Are you in process of income verification or proof of income? I will write CPA income verification letter for your lender or landlord with 100% approval rate.

Click the "Request" button to place your order easily.

Complete the checkout process to confirm your order.

Fill out the form after checkout and get live portal access.

You are all done, CPA will write your letter in 2 hours.

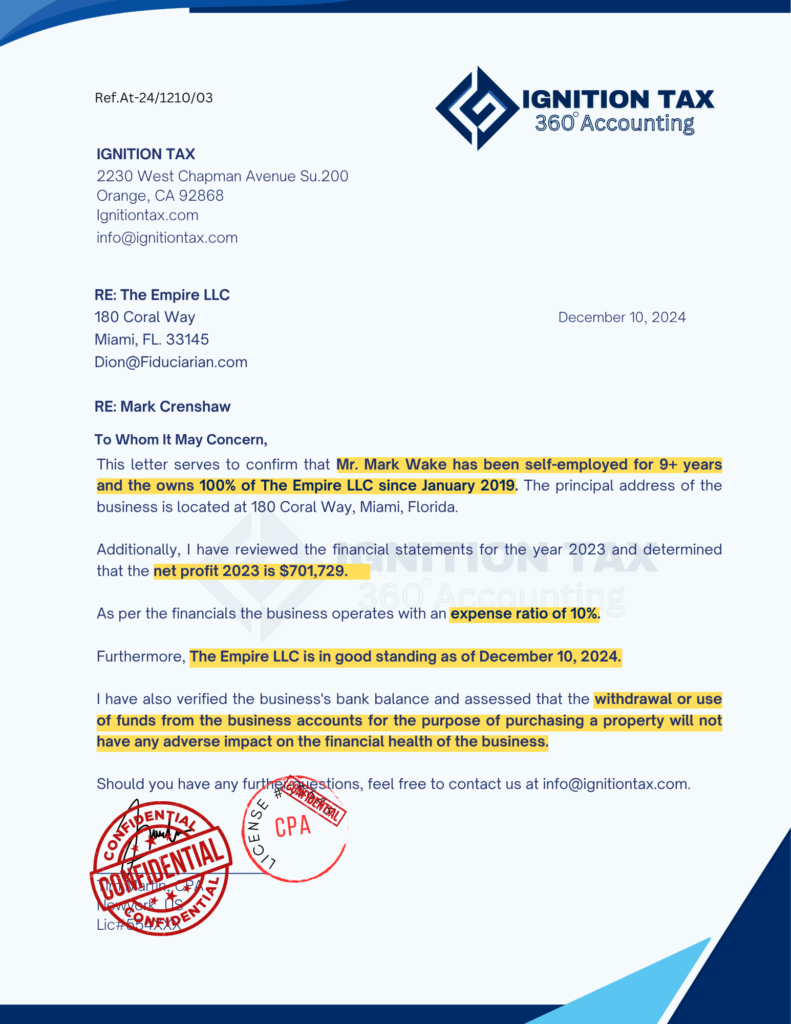

We are in process of getting rental apartment in newyork city and my landlord demands CPA letter that verifies my details.

