If a mortgage lender asks for a CPA income verification letter for mortgage, they are trying to reduce risk.

The underwriter wants income that is supported by records.

They also want language that stays within professional standards.

A CPA Income Verification Letter can help when the file needs a clean summary.

It can also help when income is not a simple W-2 paycheck.

But the letter is only as strong as the income verification documents behind it.

One stat to keep in mind.

Many mortgage programs pay close attention to your debt-to-income ratio(DTI).

A common benchmark used in lending is around 43% DTI for certain qualified mortgage decisions, though rules vary by program and lender.

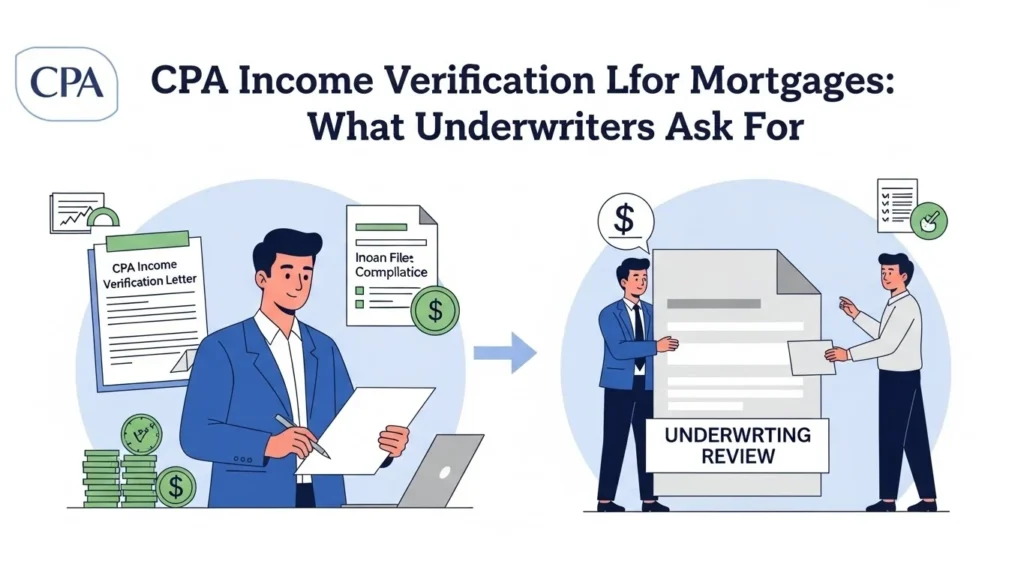

What a CPA Income Verification Letter Means in Mortgage Underwriting

A Certified Public Accountant (CPA) may prepare a letter that summarizes income based on reviewed documents.

Mortgage lenders use it as supporting documentation.

They do not treat it as a replacement for lender verification steps.

A CPA letter often shows:

- The income period being referenced

- The type of income being discussed

- The documents reviewed

- A short limitations disclaimer

- CPA letterhead and CPA signature

It should stay factual.

It should not “predict” income.

It should not promise approval.

Why a Mortgage Lender or Underwriter Requests This Letter

Underwriting is a process of confirming what is in the file.

The underwriter compares the loan application requirements to the documents provided.

If the income story is incomplete, they may request a CPA letter.

Common reasons include:

- Self-employed income needs clarification

- 1099 income is variable and needs a clean summary

- Business income records need context

- The lender wants a single document that ties records together

- The underwriter wants a clear income period and reported income basis

Sometimes the request is driven by time.

A loan file can move quickly once conditions are met.

A clear, document-based letter can reduce back-and-forth.

CPA Income Verification Letter for Mortgage vs Other Lender Documents

A CPA letter is one piece of the file.

It is not the only proof the lender will use.

Verification of Employment (VOE) is different

VOE typically comes from the employer.

It confirms employment status and sometimes pay details.

It is not designed to confirm self-employed income.

IRS (Internal Revenue Service) records are different

Some lenders ask for an IRS transcript.

That is an IRS-issued record tied to filed tax returns.

It can help confirm reported income.

A CPA income verification letter is not an IRS document.

It is based on reviewed income verification documents.

Bank statements are different

Bank statements show deposits and cash flow.

They do not automatically prove taxable income.

Lenders may still require them, especially in self-employed files.

What Underwriters Ask For in a CPA Income Verification Letter for Mortgage

Underwriters usually want clarity, not length.

They want the letter to match the loan application requirements and the file.

The basics they look for

- Correct name of the borrower

- Clear income period

- Income type stated clearly

- Document list (what the CPA reviewed)

- CPA letterhead and contact information

- CPA signature

- Client authorization if required by your process

- A limitations disclaimer written in plain language

If any of these are missing, the lender may push back.

Or they may ask for a revised letter.

Income Verification Documents Underwriters Commonly Compare Against

Your CPA letter should match the documents in the file.

If the letter and documents disagree, underwriting can slow down.

W-2 income files

W-2

W-2 is a key document for employee wages.

Underwriters often compare W-2 totals to tax returns if returns are provided.

