Embarking on a freelancing or self-employment journey is an exhilarating adventure, but it comes with unique financial challenges. To ensure a prosperous and secure future, mastering the art of financial planning is crucial. In this blog, we’ll explore 10 Best Financial Planning tips for Freelancers and self employed individuals, presented in a visually appealing format with tables and a vibrant color scheme.

1. Create a Comprehensive Budget

| Expense Category | Amount ($) |

|---|---|

| Housing | |

| Utilities | |

| Healthcare | |

| Business Expenses | |

| Savings | |

| Entertainment | |

| Miscellaneous | |

| Total |

Begin with a detailed monthly budget, allocating funds to essential categories. This will provide a clear overview of your financial landscape, helping you make informed decisions.

2. Build an Emergency Fund

Table: Emergency Fund Tracker

| Month | Emergency Fund ($) |

|---|---|

| Jan 2024 | |

| Feb 2024 | |

| Mar 2024 | |

| Apr 2024 | |

| May 2024 |

Life is unpredictable. Establishing an emergency fund ensures you’re prepared for unexpected expenses, offering peace of mind during challenging times.

3. Set Clear Financial Goals

Define short-term and long-term financial goals, outlining specific amounts and deadlines. This will guide your savings and investment strategies.

4. Understand Tax Obligations

| Task | Deadline |

|---|---|

| Gather Receipts and Invoices | |

| Estimate Quarterly Taxes | |

| Maximize Deductions | |

| Consult Tax Professional |

Navigating tax responsibilities is critical. Keep track of deadlines and consult a tax professional to optimize deductions and minimize liabilities.

5. Invest Wisely

Investing wisely isn’t about chasing quick bucks or winning the stock market game. It’s about planting seeds today for a fruitful future. It’s about understanding your goals, balancing risk, and choosing diversified paths to growth. It’s about patience, knowledge, and keeping your emotions in check. It’s about building a secure tomorrow, brick by financial brick. Invest wisely – it’s not just about money, it’s about building a stronger, future-proof you.

6. Invoice and Payment Tracking

Maintain a systematic record of your invoices and payments to ensure timely and accurate income tracking.

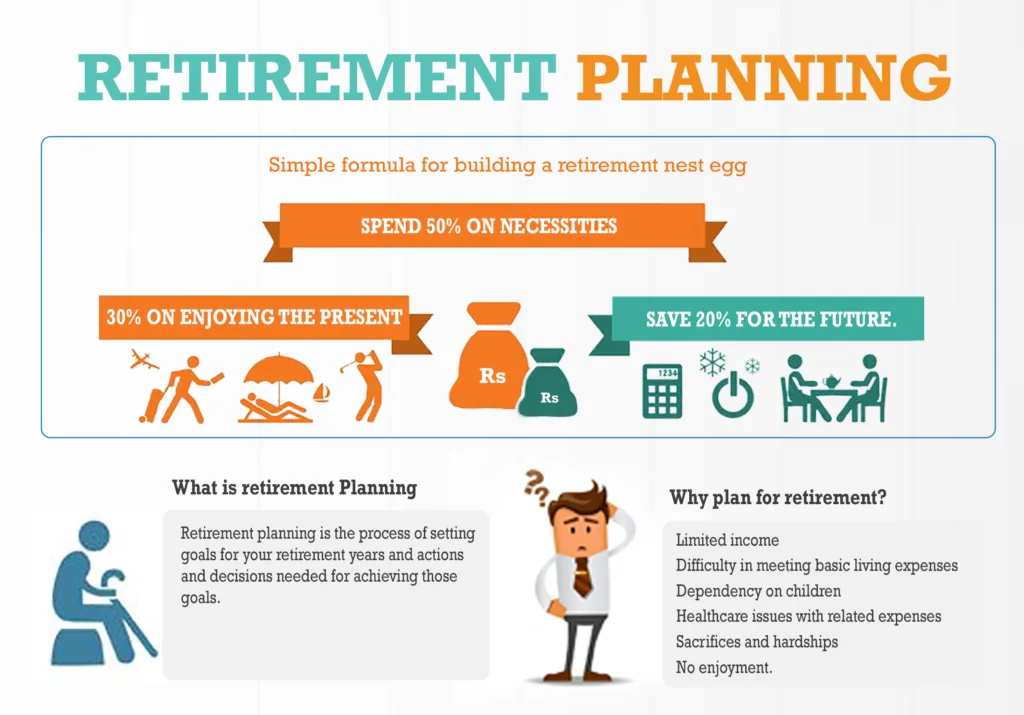

7. Plan for Retirement

Self-employed individuals must prioritize retirement savings. Create a plan and consistently contribute to secure a comfortable retirement.

8. Insurance Coverage

What is Insurance Coverage?

Insurance coverage is a contract between you (the policyholder) and an insurance company (the insurer). You pay a premium (regular payments) to the insurer, and in return, they agree to financially compensate you if certain events happen, like:

- Accidents: Car accidents, medical emergencies, or property damage.

- Illness: Medical bills, lost wages, or long-term care.

- Death: Funeral costs, income replacement for your family.

Why is Insurance Coverage Important?

Life is full of uncertainties. Even the most careful planner can’t predict everything. Insurance coverage provides peace of mind knowing that you’re financially protected if something unexpected happens. It can help you:

- Avoid financial hardship: A major illness or accident can quickly drain your savings. Insurance can help cover the costs, so you don’t have to bear the burden alone.

- Protect your loved ones: If you’re the breadwinner in your family, your death could leave them in a difficult financial situation. Insurance can provide them with income replacement to help them cope.

- Get back on your feet: If your home or car is damaged or destroyed, insurance can help you rebuild.

9. Continuous Learning and Skill Development

Invest in yourself by setting aside funds for ongoing education and skill development. Stay relevant in your industry to enhance earning potential.

10. Regularly Review and Adjust

| Date | Net Worth ($) | Financial Goals Progress (%) |

|---|---|---|

| Jan 2024 | ||

| Jul 2024 | ||

| Jan 2025 |

Consistently review your financial plan, making adjustments as needed. Track your progress and celebrate achievements along the way.

10 Best Financial Planning tips for Freelancers and self employed individuals

Conclusion

Achieving financial success as a freelancer or self-employed individual requires careful planning and execution. By following these 10 Best Financial Planning tips for Freelancers and self employed individuals you’ll be well on your way to building a stable and thriving financial future. Remember, financial freedom is a journey, not a destination.

10 Best Financial Planning tips for Freelancers and self employed individuals

Contact Now