Schedule C income is common for sole proprietors.

It is also one of the most questioned income types in underwriting.

A bank underwriter or mortgage lender often wants to confirm that the numbers are real, consistent, and supported by records.

That is where a CPA letter verifying Schedule C income may come up.

The request is usually part of income verification.

It is meant to clarify what the filed return shows and how it connects to supporting records.

This article explains what banks and lenders typically ask, what documents support a Schedule C income story, and how a CPA letter should be written so it stays factual and clear.

It also explains where a CPA income verification letter for 1099 income fits in, since many Schedule C filers also receive 1099 forms.

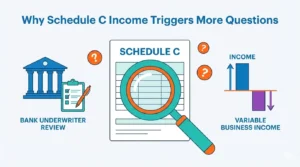

Why Schedule C Income Triggers More Questions

Schedule C is part of a tax filing for many sole proprietors.

It reports business income and documented expenses.

Because the income is not a fixed paycheck, lenders often verify it more closely.

Banks look for stability and repeatability

A bank underwriter usually wants to understand whether income is consistent.

They may compare multiple tax returns.

They may also ask for a current profit and loss statement(P&L) to see the present period.

Lenders look at how expenses affect usable income

Schedule C net profit is often more important than gross revenue.

Documented expenses can lower net income.

That can change the borrower’s qualifying income for a mortgage lender.

The “story” matters

If income is rising, falling, or variable, the file needs context.

Underwriting wants to see that the income period requested matches the documents provided.

What a CPA Letter Verifying Schedule C Income Is and Is Not

A CPA letter should be a document-based summary.

It is usually issued on CPA letterhead and includes a CPA signature.

It should state the income period and what was reviewed.

What it is

- A summary of income verification based on tax returns and other records

- A way to clarify which filed return was reviewed

- A method to align the letter with underwriting questions

What it is not

- Not an audit report

- Not a guarantee of future income

- Not a statement that income will continue

- Not a substitute for required lender documents

Most lenders want careful wording.

They want clear limitations.

That protects the reader from misunderstanding.

The Core Documents Lenders Expect for Schedule C Income

A CPA letter is strongest when it matches the file.

Banks and lenders often want a set of supporting records.

Tax returns and the filed return

Why the filed return is central

The filed return shows what was reported to the IRS(Internal Revenue Service).

It creates a defined income period.

It also shows the relationship between revenue and documented expenses.

What lenders look at on tax returns

- Schedule C net profit

- Consistency across years

- Large changes in revenue or expenses

- Any notes that affect stability

Profit and loss statement(P&L)

A current P&L is common in underwriting requests.

It supports income statements for the current year.

Why a P&L matters

- It updates the income picture past the last filed return

- It shows recent business performance

- It helps the underwriter assess trends

Business records

Business records support the P&L and income statements.

These can include bookkeeping reports or other business records.

What business records help confirm

- Revenue totals for the period

- Expense categories and reasonableness

- Alignment between records and the filed return approach

Bank statements

Bank statements may be requested to support deposits and cash flow patterns.

Important note

Bank deposits are not the same as taxable income.

Bank statements do not show documented expenses.

Still, lenders may use them as a consistency check.

If bank statements are part of the review, the letter should say so clearly.

If not, it should not imply they were reviewed.

Common Questions Banks and Lenders Ask About Schedule C Income

These questions come up often in underwriting.

A CPA letter can help address them in a record-based way.

How much of this income can be used for qualification?

Underwriters often look at net profit from Schedule C.

They may average it across years.

They may also adjust based on stability.

A CPA letter should not decide lender methodology.

It can state what the filed return shows for the relevant income period.

Why did income change from one year to the next?

If revenue or net profit changed, underwriting may ask why.

A CPA letter can reference:

- The difference between the tax years

- Whether the P&L suggests the change continued or reversed

- What documents were reviewed for the updated period

It should avoid speculation.

It should stick to what the records show.

Are expenses unusually high?

Some lenders examine documented expenses closely.

They want to know whether expenses reduce usable income.

A CPA letter can confirm that Schedule C shows documented expenses and net profit.

It should not justify personal business decisions.

It should not rewrite the tax filing.

Is the business still operating?

Underwriting may ask for evidence of current activity.

This is where a current P&L and business records help.

Bank statements may also be requested.

A CPA letter can confirm which documents were reviewed for current activity.

It should not guarantee future operations.

Does the borrower also have 1099 income?

Many sole proprietors receive 1099 forms.

This connects to your other keyword, CPA income verification letter for 1099 income.

A 1099 shows gross payments from a payer.

Schedule C and the tax return show how it was reported.

A CPA letter can reference that relationship if the documents reviewed support it.

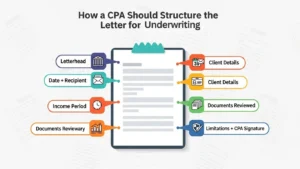

How a CPA Should Structure the Letter for Underwriting

A clear structure reduces questions.

It also helps the underwriter scan faster.

Header and identification

CPA letterhead and contact details

This identifies the CPA firm and provides contact info.

Date and recipient

If the lender provides a recipient line, use it.

If not, keep it standard.

Income period and documents reviewed

Define the income period

The letter should clearly state the period covered.

For example:

- Tax year 2024 filed return

- Year-to-date through a defined end date

List documents reviewed

Examples:

- Tax returns including Schedule C (filed return)

- Current profit and loss statement(P&L) for a defined period

- Business records supporting the P&L

- Bank statements, if included

Income summary

The summary should use plain wording.

It should label the basis of the income.

It should not mix gross and net without clarity.

Limitations statement

Limitations are important in lender settings.

Keep it short.

State that the letter is based on documents reviewed and is not an audit report.

Signature block

Include:

- CPA signature

- CPA firm name and details on letterhead

Mistakes That Cause Delays or Rejection

Many problems are preventable.

These are common ones.

No clear income period

Underwriters need a time frame.

Without it, the letter is hard to use.

Missing the link to the filed return

If the letter does not reference the filed return, the lender may request clarification.

Mixing revenue and net income

Schedule C has revenue and expenses.

Underwriters often focus on net profit.

If the letter does not label the number, it can be misunderstood.

Overstating what is verified

A CPA should not imply audit-level assurance.

The letter needs clear limitations.

Conflicts with supporting documents

If the letter summary does not match the tax returns or P&L, underwriting will ask questions.

How to Prepare Your File Before You Request the Letter

A clean file speeds up the process.

It also reduces follow-ups from the bank underwriter.

Document checklist for most Schedule C files

- Filed tax returns for the required years

- Schedule C pages included in full

- Current profit and loss statement(P&L) for the requested income period

- Business records that support the P&L

- Bank statements if the mortgage lender requests them

- Any underwriting condition text that explains what they want

Consistency checks

- Names match across documents

- Time periods align

- Pages are complete

- Totals are readable

Where a CPA Income Verification Letter for 1099 Income Fits

Some lenders phrase their request around 1099 income.

Others phrase it around Schedule C.

In many files, it is the same income story:

- 1099 forms show payments received

- Schedule C and the filed return show how it was reported

- The P&L and business records support current activity

- Bank statements may support cash flow checks

So a request for a CPA income verification letter for 1099 income can overlap with a Schedule C verification request.

The important point is clarity on the income period and the documents reviewed.