We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

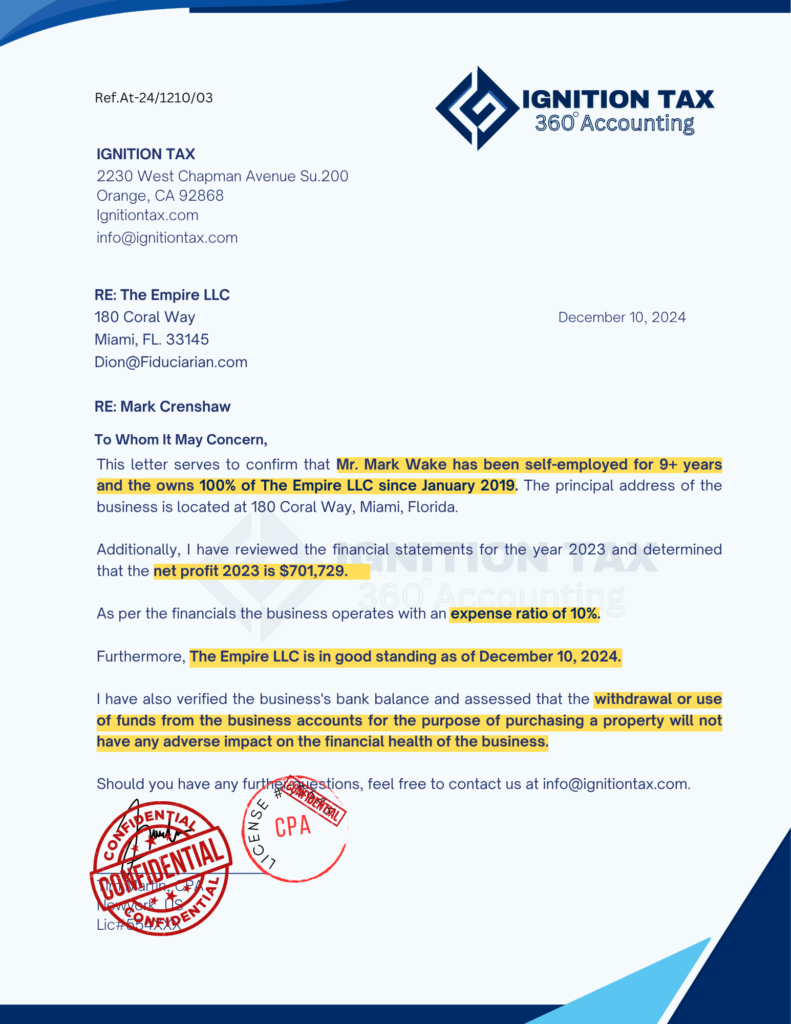

Our lenders require a letter that verifies the business expense ratio, which is 15%. Additionally, the letter should state that “the use of business funds does not have any adverse impact on the business”.We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

As we are US Licensed CPA, we’re committed to making the process easy, reliable, and stress-free for you.

CPA take the time to create letters customized to your unique situation and prepared just for you.

Direct verification to your Lenders or Loan Officers.

Fast Delivery in Just 2 Hours.

Guaranteed Approval or Your Money Back.

Ignitiontax prepares CPA Letter services for the United States. Scope is clear. We verify income and facts from tax returns, bank statements, and financial statements. We align wording to lender and landlord checklists. For self-employed clients, most mortgage programs expect one to two years of federal tax returns. Fannie Mae and Freddie Mac outline these documentation rules.

We follow AICPA(American Institute of Certified Public Accountants) guidance for third-party verification and comfort letters. We state what was checked. We avoid assurances outside CPA standards.

Banks or lenders require a CPA letter to verify your financials or business status for loan approval.

Prepared for mortgage brokers, banks, and refinancing. We align with agency documentation rules for self-employed borrowers—typically one to two years of signed federal returns, with program variations. We reflect the verified figures and the period covered.

The letter can support: income stability notes, business existence, and source-of-funds or use-of-business-funds confirmation when requested. We coordinate delivery to the lender and include lender name, address, loan number(if provided), and the borrower’s consent.

A CPA writes a letter confirming your earnings for various purposes, ensuring accurate income verification.

For lenders, landlords, and banks. We confirm income using IRS(Internal Revenue Service) tax returns, year-to-date P&L, balance sheet, and bank statements. Letter includes client name, business entity(if any), time in business, method used, and signature on CPA letterhead. Many landlords accept a CPA letter as proof of income along with tax returns and statements.

Use cases: mortgage pre-approval, apartment application, lease renewal, line of credit, and underwriting re-verification. We tailor the cpa letter sample to the recipient’s template when provided.

Need to verify your business expense ratio? This letter, requested by lenders or banks, confirms your working expenses.

