When a mortgage lender requests a CPA comfort letter to support a borrower’s loan file, the request often creates confusion, for accountants, brokers, loan officers, and the borrower. Lenders want “verification,” accountants want to follow AICPA ethics, and borrowers simply want their mortgage approval to move forward.

A well-written CPA comfort letter template helps bridge these expectations. But due to strict cpa comfort letter requirements, the wording must stay aligned with AICPA, State Board of Accountancy rules, and lender documentation standards.

This guide explains what lenders expect, what CPAs are allowed to verify, and provides sample templates that are compliant, clear, and usable for accountants, brokers, and loan officers.

Why Mortgage Lenders Request CPA Comfort Letters

When Do Lenders Need a CPA Letter?

Mortgage Lenders, especially Conventional Mortgage Lenders, Portfolio Lenders, and Non-QM Lenders, typically request a CPA comfort letter when:

- The borrower is self-employed.

- AUS findings (from Desktop Underwriter (DU) or Loan Product Advisor (LPA) require additional documentation.

- The business’s financial statements raise questions about consistency.

- Underwriters need independent confirmation of business activity.

A CPA letter is not always required by Fannie Mae (FNMA), Freddie Mac (FHLMC), FHA, VA, or USDA guidelines, however, lenders may impose the request as an internal risk control.

Understanding CPA Comfort Letter Requirements

To write or evaluate a compliant letter, accountants, brokers, and loan officers must understand core cpa comfort letter requirements, which arise from:

- AICPA Professional Ethics Rules

- State Board of Accountancy regulations

- Third-Party Verification Standards

- Assurance Services Standards (Audit, Review, Compilation)

- IRS documentation rules

- FHFA lender oversight frameworks

What a CPA Can Verify

CPAs are allowed to confirm historical, factual information, including:

- Years the CPA has prepared the borrower’s tax returns

- Entity structure (LLC, S-Corp, C-Corp, Partnership, Sole Proprietorship)

- Ownership status

- Whether financial statements were prepared or reviewed

- Whether bookkeeping records exist and appear consistent

- Whether tax returns filed match IRS records

- Whether the business appears active (based on CPA knowledge)

What a CPA Cannot State

To comply with ethics rules, CPAs must not:

- Predict future income

- Guarantee loan repayment

- Confirm the borrower’s ability-to-repay

- Declare financial statements “audited” when they are not

- Validate income beyond what tax returns and records show

These limitations are essential to keep every cpa comfort letter template compliant.

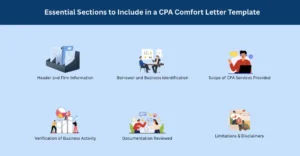

Essential Sections to Include in a CPA Comfort Letter Template

Header and Firm Information

- CPA Firm Name

- Address, phone, and email

- State Board of Accountancy license number

- Date of issuance

Borrower and Business Identification

- Borrower / Client name

- Business name (if applicable)

- Entity structure

- Business partner or co-owner names (if any)

Scope of CPA Services Provided

A clear explanation of what work the CPA performed:

- Tax preparation

- Bookkeeping assistance

- Compilation or review (if applicable)

- General advisory services

Verification of Business Activity

The CPA may state:

- Business is operational

- Business records have been reviewed

- The borrower appears self-employed based on documentation

Documentation Reviewed

Such as:

- IRS tax returns

- Financial statements

- General ledger

- Forms 1099

- Bank statements

- Merchant processing summaries (PayPal, Stripe, Square)

Limitations & Disclaimers

To comply with professional rules, disclaimers often include:

- No assurance is provided

- No guarantee of income or loan repayment

- Review limited to information supplied by the client

This section protects CPAs from liability.

CPA Comfort Letter Template (General Use)

Below is a customizable, compliant cpa comfort letter template used by mortgage lenders, CPAs, and brokers. It adheres to AICPA and State Board guidance.

Sample Template

[CPA Firm Letterhead]

[Address | Phone | Email | State License Number]

Date: [Insert Date]

To: [Mortgage Lender / Underwriter / Loan Processor]

Re: Borrower: [Name] — Business: [Business Name, If Applicable]

Dear [Lender/Underwriter],

I am a Certified Public Accountant licensed in the state of [State], and my firm has provided tax and accounting services to [Client/Borrower Name] and [Business Name] for the period of [Years Served].

Business and Tax Verification

Based on the records provided to me and the services performed, I can confirm the following factual information:

- The borrower operates as a [LLC/S-Corp/C-Corp/Partnership/Sole Proprietorship].

- The business appears active and operational for the tax years [Years].

- I prepared or reviewed the following documents:

- Federal and state tax returns

- Profit & Loss statements

- Balance sheets

- Bookkeeping records

- Merchant processing summaries (PayPal, Stripe, Square)

- The information reviewed was based on client-provided documentation.

Scope and Limitations

My letter is limited to verifying historical facts. I am not providing assurance, audit services, or any guarantee of future income, financial condition, or the borrower’s ability to repay any loan. This letter does not constitute an audit, review, or compilation under AICPA standards.

Please feel free to contact me if you have additional questions.

Sincerely,

[Name, CPA]

[Title]

[Firm Name]

Template Variation for Self-Employed Borrowers

When to Use This Version

This version is helpful when:

- The borrower files Schedule C

- The lender needs confirmation of business activity

- Non-QM or portfolio lenders request enhanced verification

Key Differences

- Additional validation of merchant or invoicing activity

- More emphasis on business documentation

- Additional limitations to comply with AICPA rules

Template Variation for Fannie Mae & Freddie Mac Loans

Why Conventional Lenders Request This Version

Although FNMA and FHLMC do not require CPA letters, underwriters often request them to support:

- DU “verification required” findings

- Inconsistent tax-reported income

- Business ownership verification

What’s Included

- Verification of years in business

- Confirmation of entity structure

- Clarification that the CPA is not providing assurance

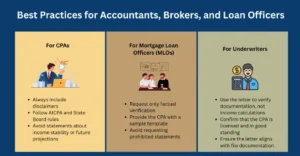

Best Practices for Accountants, Brokers, and Loan Officers

For CPAs

- Always include disclaimers

- Follow AICPA and State Board rules

- Avoid statements about income stability or future projections

For Mortgage Loan Officers (MLOs)

- Request only factual verification

- Provide the CPA with a sample template

- Avoid requesting prohibited statements

For Underwriters

- Use the letter to verify documentation, not income calculations

- Confirm that the CPA is licensed and in good standing

- Ensure the letter aligns with file documentation