If you are self-employed, proof of income usually takes more work.

There is no payroll department to confirm your pay.

There may be no single “salary number” that stays the same each month.

That is why many lenders and landlords ask for an income verification letter for self-employed from CPA.

They want a clear summary tied to records.

They also want the income period stated in a way that matches the application.

This is common in rental files too.

A CPA income verification letter for apartment lease is often requested when the building wants an easy-to-review income package for a self-employed borrower.

This article explains what a CPA reviews, how tax returns and a profit and loss statement(P&L) work together, and how to prepare a documentation set that is easier to accept.

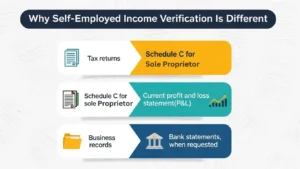

Why Self-Employed Income Verification Is Different

Self-employed income is often variable.

It can change by season, client, or contract cycle.

It can also be affected by business expenses.

Because of that, reviewers rely on records like:

- Tax returns

- Schedule C for sole proprietors

- Current profit and loss statement (P&L)

- Business records

- Bank statements, when requested

A CPA letter helps summarize these items.

It does not replace them.

It explains how the summary was built from the documents reviewed.

What “Income Verification Letter for Self-Employed from CPA” Usually Means

An income verification letter is a written summary prepared by a CPA.

It is typically issued on CPA letterhead.

It includes a CPA signature.

It states the income period and the documents reviewed.

A CPA letter may be requested for:

- Mortgage files

- Loan applications

- Business financing

- Apartment lease packages

- Contractor screening

- Immigration or other documentation needs

The purpose changes the structure.

But the core requirement stays the same.

The letter must be document-based.

Documents a CPA Often Uses for Self-Employed Proof of Income

A self-employed borrower can have several income sources.

Some are paid as 1099.

Some are paid to a business account.

Some are seasonal.

A CPA typically builds the letter from a documentation set.

That set depends on how you file and how you earn.

Tax returns

Tax returns are a primary source.

They show reported income for a defined tax year.

They also show deductions that affect net income.

Why tax returns matter to reviewers

They are standardized.

They show what was filed.

They create a clear income period for comparison.

Schedule C for sole proprietors

If you are a sole proprietor, Schedule C is often central.

It shows business income and expenses.

What Schedule C helps confirm

- Whether income is reported as self-employment income

- The relationship between revenue and expenses

- Net profit trends from year to year

For many lenders and landlords, Schedule C is a key part of proof of income for a self-employed borrower.

Current profit and loss statement (P&L)

A current P&L is often requested when the application needs a more recent view than last year’s tax return.

Why a current P&L is requested

- It covers the current year income period

- It helps show recent business activity

- It supports income stability checks

A P&L should be consistent with business records.

It should also use a clear date range.

Business records

Business records support the numbers in a P&L.

They may include invoices, payment summaries, or bookkeeping reports.

What these records help with

- Showing business income patterns

- Supporting income totals for the stated period

- Reducing questions about where income comes from

Bank statements

Bank statements may be requested by the reviewer.

They can help show deposit patterns.

Important note about bank statements

Bank deposits are not the same as taxable income.

But they can support cash flow when used carefully.

A CPA may review bank statements if they are included in the documentation set.

The CPA letter should state what was reviewed and what was not.

Contractor-based income and 1099 forms

If your work is contractor-based, you may have 1099 forms.

These show payments from clients.

How 1099 forms fit in

- They support gross payments received

- They help confirm client sources

- They connect to how income is reported on tax returns

A CPA may reference 1099 forms as part of the documents reviewed.

But the final income summary should still tie back to the tax return and P&L where applicable.

How a CPA Builds the Income Summary

A CPA should take a careful approach.

The goal is clarity and consistency.

Step 1: Confirm the income period

The income period must match the purpose.

For a rental application, it may be the last year and current earnings.

For financing, it may require multiple years.

A strong letter states the period clearly.

For example:

- Tax year 2024

- January 1, 2025 through September 30, 2025

Step 2: Review tax returns and Schedule C

For sole proprietors, Schedule C often drives the income picture.

The CPA reviews how income was reported.

This matters because “business income” and “take-home cash” can differ.

Expenses affect net profit.

Step 3: Review the current P&L

The CPA reviews the P&L for the stated income period.

The CPA checks whether totals make sense compared to the tax return history.

Step 4: Cross-check with business records and bank statements, when applicable

If bank statements are part of the documentation set, the CPA checks for reasonable consistency.

This is not a guarantee.

It is a consistency review based on the documents reviewed.

Step 5: Draft the letter using professional standards

The letter should be factual.

It should be easy to scan.

It should avoid overstatements.

What the Letter Should Include

Most recipients want a standard structure.

A CPA letter should include key identifiers and scope language.

CPA identifiers

CPA letterhead

This shows the CPA firm identity and contact details.

CPA signature

A signed letter is typically expected.

Licensed CPA reference

If the recipient requires it, the letter can reference that the signer is a licensed CPA.

Client authorization

Many processes require client authorization.

It shows the client requested the letter and permitted the use of documents for the stated purpose.

Documents reviewed

The letter should list the documents reviewed, such as:

- Tax returns

- Schedule C

- Current profit and loss statement (P&L)

- 1099 forms, when applicable

- Business records

- Bank statements, when applicable

Proof of income summary

The letter should summarize income in a way that matches the file.

It should clearly label:

- The income type

- The income period

- The basis of the numbers

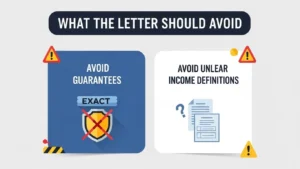

What the Letter Should Avoid

Avoiding the wrong language is important.

Some recipients reject letters that go too far.

Avoid guarantees

A CPA letter should not promise:

- Future income

- Approval outcomes

- Certainty beyond the documents reviewed

Avoid unclear income definitions

If the letter references “income,” it should be clear what that means.

Is it gross receipts?

Is it net profit?

Is it taxable income?

A clear letter labels the income basis.

How This Applies to a CPA Income Verification Letter for Apartment Lease

A lease file is usually time-sensitive.

A landlord or property management company wants quick proof of income.

Self-employed renters often get asked for:

- Tax returns

- A current P&L

- Bank statements, if required

- A verification of income letter or employment and income verification letter equivalent

A CPA income verification letter for apartment lease helps by:

- Stating the income period clearly

- Summarizing income based on documents reviewed

- Providing CPA letterhead and CPA signature for credibility

- Reducing follow-up questions when the file is complete

The landlord still may require specific documents.

The CPA letter supports the package.

It does not replace the required file items.

Common Mistakes That Slow Self-Employed Income Verification

Most delays are avoidable.

Here are common issues that create back-and-forth.

Missing or inconsistent periods

Tax returns cover one period.

P&L covers a different period.

The letter does not explain the difference.

Incomplete documentation set

A reviewer asks for proof of income.

But the file does not include the key documents reviewed.

P&L does not match records

A P&L with unclear categories or missing totals can trigger questions.

Names do not match across accounts

Bank statements and records must match the applicant identity or business identity.

Practical Checklist Before You Request the Letter

A clean documentation set saves time.

Use this checklist.

Basic checklist

- Tax returns for the needed years

- Schedule C if you are a sole proprietor

- Current profit and loss statement(P&L) for the stated income period

- 1099 forms if you receive contractor income

- Business records that support the P&L

- Bank statements only if required by the recipient

- Clear notes on the purpose of the letter

Quick consistency check

- Names match across documents

- Dates and periods match the request

- Pages are complete

- Totals are readable