Some lenders and landlords ask for an expense ratio.

We calculate the expense percentage from your income statement and supporting records.

The letter states the period covered, method used, key components, and limits.

It does not replace audited financial statements. It gives the recipient a concise expense view linked to actual records.

Looking to lease or rent an apartment? A CPA can write a letter verifying your status for tenant or lender needs.

Landlords and property managers want reliable income verification.

We prepare a CPA proof of income letter that pairs with tax returns, bank statements, or a current P&L (profit and loss).

Letters include recipient name, property address if available, period covered, and CPA signature on letterhead. Delivery can go directly to the leasing office upon your consent.

Certify your self-employment status with a CPA letter, ensuring 100% approval for your needs.

This CPA letter is built for sole proprietorship and small business owners. It addresses self-employment income, expense patterns, and business stability.

Most mortgage programs require one to two years of signed federal tax returns for self-employed borrowers. We align the letter with the figures under review.

Self-employment is common. In Q4 2023, 9.1 million unincorporated self-employed workers represented 5.7% of nonagricultural workers. Lenders often need third-party confirmation for this group.

Own a business? A CPA will write a letter confirming your business name, status, and ownership.

Lenders often ask for a “use of funds” confirmation.

We issue a CPA letter that states the intended use: down payment, closing costs, line of credit, equipment purchase, or working capital.

We reference the source of funds and relevant financial records.

We confirm the transaction is recorded within standard accounting practices and consistent with the business purpose.

If policy language is required, we align wording to the lender’s checklist and program rules.

This letter supports underwriting for business loan, line of credit, mortgage, or refinancing.

We include recipient name, loan number(if provided), period covered, and CPA signature.

When requested, we add a brief statement on solvency indicators tied to financial statements—without providing an audit opinion.

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

We start every project with a CPA engagement letter.

It defines scope, deliverables, timeline, and fees.

It explains responsibilities: client, lender, and CPA.

It covers confidentiality, data access, and record retention.

It states liability (financial accounting) limits and indemnity terms.

It references applicable standards: AICPA(American Institute of Certified Public Accountants) and state board rules.

You receive clear terms before work begins—no surprises.

Use cases: income verification, CPA comfort letter, CPA 3rd party verification, CPA expense ratio letter, and CPA letter of explanation.

Entities included: client name, business entity, recipient, purpose, and consent for third-party delivery.

We reference documents examined and calculations made. We do not provide an audit opinion or guarantee loan performance.

We explain procedures performed and the limits of our work. We reference documents examined and calculations made. We do not provide an audit opinion or guarantee loan performance. Our language follows AICPA comfort-letter guidance and third-party verification practices to reduce misinterpretation and risk.

Common requests: confirmation of self-employment, business existence, revenue methods, and expense ratio notes. When a requester asks for assertions beyond CPA standards, we propose acceptable wording instead.

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

We issue a CPA verification letter to third parties. Banks, insurance carriers, mortgage brokers, and creditors use it to confirm facts.

Scope is defined. We confirm items we can support with tax returns, financial statements, and bank statements.

Typical requests: self-employment status, time in business, business existence, revenue method, and use of business funds.

Language follows AICPA(American Institute of Certified Public Accountants) guidance for comfort letters and third-party verifications. We explain procedures and limits to avoid misinterpretation.

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

Underwriting flags unusual items. We provide a CPA letter of explanation to add context.

Use cases: large year-over-year changes, seasonal revenue, one-time expenses, or a recent entity change.

We reference source documents and calculations. We avoid legal advice.

Our goal is clarity for credit risk review and a direct link to the loan file.

Your letter appears on CPA letterhead with signature, seal, and notarial acknowledgment. We confirm identity, date, and capacity.

Some recipients require a notarized CPA letter.

This occurs with certain state forms, lenders, and adoption or immigration files.

We coordinate a commissioned notary.

Your letter appears on CPA letterhead with signature, seal, and notarial acknowledgment.

We confirm identity, date, and capacity.

