Read Details

CPA Letter for Self Employed | Income Verification

A CPA Letter for Self Employed is an official document prepared by a Certified Public Accountant (CPA) confirming your income and self-employment status.

It serves as verified proof for lenders, landlords, or government agencies that your financial information has been reviewed by a licensed accounting professional.

Self-employed individuals often face income verification challenges when applying for a loan, mortgage, lease, or business funding. A CPA letter simplifies this process.

It validates your earnings using data from your tax returns, income statements, or bank records, following the guidelines of the Internal Revenue Service (IRS) and the American Institute of Certified Public Accountants (AICPA).

Across the United States, financial institutions rely on this letter to confirm an applicant’s financial stability and credibility.

For many independent contractors and small-business owners, it becomes an essential document for proof of income verification.

Statistics show that over 65% of lenders request verified accountant letters from self-employed borrowers during loan assessments.

This demand continues to grow as more professionals move toward independent work and sole proprietorship.

At Ignition Tax, every CPA letter is prepared with careful review, ensuring it meets legal and documentation standards accepted nationwide.

About Ignition Tax — CPA Letter Experts for Self-Employed Professionals

Ignition Tax is a U.S.-based accounting firm focused on helping self-employed individuals verify income through professionally drafted letters.

Our team includes licensed experienced Accountant in tax preparation, business management consulting, and financial verification.

We serve freelancers, consultants, contractors, and small-business owners who require official documentation to prove income or verify business activity.

Every letter we issue complies with IRS (Internal Revenue Service) and American Institute of Certified Public Accountants standards, ensuring accuracy and confidentiality.

Our process follows strict professional ethics — no assumptions, no estimations.

We analyze your tax returns, bank statements, and income records to provide a verified statement that supports your loan, lease, or business application.

Ignition Tax stands for transparency and regulatory compliance.

Whether you need a CPA letter for mortgage, loan approval, or self-employment verification, we deliver documentation that aligns with U.S. financial and legal frameworks.

Each document is issued on official letterhead, signed by a CPA, and accepted by lenders and agencies nationwide.

Who Needs a CPA Letter for Self Employment Verification

A letter verifying income is often required when self-employed professionals must show proof of income or confirm verification of self employment for financial or legal purposes.

Since self-employed individuals do not receive traditional paychecks, lenders and organizations rely on this document to assess individuals income stability and accuracy.

The need for self employment verification applies across different professional categories.

Freelancers and Independent Contractors

Freelancers and independent contractors often earn from multiple clients or projects, making consistent income reporting difficult.

A Certified Public Accountant that verifies income brings structure and validation.

It confirms that their earnings are reviewed by a CPA and based on verifiable financial records.

Whether applying for an apartment lease, personal loan, or mortgage, freelancers use this verification of self employment to demonstrate reliable income without providing months of invoices or client statements.

Small Business Owners and Sole Proprietors

Small business owners and sole proprietors frequently require self employment verification when applying for business loans, credit lines, or equipment financing.

A letter verifying income supports these requests by confirming individuals income generated through legitimate business activity.

Lenders and investors see the letter as evidence of both business credibility and financial transparency.

For many, this document substitutes lengthy audits or financial reviews, providing a clear overview of revenue and tax compliance.

Consultants, Realtors, and Gig Workers

Professionals in consulting, real estate, and the gig economy often rely on project-based earnings.

When their income sources vary, a letter for self employment verification acts as a trusted summary of their financial information.

Banks and landlords accept these letters as an official verification of self employment, ensuring that the individual’s income has been evaluated by a licensed CPA.

This simplifies their financial interactions, from rental applications to mortgage underwriting and loan approvals.

Why Lenders, Landlords, and Banks Ask for a CPA Letter

A letter provides proof of income verification from a qualified accountant, which is essential for risk assessment in various financial transactions.

Entities such as lenders, banks, and landlords rely on this letter to confirm that the applicant’s self-employment income is accurate and consistent.