Pay history and consistency

Even when W-2 is strong, lenders may still compare:

- Pay documentation (if requested)

- Year-to-date(YTD) earnings

- Consistency of employment

A CPA letter can summarize.

But it should not replace direct employer or payroll evidence when required.

1099 income and contractor income files

1099

1099 forms show non-employee compensation.

They do not automatically show net income.

Underwriters often want to see how 1099 income was reported.

That leads to tax returns and Schedule C.

Tax returns

Tax returns show how income was filed.

They also show deductions that can change how lenders view usable income.

A CPA letter should reference what was reviewed.

It should not “add back” deductions unless the lender’s method supports it and the letter language stays within professional standards.

Self-employed and business owner files

Profit and loss statement(P&L)

For a current period, underwriters often ask for a profit and loss statement.

They may compare it to tax returns.

Business income records

Business income records can include accounting reports and related summaries.

The goal is consistency.

Bank statements

Some lenders use bank statements to support cash flow patterns.

They may look for reasonable alignment with reported income.

A CPA income verification letter for mortgage can explain the scope of what was reviewed.

It should not claim verification beyond the records.

What a CPA Letter Should Say and What It Should Avoid

Underwriters tend to reject letters that sound like guarantees.

They also reject letters that look like a template with no document basis.

What it should include

Clear income period

State the period.

Example: calendar year, tax year, or a defined date range.

Document-based statements

Use phrases like:

- “Based on the documents provided and reviewed…”

- “The following records were reviewed…”

- “Income was summarized from…”

This keeps the letter aligned with professional standards.

CPA identifiers

Include:

- Licensed CPA status, when relevant

- CPA letterhead

- CPA signature

- Firm contact information

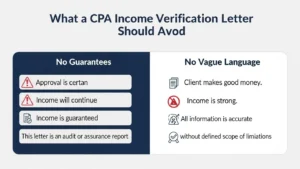

What it should avoid

No guarantees

Avoid statements that imply:

- Approval is certain

- Income will continue

- Income is “guaranteed”

- The letter is an audit or assurance report

No vague language

Avoid:

- “Client makes good money.”

- “Income is strong.”

- “All information is accurate” without scope language.

Underwriters need measurable statements tied to records.

Why Client Authorization Matters

Some lenders want the CPA to confirm the client authorized the release of information.

This is especially true when third parties are involved.

A simple client authorization line can reduce questions.

It clarifies that the borrower requested the letter.

It also supports privacy expectations.

Professional Standards and Limitations Disclaimer

A mortgage underwriter may not use the same terminology a CPA uses.

So keep the limitations statement simple.

A good limitations disclaimer usually does two things:

- It explains the letter is based on reviewed documents.

- It clarifies that it is not an audit report.

This protects both sides:

- The borrower, because the letter is less likely to be rejected

- The CPA, because the scope is clear

A Practical Checklist Before You Request the Letter

If you want faster turnaround, focus on readiness.

Most delays come from missing or mismatched records.

Document checklist

Have these ready, as applicable:

- Tax returns for the requested years

- W-2, if you are employed

- 1099, if you are a contractor

- Profit and loss statement(P&L), if self-employed

- Business income records, if you own a business

- Bank statements, if the mortgage lender requests them

- Any IRS(Internal Revenue Service) request details, if mentioned in lender conditions

File consistency checks

Before you send documents, confirm:

- Your name matches across documents

- The income period requested is clear

- Pages are complete

- Totals are readable

Small issues can trigger underwriting questions.

Common Reasons Underwriters Reject CPA Income Verification Letters

This is where many files get stuck.

Most rejections come from a few patterns.

The letter does not match the lender request

The lender asked for one period.

The letter references another.

The letter does not list reviewed documents

Underwriters want to know the basis.

A document list helps.

The letter sounds like a guarantee

Guarantee language is a red flag.

It can violate professional standards.

Missing CPA signature or CPA letterhead

Some lenders treat this as non-acceptable formatting.

They may ask for a corrected version.

Income numbers do not align with tax returns

If reported income differs, underwriting may ask for explanation.

Or they may request additional supporting items.

Sample Structure Underwriters Usually Accept

This is a structure, not a fill-in template.

It helps you understand what the lender expects.

Header section

- CPA letterhead

- Date

- Recipient (mortgage lender, underwriter team, or “To Whom It May Concern” if lender allows)

Client identification

- Borrower name

- Statement of client authorization (if required)

Income summary section

- Income type and period

- Short statement of what was reviewed

- Short summary of income based on records

Documents reviewed

- Tax returns

- W-2 / 1099

- Profit and loss statement(P&L)

- Business income records

- Bank statements (if reviewed and relevant)

Limitations disclaimer

- Clear scope language

- Not an audit report statement

Signature block

- CPA signature

- Licensed CPA identifiers

- Firm contact info

When a CPA Income Verification Letter Helps the Most

A CPA letter is most helpful in files with complexity.

That includes:

- Self-employed borrowers

- Variable income

- Contractor income

- Multiple income sources

- Business owners with changing revenue patterns

It can also help when the lender wants one summary document.

But it should always reflect the supporting file.