How Much Does a CPA Letter Cost? Complete Pricing Guide

How much does a CPA letter cost? If a lender, landlord, or investor asks for a CPA letter,

Need a CPA in Encinitas, California? Ignition Tax handles tax preparation, bookkeeping, financial statement preparation, payroll tax, sales tax, CPA letters, and auditing. Clear scope. Fast intake. Lender-ready documentation when needed.

You get a local accounting firm with national standards. We follow authority IRS rules. We keep filings on schedule. Quarterly estimated taxes occur four times a year. Sales tax returns are monthly, quarterly, or annual based on registration and revenue. Simple steps. No jargon.

For borrowers and renters, we prepare CPA letters for income verification, comfort, and third-party verification. Mortgage, refinance, or apartment applications. Signed on company letterhead. Notarized if required by the recipient.

For small businesses, we keep books current, reconcile bank statements, and deliver a clean income statement and balance sheet. This supports credit, line of credit, and business loan reviews. It also streamlines tax return filing and year-end close.

For employers, our payroll tax services cover registrations, deposits, and quarterlies. We align with California and federal rules. We also manage sales tax nexus checks and filings for Encinitas and nearby North County.

If you need an audit, review, or agreed-upon procedures, we define the engagement up front. Procedures, limits, and timelines are documented. No overstatements. No legal advice. Only accountable Accounting work you can use with banks, mortgage brokers, and other financial institutions.

We handle Tax preparation, Accounting, and specialized services with a defined scope. Work is performed under AICPA standards and IRS(Internal Revenue Service) rules.

We maintain license verification, professional liability insurance, and written engagement terms.

Need lender paperwork? We prepare CPA letters on firm letterhead for income verification, comfort, and third-party verification.

Use cases: mortgage, refinancing, apartment applications, business loan, and line of credit requests.

We file Federal and California Tax returns for individuals and small businesses in Encinitas CA.

Scope includes estimates, extensions, and back taxes help.

We review your prior filings, entity status(LLC, S-Corp, sole proprietorship), and deductions.

You get a simple checklist, clear review steps, and a signed e-file authorization.

Year-end planning focuses on cash flow. We time deductions and income to manage Credit and Income impact.

If notices arrive, we handle IRS(Internal Revenue Service) and state responses.

Federal and California Tax return filing, extensions, and year-end close. IRS representation Encinitas when notices arrive.

We file Federal and California Tax returns for individuals and small businesses in Encinitas CA.

Scope includes estimates, extensions, and back taxes help.

We review your prior filings, entity status(LLC, S-Corp, sole proprietorship), and deductions.

You get a simple checklist, clear review steps, and a signed e-file authorization.

Year-end planning focuses on cash flow. We time deductions and income to manage Credit and Income impact.

If notices arrive, we handle IRS(Internal Revenue Service) and state responses.

Monthly reconciliations, bank statements, income statement, and balance sheet. QuickBooks help Encinitas on request.

Monthly books stay current.

We reconcile bank statements, categorize expenses, and prepare an income statement and balance sheet each month.

You see vendor trends, margins, and upcoming liabilities.

We support QuickBooks help Encinitas for setups, cleanups, and training.

Tight books speed tax preparation, loan reviews, and due diligence.

Lender-ready financial statements for loan applications, credit, and planning.

Registrations, deposits, quarterlies, and employment verification reports if requested by a financial institution.

Nexus review, Use tax checks, portal filings, and rate updates.

Fund accounting, grant tracking, board reporting, and audit support.

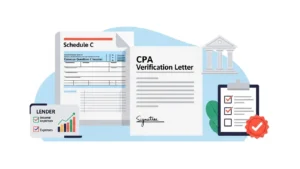

income verification letter, comfort letter, letter for mortgage/home loan/apartment, letter of explanation, expense ratio letter, notarized letter.

Defined procedures, limits stated; no misrepresentation or legal advice.

Intake → Consent → Documents → CPA review → Draft → Signed on letterhead → Delivery.

Simple flow. Short timelines when files are complete.

Tell us the service: tax preparation, bookkeeping, financial statements, payroll, sales tax, letters, or auditing.

Authorize us to speak with your lender, bank, mortgage broker, or landlord if needed.

Upload tax returns, bank statements, income statement, balance sheet, and ID.

note limits, and align to (American Institute) guidance and IRS(Internal Revenue Service) rules.

We prepare the return, report, or letter.

A CPA signs. Notarized option available.