Scope remains the same: we verify facts from tax returns, financial statements, and bank statements.

We do not provide legal advice.

Common requests: mortgage packages, apartment rentals, business licenses, insurance, and creditor files.

Ask for a notarized option when the checklist mentions “notary,” “acknowledgment,” or “jurat.”

This letter, required by lenders or tenants, certifies your employment status, tenure, and wages.

Ignition Tax prepares a CPA-signed income verification letter based on your income verification documents.

The letter is written for review teams.

It stays within professional standards.

In the U.S., renters often spend around 30% of income on housing as a standard affordability guide.

Many landlords and apartment management teams use this ratio during screening.

A clear verification of income letter helps them confirm the numbers faster.

Brooklyn applications move fast.

NYC lease packages are time-sensitive.

Banks and mortgage lenders may also ask for specific wording for underwriting.

We align the employment and income verification letter to your stated purpose.

We also align it to the time period your reviewer needs.

This service fits common requests such as:

You get a Certified Public Accountant income verification letter that is built for review.

It is easy to scan.

It states the income basis in plain wording.

It matches the purpose of your request.

We prepare letters for common decision points.

These include:

If your reviewer asks for a specific recipient line, we format for that.

If they ask for a time period, we reflect that.

Your verification of income letter is based on records.

We do not guess.

We use income verification documents that fit your situation, such as:

For self-employed income, we often rely on tax returns and business records.

For W-2 employees, we focus on pay and tax documents.

Your CPA letter verifying income states what was reviewed.

It also states the time period covered.

This helps lenders and landlords understand the basis of the numbers.

We include a simple limitations disclaimer.

It supports professional standards.

It avoids language that implies an audit or guarantee.

This service is built for review teams.

It supports common lender and landlord checks.

It also supports employer requests that need a signed statement from a Certified Public Accountant.

You get a verification of income letter that is document-based.

You also get wording that stays within professional standards.

Underwriting teams read fast.

They look for clear dates, clear amounts, and clear support.

This CPA income verification letter is structured for:

Many lenders ask for income that can be supported over time.

For self-employed income, it is common for reviewers to request up to 2 years of tax returns or comparable records.

Rules vary by lender and program.

Not every income type fits a standard employer letter.

That is where an income verification letter from a Certified Public Accountant can help.

We support income scenarios such as:

We use tax returns and business records when they apply.

We keep the language simple.

Many reviewers do not want a long narrative.

They want a clear income period.

They want the basis for the numbers.

Your CPA letter verifying income can cover:

This reduces back-and-forth.

It also helps the decision-maker understand what the letter does and does not say.

NYC rental screening often uses simple income benchmarks.

Many landlords use the 40x rent guideline.

That means annual income around 40 times the monthly rent.

It is common in many NYC apartment lease reviews, but it is not universal.

We format proof of income for:

If a landlord asks for a proof of income letter, we align the letter to the documents you provide.

If they ask for an employment verification letter, we clarify what can be confirmed from records.

Some reviewers require clear identifiers.

They may want proof the letter is from a licensed CPA.

When needed, the letter includes:

We keep it professional.

We avoid statements that imply a guarantee.

We follow ethical standards and verification procedures based on the records provided.

People come to us when they need a CPA income verification letter that can hold up in a real review.

They also come to us when timing matters.

Brooklyn rental and lending requests can move fast.

So we keep the process clear and document-based.

A CPA letter verifying income must be careful.

It should reflect what the records support.

It should also stay within ethical boundaries.

We follow:

We do not write beyond what can be verified.

That reduces rejection risk.

Most banks and landlords read in seconds.

They look for the period, income basis, and signature.

Our letters use:

This helps the reviewer find what they need without follow-up.

A mortgage application review is not the same as an employer request.

A loan application may need underwriting-focused wording.

An apartment lease may need proof-of-income clarity.

We adjust the structure to fit the purpose, such as:

We keep the scope aligned to the request.

