Need a CPA letter for mortgage, apartment, bank, or insurer? We prepare CPA income verification letters, CPA comfort letters, and CPA 3rd-party verification—fast, accurate, and compliant across the United States.

Need a CPA letter for mortgage, apartment, bank, Self-employed workers are a meaningful segment of borrowers. In Q4 2023, 9.1 million Americans were unincorporated self-employed, about 5.7% of nonagricultural workers. That group often needs third-party income verification to satisfy lenders.

Most lenders ask self-employed clients for two years of tax returns and a current P&L(profit and loss) with a balance sheet. A CPA letter aligns the financial details you provide with the documents in your loan file.

We keep scope clear. We verify facts available from tax returns, bank statements, and financial statements. We do not provide legal advice.

or insurer? We prepare CPA income verification letters, CPA comfort letters, and CPA 3rd-party verification—fast, accurate, and compliant across the United States.

Ignitiontax is a Certified Public Accountant(CPA) firm focused on lender and landlord documentation. Our CPA Letter services cover income verification, comfort letters, and 3rd-party verification for banks, mortgage brokers, property managers, insurers, and creditors in the United States.

We work with self-employed individuals, small business owners, contractors, and freelancers. We prepare a CPA letter of explanation, CPA expense ratio letter, CPA letter for apartment rentals, CPA letter for home loan and mortgage, and CPA letter use of business funds. We also handle notarized CPA letters when required by the recipient.

We work with self-employed individuals, small business owners, contractors, and freelancers. We prepare a CPA letter of explanation, CPA expense ratio letter, CPA letter for apartment rentals, CPA letter for home loan and mortgage, and CPA letter use of business funds. We also handle notarized CPA letters when required by the recipient.

Each CPA letter is issued on CPA letterhead. It includes client name, purpose, recipient, procedures performed, and signature. Where needed, we coordinate VOE(Verification of Employment) language and lender address details.

Quality and compliance matter. We follow AICPA(American Institute of Certified Public Accountants) professional standards and IRS(Internal Revenue Service) rules for documentation. We maintain confidentiality, accuracy, and a defined scope of attestation.

If you need a starting point, ask for a cpa letter template or a cpa letter sample(cpa letter example). We tailor the final letter to the lender’s checklist and to your tax returns and financial records.

Ignitiontax prepares CPA Letter services for the United States. Scope is clear. We verify income and facts from tax returns, bank statements, and financial statements. We align wording to lender and landlord checklists. For self-employed clients, most mortgage programs expect one to two years of federal tax returns. Fannie Mae and Freddie Mac outline these documentation rules.

We follow AICPA(American Institute of Certified Public Accountants) guidance for third-party verification and comfort letters. We state what was checked. We avoid assurances outside CPA standards.

Banks or lenders require a CPA letter to verify your financials or business status for loan approval.

Prepared for mortgage brokers, banks, and refinancing. We align with agency documentation rules for self-employed borrowers—typically one to two years of signed federal returns, with program variations. We reflect the verified figures and the period covered.

The letter can support: income stability notes, business existence, and source-of-funds or use-of-business-funds confirmation when requested. We coordinate delivery to the lender and include lender name, address, loan number(if provided), and the borrower’s consent.

A CPA writes a letter confirming your earnings for various purposes, ensuring accurate income verification.

For lenders, landlords, and banks. We confirm income using IRS(Internal Revenue Service) tax returns, year-to-date P&L, balance sheet, and bank statements. Letter includes client name, business entity(if any), time in business, method used, and signature on CPA letterhead. Many landlords accept a CPA letter as proof of income along with tax returns and statements.

Use cases: mortgage pre-approval, apartment application, lease renewal, line of credit, and underwriting re-verification. We tailor the cpa letter sample to the recipient’s template when provided.

Need to verify your business expense ratio? This letter, requested by lenders or banks, confirms your working expenses.

Some lenders and landlords ask for an expense ratio.

We calculate the expense percentage from your income statement and supporting records.

