For many self-employed applicants, providing proof of income isn’t as simple as handing over a W-2. Mortgage lenders often request a CPA comfort letter for mortgage lenders as part of their verification process. These letters, sometimes called *CPA verification letters help underwriters understand the legitimacy, financial activity, and continuity of a borrower’s business.

If you’re a freelance worker, small business owner, LLC member, or operate as an S-Corp, C-Corp, Partnership, or Sole Proprietorship, your lender may ask your accountant to issue a CPA comfort letter to verify details that tax returns alone cannot explain.

This guide breaks down what underwriters really expect and how borrowers and their CPAs can prepare confidently.

What Is a CPA Comfort Letter?

A CPA comfort letter is a written statement prepared by a Certified Public Accountant (CPA) confirming specific, limited facts about a borrower’s business or income. It is not an assurance report, audit opinion, or financial guarantee. Instead, it verifies factual information already backed by documentation.

Mortgage lenders request these letters to bridge informational gaps found in:

- Bank statements

- Tax returns

- Merchant processing income

- E-commerce platform revenue

- Profit & Loss (P&L) statements

- Balance sheets

- Business licenses

- Articles of incorporation / organization

Because underwriters work under strict risk-management standards set by Fannie Mae, Freddie Mac, FHA, VA, USDA, and the FHFA, comfort letters help them ensure compliance without requiring an unnecessary audit.

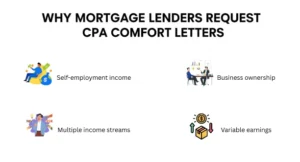

Why Mortgage Lenders Request a CPA Comfort Letter

For Self-Employed Borrowers and Business Owners

If you file taxes as an LLC, S-Corp, Partnership, or Sole Proprietorship, your income may fluctuate year to year. Lenders ask for comfort letters to confirm:

- Business ownership

- Length of business operation

- Whether the business is active

- Whether income appears consistent with documented activity

This helps the Mortgage Loan Officer (MLO) and underwriter validate your application without delaying the approval.

To Comply With Third-Party Verification Rules

Regulated lenders must follow strict documentation rules set by:

- AICPA (American Institute of Certified Public Accountants)

- State Boards of Accountancy

- IRS verification guidelines

- Assurance services standards

These rules prevent CPAs from “guaranteeing” income but allow them to verify factual information pulled from financial records.

What Underwriters Expect in a CPA Comfort Letter for Mortgage Lenders

Underwriters use a comfort letter to verify facts, not projections, opinions, or assurances.

Basic Business Verification

The letter should confirm:

- Business name and legal structure (LLC, S-Corp, Corp, etc.)

- Business start date

- Ownership percentage

- Borrower’s role in the business

Activity and Operational Status

Lenders need confirmation that the business is active, such as:

- Ongoing invoicing

- Merchant processing revenue (PayPal, Stripe, Square)

- E-commerce activity (Shopify, Amazon, Etsy)

- Regular deposits in business bank accounts

Financial Documentation Reviewed

The CPA may list documents reviewed, such as:

- Personal and business IRS tax returns

- IRS tax transcripts

- Profit & Loss (P&L) statements

- Balance sheets

- Bank statements

- Bookkeeping records

Internal Controls and Bookkeeping Quality (If Applicable)

Underwriters may consider whether the business keeps reasonable internal controls and organized financial records.

Standard CPA Disclaimer Language

CPAs must include disclaimers clarifying they are not providing:

- An audit

- A review

- An assurance report

- A guarantee of income

This is required to comply with:

- AICPA ethics rules

- Assurance services standards

- State Board of Accountancy regulations

What CPAs Cannot State in a Comfort Letter

Prohibited Statements

CPAs cannot comment on:

- Future earnings

- Borrower’s ability to repay

- Borrower’s creditworthiness

- The lender’s decision to approve a loan

- Any subjective projections

They may only confirm factual, historical information supported by documentation.

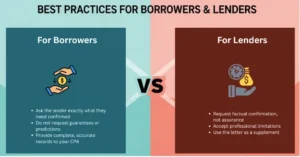

How Borrowers Should Prepare Before Requesting a CPA Comfort Letter

A comfort letter cannot be written without reliable records. Borrowers should prepare:

Clean, Updated Financial Statements

- Most recent P&L

- Current balance sheet

- Organized bookkeeping records

Bank Statements and Merchant Statements

Provide:

- Business and personal bank statements

- PayPal, Stripe, Square reports

- E-commerce dashboards (Shopify, Amazon, Etsy)

Tax Documentation

Have ready:

- Personal 1040 tax returns

- Business returns (1120, 1120S, 1065)

- IRS transcripts (if requested)

Business Legal Documents

Examples:

- Articles of Incorporation / Organization

- Business license

- Operating agreements

What Lenders Review Alongside a CPA Letter

A comfort letter alone is never enough. Underwriters also examine:

Automated Underwriting System (AUS) Results

- Desktop Underwriter (DU) for Fannie Mae

- Loan Product Advisor (LPA) for Freddie Mac

Income Trends and Stability

They look for:

- Stable or increasing income

- No unexplained losses

- Consistent business deposits

Debt-to-Income (DTI) Calculations

The CPA letter supports income numbers but does not replace lender calculations.

How CPAs Prepare the Letter (From the Accountant’s Perspective)

An Accounting Firm or Enrolled Agent (EA) may follow a structured process:

Engagement Letter

Before preparing a comfort letter, CPAs often require a signed engagement letter outlining:

- Scope of work

- Limitations

- Professional standards

Step 2: Document Review

The CPA must review supporting documentation provided by the borrower.

Drafting the Letter According to AICPA Standards

The letter must stay factual and avoid prohibited assurances.

Step 4: Adding Disclaimers

AICPA requires clear disclaimers such as:

“This letter does not constitute an audit or assurance report.”

“No opinion on future income is provided.”

Step 5: Issuing the Final Document

The letter is printed on firm letterhead and signed with CPA license details.

Tips for Borrowers to Avoid Delays

Notify Your CPA Early

Most delays happen because borrowers ask for letters at the last minute.

Organize All Records Before Contacting the CPA

This includes tax returns, bank statements, merchant statements, and financial statements.

Request Only What the CPA Is Allowed to Provide

CPAs cannot certify income, guarantee earnings, or confirm loan repayment ability.

Coordinate With Your Loan Officer and Underwriter

Provide your CPA with the exact lender requirements to avoid revisions.