Income verification documents contain sensitive details.

We treat them that way.

We only request what is needed for verification.

We do not ask for extra documents without a reason.

We also keep the process focused, so you can submit your letter sooner.

The process is simple.

It is built to reduce delays.

It is also built to reduce back-and-forth with a lender, landlord, or employer.

Start by telling us why you need the letter.

This helps us match the format and wording.

Common use cases include:

If you have a sample letter income verification from the reviewer, share it.

We can align the structure to what they expect.

Next, you share the documents that support the income.

We only ask for what fits your situation.

Examples include:

If you are self-employed, business records and tax returns are often key.

If you are employed, W-2 and related income documentation may be enough.

We review your documents and build the draft letter.

We check for consistency across records.

This includes parsing names, dates, and amounts across documents.

We keep the scope clear:

This keeps the verification of income letter easy to validate.

After review, we finalize the CPA income verification letter.

It includes letterhead and a Certified Public Accountant signature.

We support reasonable formatting requests, such as:

Delivery options depend on your request and timeline.

Sometimes a reviewer asks a follow-up question.

They may ask what documents were used.

They may ask for the time period clarification.

You get one point of contact at Ignition Tax.

We help answer questions about what the letter states.

We keep responses consistent with the letter and the records.

Different reviewers ask for different formats.

So we offer focused options.

Each CPA income verification letter is based on your income verification documents.

Each letter states the time period and what was reviewed.

If you are self-employed, income is often shown across records.

Lenders and landlords may want a letter that ties the story together.

We prepare an income verification letter for self employed income such as:

Common supporting items include tax returns, business records, and a profit and loss statement (P&L).

We keep the wording clear.

We avoid claims that go beyond the documents.

1099 income can change month to month.

Reviewers often want a clear time period and the source documents used.

We support:

Your CPA letter verifying income can reference the documents reviewed.

It can also clarify whether the income is personal income, business income, or both, based on records.

Mortgage underwriting is detail-focused.

It often requires clear dates, clear income basis, and simple language.

We prepare CPA income verification letters for mortgage requests with:

If your mortgage lender provides a template or wording request, we align the draft to it where appropriate.

Brooklyn and NYC rentals often move on short timelines.

Landlords and management companies want fast proof of income.

They also want the letter to match the rental application package.

We prepare a CPA income verification letter for apartment lease needs such as:

The letter is written for quick review.

It states the income period and the documents reviewed.

It keeps the scope clear.

Some applicants need proof of rental income.

This can apply to property owners or landlords.

We can support proof of rental income when records support it.

Examples of records may include:

We only state what the documents support.

If records are limited, we explain what can be confirmed.

Some requests use “IRS income verification letter” as a general phrase.

A CPA letter is different from an Internal Revenue Service transcript.

If your reviewer uses this wording, we keep the letter clear:

This helps avoid confusion during review.

A verification of non filing letter is usually an Internal Revenue Service document.

It is not the same as a CPA letter verifying income.

If you need a verification of non filing letter, we can explain:

If your reviewer needs both, we help you understand the checklist.

We keep the process focused on the documents required.

People usually contact us when a deadline is close.

They also contact us when a reviewer wants a CPA letter verifying income with clear wording.

Here are examples of what clients in Brooklyn have shared.

Rental application timeline

“Needed a CPA income verification letter for an apartment lease. The turnaround was quick. The letter matched what the management company asked for.”

Lender acceptance

“Submitted the income verification letter from a CPA for a loan application. The format was clear. The lender accepted it without extra edits.”

Reviewers tend to focus on a few items.

We format the letter around these points:

You need a CPA income verification letter that fits the request.

You also need it to stay within professional standards.

That is what we focus on at Ignition Tax in Brooklyn, NY.

Requests are not all the same.

A landlord may want a proof of income letter for an apartment lease.

A bank may want underwriting-ready wording for a loan application.

An employer may want an employment and income verification letter for HR.

We structure the letter around the use case, such as:

This helps reduce revisions and delays.