The letter states the period covered, method used, key components, and limits.

It does not replace audited financial statements. It gives the recipient a concise expense view linked to actual records.

Looking to lease or rent an apartment? A CPA can write a letter verifying your status for tenant or lender needs.

Landlords and property managers want reliable income verification.

We prepare a CPA proof of income letter that pairs with tax returns, bank statements, or a current P&L (profit and loss).

Letters include recipient name, property address if available, period covered, and CPA signature on letterhead. Delivery can go directly to the leasing office upon your consent.

Certify your self-employment status with a CPA letter, ensuring 100% approval for your needs.

This CPA letter is built for sole proprietorship and small business owners. It addresses self-employment income, expense patterns, and business stability.

Most mortgage programs require one to two years of signed federal tax returns for self-employed borrowers. We align the letter with the figures under review.

Self-employment is common. In Q4 2023, 9.1 million unincorporated self-employed workers represented 5.7% of nonagricultural workers. Lenders often need third-party confirmation for this group.

Own a business? A CPA will write a letter confirming your business name, status, and ownership.

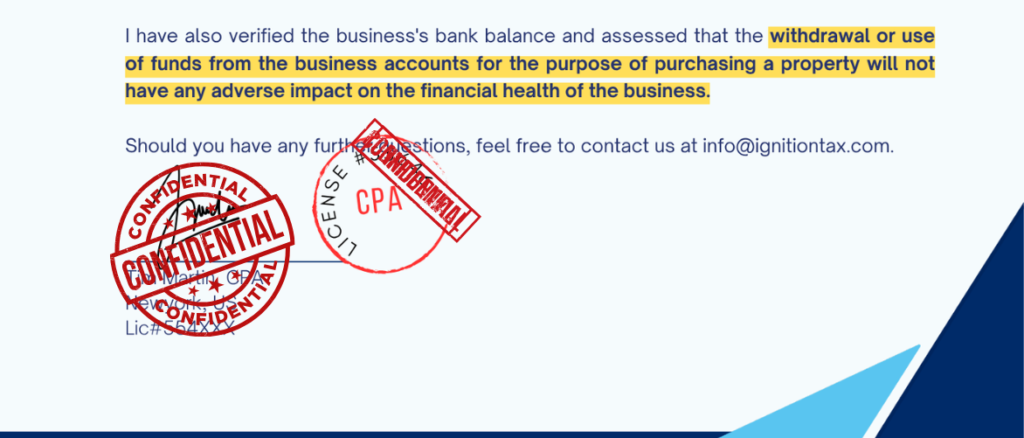

Lenders often ask for a “use of funds” confirmation.

We issue a CPA letter that states the intended use: down payment, closing costs, line of credit, equipment purchase, or working capital.

We reference the source of funds and relevant financial records.

We confirm the transaction is recorded within standard accounting practices and consistent with the business purpose.

If policy language is required, we align wording to the lender’s checklist and program rules.

This letter supports underwriting for business loan, line of credit, mortgage, or refinancing.

We include recipient name, loan number(if provided), period covered, and CPA signature.

When requested, we add a brief statement on solvency indicators tied to financial statements—without providing an audit opinion.

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

We start every project with a CPA engagement letter.

It defines scope, deliverables, timeline, and fees.

It explains responsibilities: client, lender, and CPA.

It covers confidentiality, data access, and record retention.

It states liability (financial accounting) limits and indemnity terms.

It references applicable standards: AICPA(American Institute of Certified Public Accountants) and state board rules.

You receive clear terms before work begins—no surprises.

Use cases: income verification, CPA comfort letter, CPA 3rd party verification, CPA expense ratio letter, and CPA letter of explanation.

Entities included: client name, business entity, recipient, purpose, and consent for third-party delivery.

We reference documents examined and calculations made. We do not provide an audit opinion or guarantee loan performance.