Secure portal, encrypted email, or direct recipient upload.

clear documents for credit, loan applications, apartment screening, or filings.

We serve Leucadia, Cardiff-by-the-Sea, Olivenhain, New Encinitas, and Old Encinitas.

Work includes Tax preparation, bookkeeping, financial statements, payroll tax, sales tax, Certified Public Accountant letters, and auditing.

Defined services for tax preparation, bookkeeping, financial statements, payroll tax, sales tax, CPA letters, and auditing.

Letters use recipient formats for mortgage, refinancing, apartment, business loan, and line of credit files.

Flat pricing for standard work. Add-ons listed before engagement.

Turnarounds stated up front. Rush options when documents are complete.

Brief updates, checklists, and next steps. Built for underwriters, landlords, and banks

Support from a Business Management Consultant and Tax Consultant lens—entity choice, quarterly estimates, and filing calendars.

Real outcomes from local work

View redacted letter sample sets, financial statements examples, and intake checklists.

Each sample shows key components: client name(redacted), recipient, purpose, period covered, method used(tax returns, bank statements, income statement), limits, and signature on CPA letterhead.

You’ll also see acceptance wording aligned to lenders, mortgage brokers, landlords, and insurers, plus brief notes on when a notarized block is required.

How much does a CPA letter cost? If a lender, landlord, or investor asks for a CPA letter,

Schedule C income is common for sole proprietors. It is also one of the most questioned income types

If you are a 1099 contractor, proof of income rarely fits into one document. Your income may change

service needed, deadline, and recipient (mortgage broker, landlord, bank, or insurance carrier).

recent tax returns, bank statements, income statement and balance sheet, and ID.

steps, and delivery options—portal upload, encrypted email, or direct recipient submission.

Nearby: Cardiff 92007, Solana Beach, Del Mar, Carlsbad, San Marcos, Vista, Rancho Santa Fe.

Virtual service is available for document review, tax preparation, bookkeeping, financial

statement preparation, payroll tax, sales tax, CPA letters, and auditing. Secure portal upload. Clear timelines.

Short answers. On topic. Built for decisions.

Flat fees for standard returns and monthly bookkeeping.

Quotes list scope, forms, and add-ons.

Rush, cleanup, and prior-year work are priced separately.

Simple returns: days, not weeks, once docs are complete.

Bookkeeping: monthly close within a set window.

CPA letters: same-day options for standard requests with full documents.

Yes. We handle notices, responses, and payment plans.

We review transcripts and prior filings before we respond.

You get a written plan and deadlines.

Yes. We file the 1120-S, K-1s, payroll tax forms, and state filings.

We review reasonable compensation and quarterly estimates.

Books must be current before filing.

Yes. Single-member, multi-member, and LLCs taxed as S-Corp.

We confirm elections, prepare returns, and align state forms.

We provide year-end checklists to avoid missed items.

It helps.

We track income, expenses, and quarterly estimates.

We prepare lender-ready financials and CPA letters when you apply for credit, a mortgage, or an apartment.

Yes, when allowed.

We confirm the standard, review supporting records, and issue a CPA letter on firm letterhead.

Scope and limits are stated.

We provide tax reporting support and coordination with your 1031 intermediary.

We explain timing, basis tracking, and state add-ons.

Legal advice is not provided.

Pre-audit cleanup, schedules, and PBC lists.

We support financial audits, reviews, and agreed-upon procedures.

We state procedures and limits in writing.

Yes. We plan around entity choice, compensation, retirement, and timing.

We align estimates and safe-harbor rules.

We document action items and dates.

Photo ID, prior-year returns, year-to-date financials, and bank statements.

For CPA letters, add recipient details, purpose, and deadline.

We confirm anything else needed at intake.

Yes, with your consent.

Delivery options: secure portal, encrypted email, or direct upload.

We record what was sent, to whom, and when.

Yes, when the checklist requires it.

We coordinate a commissioned notary and add the acknowledgment block.

The scope of the letter does not change.

Send the short form with service, deadline, and city.

Upload documents to the secure portal.

We reply with scope, fee, and a timeline.

Meet the experts behind our success. Our team blends knowledge, creativity, and dedication to deliver the best solutions for our clients.

Customer support specialist

Accountant

Accountant

Licensed CPA

Sale tax Accountant

We proudly serve clients nationwide with a strong local presence in over 20 U.S. cities

Take the first step towards financial clarity and compliance. Schedule a free consultation with our experts today.