A CPA letter verifying income must be credible.

So we follow a consistent process.

Your letter can include:

We keep formatting professional and simple.

Some reviewers ask for statements a CPA cannot ethically make.

We address that early.

We provide:

This helps your reviewer understand the scope.

It also protects you from a letter that could be rejected for improper wording.

Brooklyn applications often move fast.

NYC reviewers also use specific wording.

We plan for both, so your income verification letter is easier to accept.

NYC lease packages can have tight deadlines.

Brokers and management companies may ask for a proof of income letter right away.

They often want it with supporting documents.

We help you submit a clean packet that may include:

If the recipient has a checklist, we align the letter to it.

Banks and lenders use different terms for similar requests.

One may say “income letter.”

Another may ask for a “letter confirming income.”

Another may request an “income certification letter.”

We keep the meaning clear by stating:

This reduces confusion during underwriting.

Underwriters may ask for more than one document type.

A common request is a profit and loss statement(P&L) plus tax returns.

We support:

We keep the wording consistent with the records you provide.

Some applications include benefit income.

Reviewers may want it listed as part of total income.

When applicable, we can reference benefit documentation in a careful way:

If a lender or landlord needs a specific format, we mirror their request where appropriate.

Last-minute requests are common in Brooklyn.

A broker may call.

A lender may email.

The fastest path is having the right income verification documents ready.

Start with documents that match your income type.

Collect what you already have.

Common items include:

If the request is for an apartment lease, keep the full packet together.

If the request is for a mortgage application, keep the most recent supporting records easy to share.

Most rejections come from small mismatches.

Check the basics:

If a lender asks for a specific wording, share that request.

We can align the structure while keeping the scope accurate.

Turnaround time depends on document readiness.

If records are complete, same-day may be possible.

If records are missing or inconsistent, next-day is more realistic.

A simple way to plan:

This helps you avoid delays in a rental application, loan application, or underwriting review.

A CPA income verification letter should be easy to review.

It should also be clear about what supports the income.

That is why we build it from records and keep the scope tight.

Most lenders, landlords, and employers expect a standard layout.

A CPA letter verifying income usually includes:

This structure helps the reviewer find key details fast.

The right documents depend on your income type.

We focus on records that support the numbers.

We may need:

If something does not line up, we flag it early.

That helps reduce follow-up requests from a bank, mortgage lender, or landlord.

A verification of income letter reflects the documents reviewed.

It does not replace official records from a bank or the Internal Revenue Service.

It is also not an audit report.

We keep the limitations statement short and clear.

This protects the reader from misunderstanding the scope.

It also supports ethical standards for Certified Public Accountant work.

Income checks do not stop after one letter.

Many people need proof again for a new apartment, a refinance, or a new loan application.

A simple record routine makes future requests easier.

Keep your income verification documents in one place.

This saves time when a lender or landlord asks again.

Store:

If you are self-employed, update records monthly when possible.

That helps confirm income periods without gaps.

It also creates follow-up questions from underwriting teams.

Simple steps help:

Cleaner records support a clearer CPA income verification letter.

They also reduce revisions.

Some lenders look beyond gross income.

They want stability.

They may ask how income trends over time.

Tracking helps you answer quickly:

This is useful for self-employed income, 1099 income, and business owner income.

It also supports faster income confirmation when you need another letter.

Many clients ask for a CPA income verification letter because a bigger goal is on the line.

A new apartment.

A mortgage application.

A loan application.

Ongoing support can make the next request easier.

We provide tax preparation services for:

Accurate tax returns support stronger income documentation.

They also reduce follow-up questions during verification.

If you need cleaner business records, bookkeeping helps.

We support reporting that is easier to verify later.

This can include:

Clear reporting helps when a lender asks for updated income confirmation.

We help set up simple systems for income documentation, such as:

This reduces delays when you need proof of income again.

If you are preparing for a loan application or mortgage application, timing matters.

So does document readiness.