We explain procedures performed and the limits of our work. We reference documents examined and calculations made. We do not provide an audit opinion or guarantee loan performance. Our language follows AICPA comfort-letter guidance and third-party verification practices to reduce misinterpretation and risk.

Common requests: confirmation of self-employment, business existence, revenue methods, and expense ratio notes. When a requester asks for assertions beyond CPA standards, we propose acceptable wording instead.

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

We issue a CPA verification letter to third parties. Banks, insurance carriers, mortgage brokers, and creditors use it to confirm facts.

Scope is defined. We confirm items we can support with tax returns, financial statements, and bank statements.

Typical requests: self-employment status, time in business, business existence, revenue method, and use of business funds.

Language follows AICPA(American Institute of Certified Public Accountants) guidance for comfort letters and third-party verifications. We explain procedures and limits to avoid misinterpretation.

A CPA can write a letter to meet your unique needs, whether legal, professional, or other purposes.

Underwriting flags unusual items. We provide a CPA letter of explanation to add context.

Use cases: large year-over-year changes, seasonal revenue, one-time expenses, or a recent entity change.

We reference source documents and calculations. We avoid legal advice.

Our goal is clarity for credit risk review and a direct link to the loan file.

Your letter appears on CPA letterhead with signature, seal, and notarial acknowledgment. We confirm identity, date, and capacity.

Some recipients require a notarized CPA letter.

This occurs with certain state forms, lenders, and adoption or immigration files.

We coordinate a commissioned notary.

Your letter appears on CPA letterhead with signature, seal, and notarial acknowledgment.

We confirm identity, date, and capacity.

Scope remains the same: we verify facts from tax returns, financial statements, and bank statements.

We do not provide legal advice.

Common requests: mortgage packages, apartment rentals, business licenses, insurance, and creditor files.

Ask for a notarized option when the checklist mentions “notary,” “acknowledgment,” or “jurat.”

This letter, required by lenders or tenants, certifies your employment status, tenure, and wages.

Start with a short request. Share client name, business entity(if any), purpose, and recipient. Add contact details and the deadline. Authorize Ignitiontax to speak with the lender, landlord, insurer, or creditor. Consent lets us deliver the CPA letter directly to the third party.

Provide U.S. tax returns(Federal), W-2/1099 if applicable, and year-to-date P&L(profit and loss). Include a recent balance sheet for businesses. Add bank statements to support deposits and cash flow. Provide a clear ID. If you have a lender checklist or cpa letter template, attach it. It helps align wording.

We review the documents and compare figures. We confirm self-employment status, time in business, and relevant totals. We describe procedures performed. We do not opine on future performance.

We draft the CPA letter with the recipient’s required items. We add client name, period covered, method used, and limits. A CPA signs on firm letterhead. If the checklist requires a notarized CPA letter, we coordinate a notary and add the acknowledgment.

We deliver securely to the lender, landlord, mortgage broker, insurer, or creditor. Options: encrypted email, portal upload, or direct handoff per instructions. We keep a record of what was sent, to whom, and when. On request, we provide a cpa letter sample or redacted example for your file.

Local support in Brooklyn. Nationwide compliance across the United States.

Ignitiontax prepares CPA Letter services for income verification, comfort letters, and third-party verification.

We work with banks, mortgage brokers, landlords, insurers, and creditors.

Service areas: Brooklyn, Queens, Manhattan, Bronx, Staten Island, Long Island, and New Jersey. Remote delivery available in all 50 states.

Use cases: mortgage and refinancing, apartment applications, business loans, line of credit, and insurance files.

Documents we rely on: U.S. tax returns, financial statements, and bank statements.

Output: signed CPA letter on firm letterhead; notarized CPA letter on request.

Our CPA-written letters boast a 100% approval rate with lenders nationwide. Below are some recent loan approvals secured by our clients.

We are currently in the process of obtaining a mortgage loan, and the lender requires a CPA letter to verify the following details:

Our lenders require a letter that verifies the business expense ratio, which is 15%. Additionally, the letter should state that “the use of business funds does not have any adverse impact on the business”.