It gives the lender documented assurance that your income statement, tax returns, or bank records support your reported earnings.

For apartment leases or rental agreements, landlords use the letter to evaluate your financial stability before finalizing tenancy.

Similarly, banks use it to establish repayment capacity for business loans or credit lines.

Real-world triggers for requesting a CPA letter verifying income include:

- Loan approval for self-employed borrowers

- Mortgage applications requiring stable income proof

- Lease applications where pay stubs are unavailable

- Business financing or credit assessments

These requests are driven by verification standards under IRS (Internal Revenue Service) and (American Institute of Certified Public Accountants) guidelines, ensuring every statement issued reflects true and verifiable income.

A letter not only validates your financial standing but also strengthens your credibility with financial institutions, landlords, and potential investors.

Types of CPA Letters We Provide

At Ignition Tax, we prepare several types of letters designed for specific financial and documentation needs.

Each letter follows IRS (Internal Revenue Service) and AICPA standards to ensure accuracy, privacy, and acceptance by institutions across the United States.

Our documents are based on verified bank statements, income statements, and financial information reviewed by licensed professionals.

Below are the main categories we serve.

CPA Letter for Mortgage (Home Loan Income Proof)

A CPA letter for mortgage confirms your self-employment income when applying for a home loan.

Mortgage lenders often require verified income statements or bank records to determine repayment capacity.

This letter provides that assurance, confirming your earnings through professional review and documentation.

By submitting a CPA letter, you reduce the need for additional audits or extended underwriting.

It helps lenders validate your income efficiently, increasing approval confidence without unnecessary complexity.

CPA Letter for Business Loan or Investor Verification

When applying for a business loan or seeking investor funding, financial transparency is crucial.

A CPA letter demonstrates your business income verification through reviewed financial statements, bank records, and tax returns.

Investors and creditors rely on this document to ensure due diligence and credibility.

It verifies that your employment status as a business owner or self-employed individual is legitimate and financially stable.

CPA Letter for Apartment or Lease Approval

Landlords often need proof of income before approving a lease for self-employed tenants.

A CPA letter for apartment confirms your self employment verification in a professional format accepted by leasing offices nationwide.

Instead of providing multiple invoices or inconsistent statements, this document presents a clean summary verified by a (CPA).

It validates your income stability and strengthens your rental application with objective financial review.

CPA Letter Confirming Self Employment

A CPA letter serves or confirming self employment serves as a direct confirmation of your employment verification status.

Letter is often required used when lenders, tax authorities, or agencies need formal confirmation that you actively run or operate your business.

This document includes your name, business structure, nature of work, and confirmation from a CPA who has reviewed your income statements or tax records.

It’s concise, factual, and compliant with professional accounting standards.

CPA Letter for Income Verification Self Employed

A CPA letter for income verification self employed acts as an official summary of your total annual or monthly earnings.

It references reviewed data such as bank statements, income statements, and tax filings to confirm accuracy.

Banks, mortgage lenders, and government agencies use this document for consistent income validation.

It provides clarity where traditional pay slips are unavailable and aligns with accepted verification frameworks in the U.S. financial system.

The CPA Letter Process — What to Expect at Ignition Tax

Our process is structured, transparent, and designed for accuracy.

At Ignition Tax, we follow a detailed procedure to ensure every CPA letter meets both financial and legal verification standards.

Each step emphasizes due diligence, confidentiality, and verification and validation.

Step 1 – Consultation and Financial Information Review

We begin with an initial consultation to understand your purpose — whether it’s for a mortgage, loan, or lease.

During this step, our team reviews your financial information, business activity, and documentation requirements.

This ensures we identify the right CPA letter format for your specific need and verify that all supporting details are consistent and valid.

Step 2 – Document Verification (Tax Returns, Income Statement, IRS Tax Forms)

We examine your submitted documentation, including income statements, bank statements, and IRS tax forms.

Each detail is reviewed by a licensed CPA under professional accounting standards.