We support planning such as:

This keeps your file easier to review.

Some recipients ask for notarization.

This is usually for a separate form.

It is not always for the CPA income verification letter itself.

If your process requires a notary public, we can coordinate guidance.

We also clarify expectations:

CPA letters are typically signed by the Certified Public Accountant.

They are not usually notarized unless the recipient specifically requests it.

A CPA income verification letter is a signed letter from a Certified Public Accountant.

It summarizes income based on documents reviewed.

It is often used for a loan application, mortgage application, rental application, or employer request.

A verification of income letter commonly includes:

The exact wording depends on your use case.

Start by sharing:

We then review and draft the letter based on records.

Cost depends on complexity.

A W-2 income letter may be more direct.

A self-employed income letter may require more records review.

Pricing factors often include:

For an exact quote, we review your use case and document set.

Turnaround time depends on how quickly you can share complete records.

If documents are ready, faster delivery may be possible.

If you have a deadline for an apartment lease or loan application, share it upfront.

Yes, a CPA income verification letter is commonly requested by a mortgage lender or bank.

We structure the letter for underwriting review.

We keep the scope aligned to the documents reviewed and the stated period.

Yes.

Brooklyn and NYC landlords often ask for proof of income letters and supporting documents.

We format the letter for a rental application or apartment lease package.

Yes.

We support:

We base the letter on records such as tax returns and profit and loss statement(P&L) documents.

We can share a general format outline.

We do not reuse another client’s letter.

Your letter is written from your documents, your period, and your recipient’s request.

A CPA letter verifying income is prepared by a Certified Public Accountant based on documents reviewed.

An Internal Revenue Service verification document is issued by the IRS, such as a transcript.

They serve different purposes.

Some lenders ask for both.

If your request mentions “income verification letter,” we help clarify what the reviewer is actually requesting.

If your lender, landlord, or employer needs a CPA income verification letter, start now.

A clear verification of income letter helps the reviewer move your file forward.

Choose the next step that fits your timeline:

If you searched “CPA income verification letter near me,” you likely need two things.

A local Certified Public Accountant who can sign the letter.

And a process that fits Brooklyn and NYC timelines.

Ignition Tax supports Brooklyn, NY clients who need:

Local requests often come with a checklist.

A broker may want a proof of income letter plus supporting documents.

A lender may want a letter confirming income with a specific income period.

We format the letter for the stated use case and the records provided.

CPA income verification letter cost depends on the work needed to review and verify documents.

It is not a flat fee for every case.

A simple W-2 situation can be more direct.

A business owner file can involve more records.

Below are the main factors we use when building a quote.

These items commonly affect CPA income verification letter price:

These items usually do not affect the quote on their own:

For an accurate CPA income verification letter quote, the fastest step is sharing your use case and the income verification documents you have available.

Turnaround time depends on one thing first.

How ready your income verification documents are.

So document readiness matters.

Same-day turnaround is more realistic when:

Same-day requests can still require quick follow-ups.

Next-day turnaround is more common when:

If you have an apartment lease deadline, share it early.

It helps prioritize the right document set.

These letters are not the same.

A letter from accountant confirming income is based on financial records.

It is often used when:

An employer income letter comes from the employer.

It typically confirms employment details and wages.

If a reviewer asks for an employment and income verification letter, we help clarify what they need.

Some reviewers accept a CPA income verification letter when employer documentation is limited.

If you are a W-2 employee, proof of income is often more direct.

Many landlords and lenders want:

A CPA income verification letter can still help when:

We keep the verification of income letter focused on the documents provided.

We also state the income period clearly, so the reviewer can match it to the application.

Self-employed income is reviewed differently than W-2 wages.

Many lenders and landlords want a clear link between your income and your records.

That is why the letter must state the period and the document basis.

For Schedule C income, we often review:

We keep the wording tight.

We avoid future income claims.

We only confirm what the documents support.

A loan application file is usually reviewed in stages.

