For self-employed borrowers navigating the mortgage process, lenders often require additional verification beyond standard tax returns. A CPA comfort letter for self-employed borrowers provides this confirmation. It is a professional document prepared by a Certified Public Accountant (CPA) or Enrolled Agent (EA), certifying factual details about a borrower’s income, business activity, and financial records. Understanding CPA comfort letter requirements are essential for borrowers, mortgage loan officers (MLOs), underwriters, and accounting professionals to ensure compliance with lender expectations and regulatory guidelines.

What Is a CPA Comfort Letter?

A CPA comfort letter, also referred to as a verification letter, is a document that confirms specific, factual financial information for lenders. It is not an audit, review, or opinion, and it does not guarantee the borrower’s ability to repay a loan.

It is most commonly requested by:

- Conventional lenders and portfolio lenders

- Fannie Mae (FNMA) and Freddie Mac (FHLMC) approved lenders

- Government-backed lenders such as FHA, VA, and USDA

- Non-QM lenders and bank statement programs

The letter helps underwriters, automated systems like Desktop Underwriter (DU) or Loan Product Advisor (LPA), and loan processors verify financial documentation in accordance with industry standards.

Why CPA Comfort Letters Are Important for Self-Employed Borrowers

Self-employed borrowers often have complex income streams. A CPA comfort letter for self-employed borrowers helps underwriters evaluate:

- Business operational status

- Ownership verification

- Income consistency

- Cash flow patterns

Unlike W-2 employees, self-employed borrowers may have deductions, variable income, or multiple entities such as LLCs, S-Corps, C-Corps, Partnerships, or Sole Proprietorships. A comfort letter provides clarity on these details.

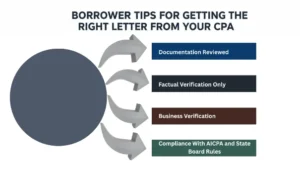

Key CPA Comfort Letter Requirements

To comply with regulatory and professional standards, a CPA comfort letter must meet specific requirements:

Factual Verification Only

The letter must strictly verify factual information, such as:

- Borrower’s name and role in the business

- Legal structure of the business

- Years in business

- Tax returns prepared (personal and business)

- Business operational status

CPAs cannot provide opinions on future income, ability-to-repay, or financial projections.

Documentation Reviewed

Lenders often require confirmation that the CPA reviewed supporting documentation, including:

- IRS Tax Returns and Tax Transcripts

- Profit & Loss (P&L) statements

- Balance sheets

- Bank statements (personal & business)

- Bookkeeping records

- Invoices and receipts

- Merchant processing records (PayPal, Stripe, Square)

- E-commerce statements (Amazon, Shopify, Etsy)

- Digital ad revenue and CPC/CPM/CPA payouts

Including these records demonstrates compliance with underwriting conditions and lender documentation guidelines.

Business Verification

Underwriters often require that the letter confirm:

- Business ownership and borrower’s percentage of interest

- Business activity verification

- Consistency of revenue streams

- Internal controls assessment

This is particularly important for loans evaluated under Qualified Mortgage (QM) rules, Ability-to-Repay (ATR) standards, or when calculating Debt-to-Income (DTI) ratios.

Compliance With AICPA and State Board Rules

A valid CPA comfort letter must adhere to:

- AICPA Professional Ethics Standards

- Assurance Standards (for audit, review, or compilation if applicable)

- State Board of Accountancy regulations

- Third-party verification guidelines from IRS and FHFA

This ensures the letter is legally defensible and professionally appropriate.

How Lenders Use CPA Comfort Letters

Lenders utilize these letters as part of a broader financial evaluation:

Income Verification and Cash Flow Analysis

Underwriters assess whether the borrower’s income is sufficient to support mortgage payments and whether cash flow is consistent with reported revenue.

Deposit and Transaction Review

For borrowers on bank statement loan programs, lenders rely on CPA verification to confirm that deposits are legitimate business income, not irregular or personal transfers.

Documentation Compliance

The letter ensures that all tax returns, P&L statements, balance sheets, and supporting documents have been reviewed by a qualified CPA, satisfying lender internal policies and investor requirements.

Best Practices for Borrowers

To streamline the CPA comfort letter process:

Organize Financial Documents

Gather tax returns, bank statements, merchant accounts, bookkeeping records, and invoices, before contacting your CPA.

Communicate With Your Loan Officer

Provide your CPA with specific lender guidelines and underwriting conditions, including AUS system notes or required formats.

Request the Letter Early

Delays often occur when borrowers contact CPAs at the last minute. Early engagement ensures timely processing.

Understand Limitations

Recognize that the CPA can only verify historical and factual financial information, not predict future income or guarantee loan approval.