This stage focuses on accuracy, ensuring every figure aligns with verified data.

It also satisfies compliance for tax return audits and financial review requirements.

Step 3 – CPA Letter Drafting and Professional Opinion

Once verified, our CPAs prepare your CPA letter based on factual data.

This includes a clear statement of income verification, employment confirmation, and any financial background needed for the intended recipient — such as a bank, landlord, or mortgage lender.

The letter reflects our professional opinion, supported by due diligence and adherence to AICPA ethical standards.

Step 4 – Delivery and Confidentiality Assurance

After approval, your CPA letter is finalized on official letterhead and delivered securely.

All personal and financial information remains confidential, following strict data protection and privacy law compliance.

We maintain document integrity through verified delivery methods and record retention standards.

Every letter issued by Ignition Tax meets the highest expectations for accuracy, confidentiality, and professional reliability.

Why Choose Ignition Tax for CPA Letter Services

Choosing a right professional for your Letter for Self Employed matters.

At Ignition Tax, our process is built around accuracy, trust, and ethical compliance.

Each letter we issue is supported by proper credentials, verified documentation, and a focus on professional standards.

Here’s why individuals and businesses across the United States rely on us:

- Transparent Pricing (Cost of CPA Letter for Self Employed)

You’ll know the total cost before we begin. No hidden fees. Our flat-rate pricing reflects the complexity of your documentation and the scope of verification required. - Licensed Certified Public Accountants

Every letter is signed by a licensed Certified Public Accountant, recognized under AICPA and state-level regulatory boards.

This ensures your letter holds official value and meets both financial and legal liability requirements. - Privacy and Regulatory Compliance

Your information is handled under strict confidentiality standards.

We comply with privacy law, data protection, and IRS (Internal Revenue Service) verification requirements to protect your financial information. - Fast Turnaround for Mortgage and Loan Applications

Our streamlined process ensures you receive your CPA letter within 24–48 hours after verification.

Each document is reviewed for accuracy and precision, ensuring it meets the expectations of banks, mortgage lenders, and credit institutions. - Ethics and Professional Trust

We maintain professional ethics and due diligence in every interaction.

From document review to final delivery, you can rely on our consistency, honesty, and technical precision.

Our Service Coverage Across USA

Ignition Tax provides CPA letter services across multiple states in the United States.

Whether you need local support or prefer remote verification, our licensed CPAs are authorized to serve nationwide.

We specialize in CPA letter for self employed USA, covering all major financial and real estate requirements.

CPA Letter for Self Employed in New York

New York professionals, including freelancers, consultants, and independent contractors, can request a CPA letter to verify income for mortgage, apartment leases, or business loans.

Our CPAs in New York understand local lender requirements and state-specific compliance guidelines.

Each letter is tailored for self employment verification, ensuring lenders and landlords receive clear financial information.

CPA Letter for Self Employed in California

In California, the demand for CPA letters continues to rise among real estate and business clients.

Our CPA services across states include income verification for self-employed borrowers, startups, and sole proprietors.

We handle everything remotely while maintaining AICPA and IRS compliance.

Each CPA letter for self employed follows verified standards for accuracy, financial transparency, and data privacy.

CPA Letter for Self Employed in Texas

For clients in Texas, we prepare CPA letters covering income verification for mortgage, loan, and business credit applications.

Our Texas-based CPAs provide fast turnaround without compromising quality or legal compliance.

These documents confirm self employment, reviewed through income statements, bank records, and tax filings that meet both federal and state verification standards.

CPA Letter for Self Employed Nationwide (Remote and Online CPA Letter Options)

We also offer online CPA letter for self employed services across the U.S.

Whether you’re in a major city or working remotely, you can complete the entire process online — from document upload to CPA verification and delivery.

Each letter is issued digitally on official letterhead and verified by a licensed CPA, ensuring it’s accepted by banks, landlords, and mortgage lenders.

This national service ensures every client — no matter the state — gets reliable CPA verification with full compliance and confidentiality.