The reviewer wants quick confirmation.

They also want scope clarity.

A Certified Public Accountant signed income verification letter can help by stating:

If the lender provides specific wording, we align structure where appropriate.

We keep the statements accurate and document-based.

Underwriting focuses on consistency.

They compare the letter to what is in the file.

We draft a CPA issued income verification letter with:

For self-employed applicants, underwriters often look for patterns.

They may compare tax returns to P&L figures.

So alignment matters.

When a reviewer asks for a letter of employment verification and salary, they usually want clear basics.

They want to confirm the person and the pay period.

They want a clean income number they can use.

Common items reviewers look for:

If you are self-employed, there may be no employer letter to provide.

In that case, a CPA income verification letter can serve as an income confirmation based on records.

A salary verification letter and a letter of wages verification are often requested for the same reason.

A reviewer needs proof of income for a decision.

This can be for a bank, mortgage lender, landlord, or employer file.

For W-2 employees, the core support usually includes:

A CPA income verification letter can help when the recipient wants a single signed summary.

It can also help when the request needs a clear income period and clean wording.

Some applicants have more than one income source.

This is common in Brooklyn.

It can include wages plus freelance work.

It can also include business income plus rental income.

An income source letter works best when it is organized by category, such as:

We keep the letter clear about what documents support each source.

We also avoid mixing time periods.

That helps the reviewer confirm income faster.

An income proof letter from employer can be enough in many cases.

But some situations still require a CPA letter verifying income.

A CPA income verification letter may be needed when:

If the reviewer asks for both, we help you understand the checklist.

We keep the Certified Public Accountant letter focused on records, not assumptions.

Proof of rental income must match records.

Reviewers often want to see where the income comes from and the time period.

Documents that usually support proof of rental income include:

We only confirm what the documents support.

If rental income varies, we state the period and basis clearly.

That helps a lender, bank, or landlord evaluate the income with fewer follow-ups.

A CPA letter verifying income is different.

It is tied to documents.

It is signed by a Certified Public Accountant.

It also includes clear limits.

A CPA income verification letter is built for review teams.

It does a few things templates usually do not:

This helps lenders and landlords evaluate the letter faster.

Every letter is written from your documents and your request.

So the numbers and wording will differ by client.

But the structure is consistent, because reviewers expect it.

A typical CPA provided income verification letter includes:

This structure supports underwriting and apartment lease review.

Recipients vary.

But the goal stays the same.

Make it clear who the letter is for and why it exists.

Common recipient types include:

If your reviewer provides exact wording, we use it where appropriate.

We keep the rest of the letter consistent with the records reviewed.

Some people call this a “AICPA income verification letter.”

In practice, you are usually requesting a CPA letter verifying income that follows ethical standards.

The key point is the same.

The letter should reflect records.

It should not overstate what can be confirmed.

We keep the letter aligned with:

This protects the reviewer from misunderstanding.

It also protects you from a letter that gets rejected for improper wording.

Income documentation is sensitive.

So the process needs structure.

We follow a document-based approach that supports compliance and verification procedures.

Our focus includes:

If a lender or landlord asks for a statement that is not supported by records, we explain the limit.

We then offer wording that stays accurate.

Mortgage underwriting often asks for a complete file.

The exact list depends on the lender and program.

But these items are common.

Typical income documentation includes:

A CPA income verification letter can help tie the documents together.

It also helps the reviewer see the period and the basis fast.

NYC apartment lease packages are often checklist-based.

Landlords and management companies may want proof of income plus supporting items.

Common income verification documents include:

If the landlord requests a proof of income letter, a CPA-signed letter can help make the packet easier to review.

Landlord requests in Brooklyn are often time-sensitive.

They also vary by building and management company.

Some ask for a letter confirming income.

Others ask for an employment and income verification letter.

We prepare a CPA income verification letter for landlord requests that:

If your landlord or broker has a sample letter to verify income, share it.

We can align the layout while keeping the content accurate and record-based.