We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

We follow AICPA(American Institute of Certified Public Accountants) professional standards.

We align documentation with IRS(Internal Revenue Service) rules and state board regulations.

We maintain confidentiality, accuracy, and a defined scope of attestation.

No legal advice. No audit opinion. Clear limits stated in every letter.

A CPA letter verifies income, business activity, and employment, giving lenders the confidence to approve your application.

Local service. Remote coverage nationwide.

Real clients. Real outcomes.

Feedback highlights clear wording, lender-ready CPA letters, and on-time delivery.

Common notes: “income verification matched tax returns,” “comfort letter explained procedures and limits,” and “third-party verification reduced back-and-forth with the mortgage broker.”

We keep names private. We can share redacted quotes on request.

I was unsure about the cost of the CPA letter, but after experiencing the service, I can confidently say it was well worth it. Ignition Tax offers such reasonable pricing without compromising on high-quality service. Excellent value!

I wasn’t sure how the process worked at first but, after communicating with the CPA and getting all the guidance I needed, I felt much more relaxed. Ignition Tax really made everything easy and trustworthy. Highly recommended

As a self-employed person, I was skeptical about whether a CPA letter would work for my mortgage. But Ignition Tax delivered a letter that perfectly verified my income, and my lender accepted it without a single question. Thank you

Last Week, I was in process of my loan application and lenders demands a CPA letter to verify my

business details. Thanks Ignition Tax for process smoothly. Its Approved!!!

I always trust Ignition Tax for CPA letters. They’re quick, reliable, and my clients have no issues with acceptance. Highly recommend!

My lender needed a business letter, and I wasn’t sure what to do. Ignition Tax guided me through the loan process and provided the letter. I highly appreciated their professionalism and communication.

The tenant approved my rental application. Thank you for making the process so easy and helping me get through it.

As a self-employed person, I needed a CPA letter for my loan. Ignition Tax provided a professional, detailed letter that met all the lender’s requirements. The team was courteous, and everything was done right. Highly satisfied

My biggest concern was getting the CPA letter in time for my mortgage deadline. Ignition Tax delivered it within 2 hours, and I was amazed at how seamless and fast the process was. Highly satisfied

At first, I was a bit confused, but I’m so glad I chose Ignition Tax! The lender accepted the letter without any additional requests. Thank you for making this so easy!

I needed a CPA letter quickly for my mortgage, and Ignition Tax delivered it professionally in no time. Literally, I received it within 2 hours, and the fast turnaround made the entire process so much smoother. I’m happy with the service

I was looking for a verified CPA for my mortgage and found Ignition Tax. They made the process easy and delivered exactly what I needed. I highly recommend their services.

We are a trusted mortgage loan firm and always recommend our clients get their CPA letters from Ignition Tax. They understand exactly what lenders require and deliver accurate, professional documents.

A CPA letter is a signed document on letterhead that confirms specific facts for a third party.

Typical use: income verification for a mortgage or apartment, comfort letter describing procedures and limits, 3rd-party verification for banks, insurers, or creditors.

It references source records such as tax returns, financial statements, and bank statements.

It is not an audit or legal advice. Scope and limits are stated in the letter.

You get a CPA letter from a Certified Public Accountant firm like Ignitiontax.

Who needs it: self-employed individuals, small business owners, contractors, and freelancers applying for a mortgage, apartment, business loan, insurance, or refinancing.

Process: submit purpose, recipient, and consent → upload documents → CPA review and verification → draft → signature on CPA letterhead → optional notarized CPA letter → secure delivery to the recipient.

If your lender lacks a format, ask for a cpa letter example or cpa letter template. We align wording to the checklist and to your file.

What lenders accept. It depends on the program and the underwriter.

Key differences.

Assurance: CPA letter = limited to stated procedures; tax return = filed with IRS(Internal Revenue Service); bank statement = issuer record, not analysis.