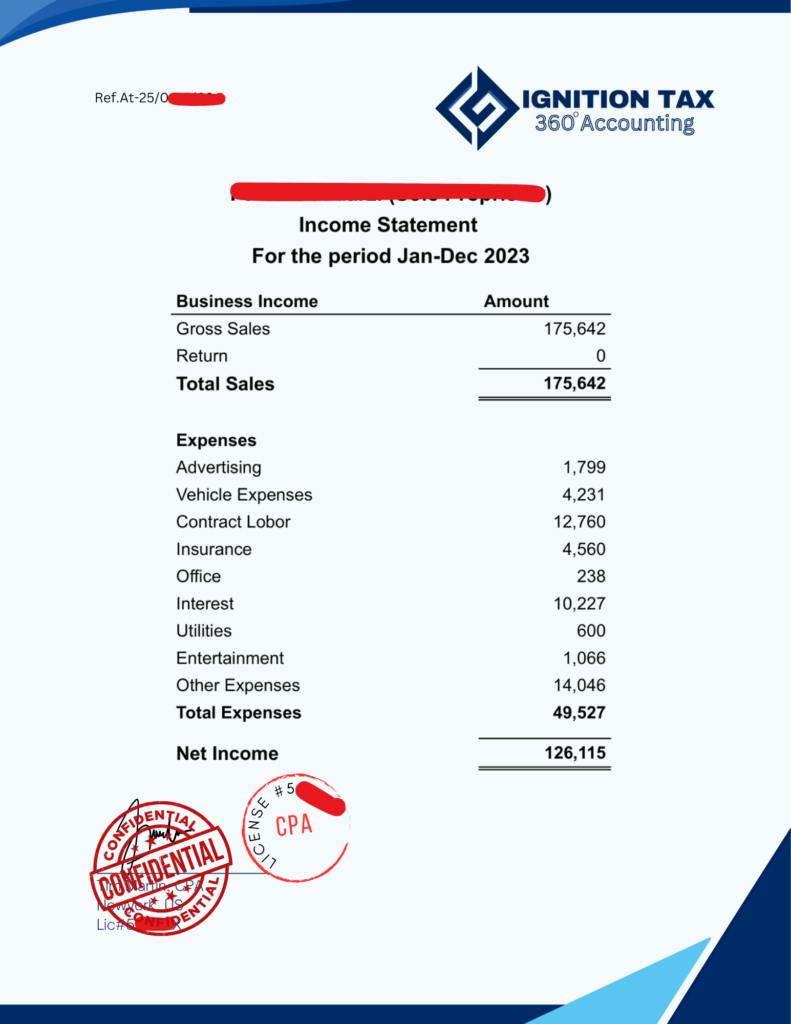

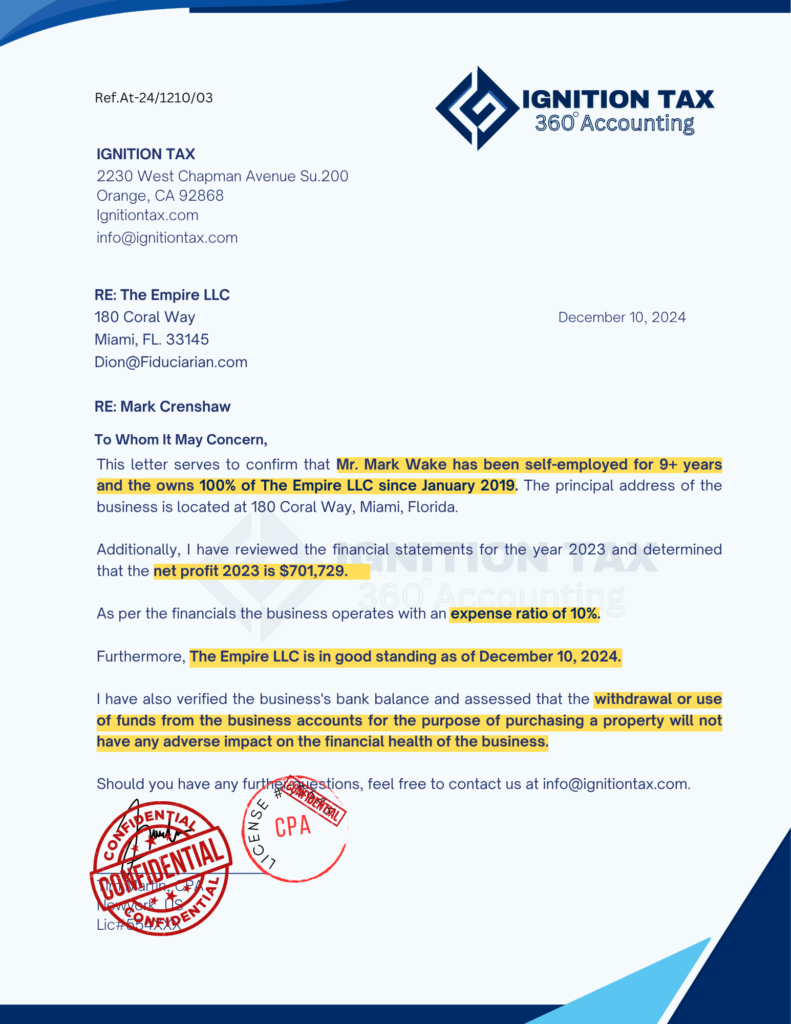

CPA Letter Sample and Documentation Guide

Before you request a CPA letter, it’s helpful to understand what the document includes and how it’s structured.

A properly formatted letter is issued on official letterhead, signed by a Certified Public Accountant (CPA), and accepted as valid income proof for lenders, landlords, and financial institutions.

Below are examples and references to help you understand what each version may contain.

Sample CPA Letter for Self Employed

A sample CPA letter for self employed typically includes:

- CPA’s full name, credentials, and license number

- Business or client name

- Description of self-employment activity

- Confirmation of income range or estimated annual earnings

- Statement of professional opinion based on reviewed documents

This document confirms that a CPA has evaluated your business license, tax returns, or income records in compliance with AICPA and IRS guidelines.

It’s concise, verifiable, and accepted across the United States as proof of self-employment income.

CPA Statement for Self Employed (Income Verification Template)

A CPA statement for self employed follows a structured template designed to verify income for loans, mortgages, or leasing.

This document outlines your business operations and summarizes your verified annual earnings.

A typical statement may read:

“Based on our review of the client’s financial information and tax filings, we confirm that the individual operates as a self-employed professional and has reported consistent income within the past fiscal year.”

This format ensures uniformity and reliability, helping you meet income proof requirements for banks and credit agencies.

CPA Letter Verifying Income of Self Employed Client Sample

A CPA letter verifying income of a self employed client sample is ideal for reference when preparing documentation for mortgage or business loan applications.

It includes confirmation of income verified through tax forms, bank statements, or financial records.

Each sample follows a professional format with official letterhead, CPA signature, and reference to the business license if applicable.

This level of documentation ensures that every income verification meets professional and regulatory expectations for transparency.

At Ignition Tax, all samples and templates adhere to current IRS tax laws and AICPA verification standards.

Compliance and Verification Standards We Follow

Every CPA letter issued by Ignition Tax meets the highest compliance requirements under U.S. financial and accounting regulations.

Our verification process follows established guidelines for accuracy, privacy, and legal accountability.

- AICPA Guidelines:

All letters are prepared under the ethical and technical standards set by AICPA to ensure objectivity and professional credibility. - IRS (Internal Revenue Service) Tax Forms and Tax Law:

We review relevant IRS tax forms and tax returns to confirm your income statement and business compliance under federal tax law. - Privacy Law and Data Protection:

Your personal and financial data remains confidential.

