CPA Letter For Verification of Self Employment

For self-employed individuals, proving income and verifying employment status can be more challenging than for those with traditional jobs. A CPA (Certified Public Accountant) letter for the verification of self-employment is a crucial document that can simplify this process. At Ignitiontax, we understand the unique needs of self-employed professionals and the importance of providing credible, detailed CPA letters to verify their self-employment status. This letter not only serves as proof of income but also provides assurance to financial institutions, lenders, and other entities that your financial situation is stable and legitimate.

What Is a CPA Letter for Verification of Self-Employment?

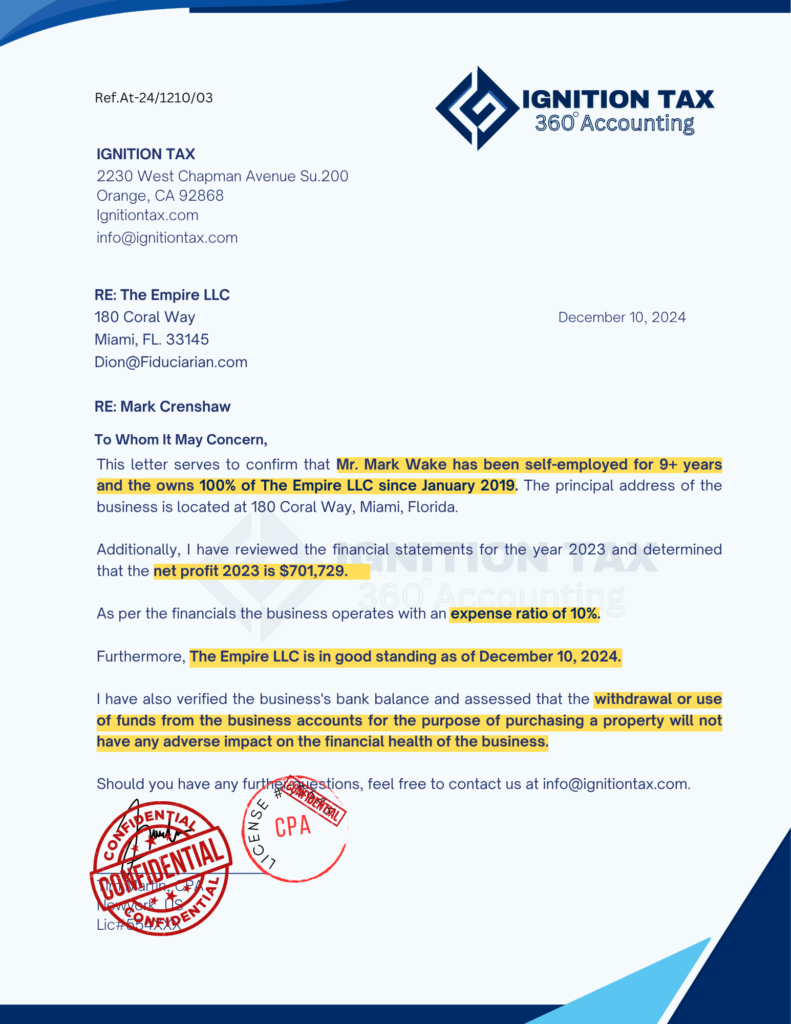

A CPA letter for the verification of self-employment is a document issued by a Certified Public Accountant that confirms and verifies your status as a self-employed individual. This letter typically includes details about your business operations, income, and the duration of your self-employment. It is often required when applying for loans, mortgages, or other financial services, where proof of stable income and employment is necessary.

Why Do You Need a CPA Letter for Verification of Self-Employment?

1. Proof of Income and Employment

One of the most important reasons for needing a CPA letter for verification of self-employment is to provide proof of income and employment status. Unlike traditional employees who can submit pay stubs and W-2 forms, self-employed individuals need to demonstrate that their income is stable and consistent. A CPA letter from Ignitiontax provides a verified statement of your income, helping to satisfy the requirements of lenders, landlords, or other entities that need confirmation of your financial situation.

2. Building Credibility with Lenders and Financial Institutions

Lenders and financial institutions often view self-employed individuals as higher risk because of the potential variability in income. A CPA letter enhances your credibility by offering an independent verification of your income and business operations. At Ignitiontax, we ensure that our CPA letters provide a comprehensive and accurate portrayal of your financial health, making it easier for you to secure loans, mortgages, or other financial products.

3. Meeting Documentation Requirements

When applying for a mortgage, loan, or even renting a property, documentation requirements for self-employed individuals can be more stringent. Many financial institutions require a CPA letter as part of their due diligence process. Without this letter, your application may be delayed or denied. Ignitiontax provides CPA letters that meet all necessary documentation requirements, helping to streamline the application process and prevent any potential roadblocks.

4. Simplifying Complex Financial Situations

Self-employed individuals often have more complex financial situations, with income derived from various sources such as freelance work, consulting, or owning a small business. A CPA letter helps to simplify this complexity by summarizing your income streams and verifying your self-employment status in a clear and concise manner. Ignitiontax specializes in understanding and communicating the nuances of self-employment, ensuring that your financial situation is accurately represented.

5. Supporting Loan and Mortgage Applications

For self-employed individuals, securing a loan or mortgage can be particularly challenging due to the fluctuating nature of income. A CPA letter is an essential tool that can help bridge this gap by providing a verified account of your income and the stability of your self-employment. This letter can be the deciding factor in whether your loan or mortgage application is approved. Ignitiontax takes pride in providing detailed CPA letters that support your application and increase your chances of success.

6. Providing Assurance to Third Parties

In addition to lenders, other third parties such as landlords, insurance companies, and government agencies may require verification of your self-employment. A CPA letter provides the necessary assurance that your self-employment is legitimate and that your income is reliable. This can be particularly important in situations where you need to demonstrate financial responsibility, such as when applying for insurance coverage or leasing a commercial property.

7. Peace of Mind

Navigating the financial landscape as a self-employed individual can be stressful, particularly when it comes to proving your income and employment status. A CPA letter provides peace of mind by ensuring that your financial information is accurately presented and verified by a qualified professional. At Ignitiontax, we are committed to supporting self-employed individuals by providing CPA letters that reflect their true financial situation, allowing them to move forward with confidence.

A CPA letter for verification of self-employment is a vital document for self-employed individuals who need to prove their income and employment status. Whether you’re applying for a loan, securing a mortgage, or dealing with any other financial or legal matter, a CPA letter from Ignitiontax can provide the assurance and credibility you need to succeed. Our CPA letters are carefully crafted to meet the specific requirements of lenders, financial institutions, and other entities, ensuring that your self-employment status is accurately verified.

At Ignitiontax, we understand the challenges faced by self-employed individuals and are here to help you navigate these challenges with ease. If you need a CPA letter for verification of self-employment or have any questions about how this document can benefit you, don’t hesitate to contact us. We’re here to provide the expertise and support you need to achieve your financial goals and secure your financial future.