Use all three together for stronger income verification and credit review.

Sometimes.

A notarized CPA letter is required when a lender, landlord, or state form asks for a notary acknowledgment or jurat.

Common triggers: adoption or immigration packets, certain mortgage closings, some licensing or insurance forms.

If the checklist mentions “notary,” “acknowledgment,” or “seal,” request notarization.

Ignitiontax can coordinate a commissioned notary and include the notarial block with the CPA signature.

Pricing. Flat fees for standard requests:

Add-ons: rush service, notary, extra recipients, or custom lender language.

Turnaround. Same-day options when documents are complete and the scope is standard. Most files finish within 1–3 business days. You receive the quote and timeline before engagement, so the CPA letter cost is clear.

No.

A lender or landlord needs a letter signed by a Certified Public Accountant(CPA) who reviewed your records.

Our letters follow AICPA(American Institute of Certified Public Accountants) standards, state board rules, and defined procedures.

Result: clear scope, proper limits, and acceptance by the recipient.

A CPA letter is a signed document on CPA letterhead that confirms specific facts for a third party.

Purpose: verification, limited attestation, or comfort.

Scope is defined. We state what we checked, the period covered, and the limits.

Typical contents: client name, business/entity, time in business, income figures, methods used(bank statements, financial statements, tax returns), recipient name, and CPA signature.

It is not an audit. It is not legal advice. It supports lender and landlord decisions for income verification, solvency, use of funds, or employment/self-employment status.

Mortgage and refinance. Underwriters may request a income verification letter, expense ratio details, or a use of business funds confirmation.

Apartment and rental. Property managers often accept a proof of income paired with tax returns and bank statements.

Insurance policy and creditors. Carriers and creditors can ask for third-party verification of revenue, business existence, or compliance notes.

Adoption or immigration files. Some packets seek income confirmation on letterhead signed by CPA.

Accredited investor. Certain offerings allow an accountant to confirm status where permitted.

We align each letter to the checklist: lender name, address, loan number, purpose, and period covered. Options include notarized letter and direct delivery to the recipient.

A CPA comfort letter explains the procedures performed and the limits of the work.

It may reference reconciliations, calculations, or agreement of figures to financial statements, bank statements, or tax returns.

It is not a opinion letter or an audit review letter unless the engagement is separately scoped under assurance standards.

What we can state: facts observed, methods used, and results of specified procedures.

What we cannot state: guarantees, forward-looking promises, or legal conclusions.

Language follows AICPA guidance and state board rules.

Outcome: clear, lender-ready documentation without overreach.

We issue a verification letter that meets recipient rules.

Include recipient name, department, and mailing address.

Add loan number, application ID, and contact email.

State purpose: income verification, use of business funds, or business existence.

Reference the documents reviewed: tax returns, income statement, bank statements.

Include limits and procedures. No legal advice.

Delivery options: secure email, lender portal upload, or courier.

Ask for a cpa letter template if the lender has one. We match format.

Bring clear financial records.

Built for self employed and sole proprietorship clients.

We confirm time in business, revenue method, and stability notes.

Methods used: reconcile bank deposits to P&L, compare year-over-year, and note seasonality.

We can add an expense ratio explanation.

If the lender requests a specific format, we align wording.

Use cases: mortgage, refinance, line of credit, and business loan.

Ask for a cpa letter sample to preview structure before we finalize.

Clear proof for rental screening.

We prepare a CPA proof of income letter that pairs with tax returns and bank statements.

Include property address, lease term, and contact for the verification of employment or income team.

We note period covered and calculation method.

Format: firm letterhead, date, recipient, and CPA signature.

Option: notarized cpa letter if the leasing office requests a notary.

Outcome: simple, consistent documentation that supports the lease decision.

Underwriters look for consistent income, clear documentation, and a defined scope.

Your CPA letter supports the file. It confirms self-employment status, time in business, and the figures tied to tax returns, financial statements, and bank statements.