We comply with privacy law, data security, and non-disclosure standards for every client file. - Regulatory Compliance and Verification Accuracy:

Our CPAs maintain transparency and formal verification procedures to ensure the document reflects true, reviewed information.

Each letter we issue carries complete accountability for accuracy and integrity.

This commitment to professional compliance protects you from errors, misrepresentation, and unnecessary legal risk.

Understanding the Cost of a CPA Letter for Self Employed

The cost of CPA letter for self employed depends on several factors — primarily the complexity of your financial records and the level of verification required.

At Ignition Tax, our pricing is transparent, predictable, and based on fair business economics.

Key variables include:

- Complexity of Review: Detailed financial histories or multiple income sources may require more CPA time.

- Document Volume: Reviewing multiple bank statements, tax returns, or supporting documents may increase the verification fee.

- Turnaround Time: Expedited service for loan or mortgage deadlines may include a priority fee.

- Verification Type: Standard income verification letters cost less than specialized CPA opinions for business loans or investor funding.

We operate on a flat rate model wherever possible to keep pricing consistent and accessible.

Each fee reflects professional time, accuracy standards, and compliance under tax law and AICPA ethics.

Clients receive an upfront estimate before we begin.

No hidden charges, no vague billing — just clear communication and trustworthy documentation.

How a CPA Letter Builds Financial Credibility

A CPA letter strengthens your financial credibility by providing an objective review of your income and business operations.

When a Certified Public Accountant (CPA) verifies your financial data, it creates trust between you and the creditor evaluating your application.

Lenders, investors, and landlords rely on this document because it reflects due diligence.

It confirms that your financial statement has been reviewed by a qualified professional who follows AICPA and IRS verification standards.

For a debtor applying for a loan or mortgage, the letter demonstrates consistency and transparency in income reporting.

It helps build confidence with financial institutions by showing a clear audit trail of income records and documentation.

The presence of a CPA signature adds legal assurance — meaning the numbers have been validated, not estimated.

This professional review becomes a key indicator of financial stability and credibility, reducing the risk for creditors and simplifying approval processes.

In short, a CPA letter is more than just proof of income; it’s a trusted verification tool backed by accuracy, ethics, and formal accounting standards.

CPA Letter vs. Other Income Proof Documents

While there are several ways to verify income, a CPA letter provides higher credibility and compliance value compared to common alternatives like bank statements, paychecks, or tax return copies.

Below is a clear comparison showing why institutions prefer this form of documentation.

CPA Letter vs. Bank Statement

A bank statement shows cash flow but doesn’t confirm the source, stability, or authenticity of income.

In contrast, a CPA letter verifies both the accuracy and legitimacy of income through professional review.

It includes confirmation that financial data aligns with tax filings, business activity, and accounting principles.

Banks and lenders view the CPA letter as stronger evidence of income verification, since it’s supported by independent analysis rather than self-reported transactions.

CPA Letter vs. Paycheck or Invoice

Paychecks and invoices highlight your earnings, A CPA letter provides a clearer picture of income stability and compliance with financial standards.

A CPA letter, however, validates income based on reviewed financial records.

It ensures that total earnings, deductions, and business activity have been verified through formal accounting procedures.

This gives lenders and landlords greater confidence in the accuracy of your financial claims.

CPA Letter vs. Tax Return Copy

While a tax return copy provides detailed financial data, it may not always satisfy lender verification requirements.

Returns can include adjustments, deductions, or business expenses that don’t clearly represent net income.

A CPA letter summarizes this data into a clear, verified format, confirming that reported figures match official filings.

It’s concise, easy to review, and supported by the CPA’s professional statement of verification.

As a result, lenders often request both documents together — the tax return for data reference and the letter for professional confirmation.

A CPA letter provides clarity, trust, and compliance in a single verified document.

It bridges the gap between raw financial data and institutional acceptance — helping self-employed individuals prove income with confidence and precision.

Legal and Ethical Considerations

At Ignition Tax, every CPA letter for self employed is issued under strict regulatory compliance and ethical standards.

