underwriters

Underwriters evaluate whether the comfort letter supports the financial picture created by:

- Tax returns

- Income calculations

- AUS findings

- Business documentation

They rely on it as a supporting document, not a primary income source.

For Loan Processors

Processors collect the CPA comfort letter early to anticipate AUS or manual underwriting conditions.

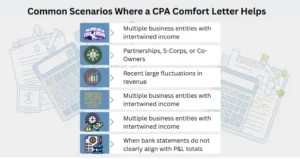

Common Scenarios Where a CPA Comfort Letter Helps

- Multiple business entities with intertwined income

- Partnerships, S-Corps, or Co-Owners

- Recent large fluctuations in revenue

- Borrowers using platforms like Amazon, Etsy, Shopify

- When transcripts are delayed at the IRS

- When bank statements do not clearly align with P&L totals