We align to the lender’s checklist and the mortgage broker’s portal format.

Good faith disclosures: we state procedures, limits, and the period covered. No legal advice.

Use cases: purchase loans, refinancing, line of credit, business loan tied to real estate, and reserves verification.

Quick comparison — when each document is accepted and why.

Document | Purpose | Typical Use | Period Covered | Who Issues | Notes |

CPA letter | Verification/comfort | Mortgage, apartment, creditor, insurer | Custom date range | Certified Public Accountant(CPA) | Confirms facts, explains procedures and limits; supports other records |

Tax return | Filed income evidence | Self-employed, small business owners | Annual | Taxpayer filed with IRS(Internal Revenue Service) | Primary income proof for underwriting and credit |

Bank statement | Liquidity and cash flow | Reserves, recent deposits, rental screening | Monthly | Bank/financial institution | Shows movement, not analysis or opinion |

Employment Verification(VOE) | Employer confirmation | W-2 wage earners | Current status | Employer/HR | Separate from CPA letter; can be paired in the file |

When in doubt, provide all three—CPA letter, tax returns, and bank statements—for a stronger credit review.

Fees. Flat pricing for standard services:

Payment. Online invoice. No hidden charges.

Engagement terms. You receive a CPA client letter(engagement letter) that defines scope, deliverables, timelines, and fees.

It includes confidentiality, data access, and record retention.

Indemnity and liability(financial accounting). Limits are stated. We comply with AICPA(American Institute of Certified Public Accountants) standards and state board rules.

For tax matters, we include a cpa client tax letter addendum if the request touches filed returns.

Some recipients require notarization for standing(law) and compliance.

Triggers: certain mortgage closings, licensing packets, adoption filings, or state forms.

We coordinate a commissioned notary. The letter includes CPA signature, firm letterhead, date, and notarial acknowledgment.

We verify facts from tax returns, bank statements, and financial statements.

State notes: wording may vary by jurisdiction and recipient policy. We match the lender’s or agency’s template and keep limits clear.

Lenders ask for a clear purpose confirmation.

We prepare a CPA letter that states the use of business funds and the source of funds.

Typical purposes: down payment, closing costs, working capital, equipment, or line of credit draws.

We reference tax returns, financial statements, and bank statements.

We note the period covered, method used, and limits.

Result: a lender-ready CPA letter that aligns with underwriting and the loan file.

Some recipients request a letter of good standing CPA.

We provide a credential summary: CPA license number, issuing state, and status.

We include AICPA(American Institute of Certified Public Accountants) membership if applicable.

We add a link or guidance for license lookup on the state board site.

This supports verification needs for banks, insurers, and creditors.

See format before you order.

We provide redacted cpa letter sample sets and a basic cpa letter template:

Your letter must be accurate and precise.

We state what we checked and what we did not check.

We avoid misrepresentation and guard against negligence by keeping scope clear.

No legal advice.

Limits of legal liability are defined in the engagement letter.

Our language follows professional standards to reduce credit risk and confusion.

We protect your data from intake to delivery.

Secure uploads. Encrypted storage. Controlled access.

Third-party consent and authorization are required for delivery.

We align documentation with the Internal Revenue Code, IRS(Internal Revenue Service) rules, and state Regulation.

Confidentiality terms are in the engagement letter.

Outcome: compliant, lender-ready CPA letter with clear procedures and limits.

Different request. Same clear scope.

We adapt letter cpa phrasing to the recipient’s checklist and city needs (CPA Near me).

Common variations:

Short notes. Real scenarios.

Outcome in each case: concise letter, recipient-ready format, limits stated to prevent misinterpretation.

Short form. Quick quote.

Tell us: purpose, recipient, deadline, and city.

Upload: U.S. tax returns, income statement(P&L), balance sheet, bank statements, and ID.

We reply with a clear scope, fee, and timeline. Ask for a cpa letter template or cpa letter sample if you want to preview structure.

Use facts to set expectations. Sources cited.