We understand that your financial information is private and must be handled with professional care.

All client data is protected under privacy law, non-disclosure agreements (NDAs), and data protection regulations applicable across the United States.

This ensures that your personal, business, and financial information remains fully confidential.

Our licensed Certified Public Accountants (CPAs) follow the AICPA Code of Professional Conduct, ensuring each document reflects accuracy, independence, and integrity.

No financial opinion or verification is issued without proper review and documentation.

We also maintain compliance with IRS (Internal Revenue Service) requirements and uphold your right to privacy under both federal and state law.

Every CPA letter undergoes an internal verification and validation process before delivery — protecting you from any form of misrepresentation or legal liability.

Our commitment to transparency, confidentiality, and ethical accountability is central to every service we provide.

What Our Clients Say

Our clients include freelancers, consultants, and small business owners across the United States who rely on Ignition Tax for verified income documentation.

Below are a few fact-based insights shared by clients who used our CPA letters for financial or rental approvals:

- “The CPA letter from Ignition Tax helped me secure my home loan quickly. My lender accepted it without additional paperwork.” — Daniel R., Independent Contractor, Texas

- “I needed an official CPA statement for my apartment lease. The team reviewed my tax documents, verified my income, and delivered the letter within a day.” — Michael T., Consultant, New York

- “Their transparency and attention to detail stood out. The CPA letter included all necessary verification elements, and my mortgage lender approved it immediately.” — Sophia M., Real Estate Advisor, Florida

Our Credentials and Professional Recognition

Ignition Tax is a licensed accounting firm led by certified professionals with extensive experience in CPA documentation, tax verification, and financial compliance.

We hold active memberships with:

- AICPA (American Institute of Certified Public Accountants)

- State Boards of Accountancy across multiple U.S. jurisdictions

- Professional associations focused on business management, financial ethics, and regulatory compliance

Our CPAs are trained in tax law, financial reporting, and verification standards approved by IRS and AICPA frameworks.

With years of experience in assisting self-employed clients, we understand the precision and confidentiality these letters demand.

Each document issued by Ignition Tax reflects:

- Verified income accuracy

- Professional CPA credentialing

- Transparent methodology aligned with ethical and legal standards

Our firm’s recognition comes from consistent client satisfaction and a reputation for delivering verified, audit-ready CPA documentation that meets nationwide acceptance standards.

Get a CPA Letter for Self Employed — Start Your Request Today

Getting your CPA Letter for Self Employed is simple, secure, and fully compliant with U.S. accounting standards.

At Ignition Tax, we value your time and confidentiality.

Submit your financial documents today and receive a verified CPA letter within 24–48 hours.

Our process is handled by licensed Certified Public Accountants (CPA) who review your income statements, bank records, and tax documentation before issuing the letter.

Each document is prepared under professional verification standards and signed on official business letterhead.

We protect your information with strict confidentiality agreements and data security protocols.

Your files remain private, backed by our business license and compliance with privacy law and IRS (Internal Revenue Service) regulations.

Contact Ignition Tax:

📧 Email: info@ignitiontax.com

📞 Phone: (640) 400-1076

📄 Business License: Registered Accounting Firm — Licensed CPA Practice, USA

Submit your documents securely. Get your verified CPA Letter within 24–48 hours.

Each letter is issued only after professional review — ensuring reliability, precision, and full regulatory compliance.

CPA Letter for Self Employed FAQs

Here are quick answers to the most common questions about our CPA letter services.

All responses are clear, factual, and based on U.S. financial verification standards.

Q1: What documents are required?

You’ll need recent tax returns, income statements, and bank records showing self-employment activity.

In some cases, a valid business license or registration certificate may also be requested.

Q2: How long does it take?

Our standard turnaround time is 24–48 hours after receiving all required documentation.

Expedited service is available for mortgage, loan, or rental deadlines.

Q3: Is a CPA letter accepted by banks and landlords?

Yes.

All letters are issued by licensed Certified Public Accountants (CPA) and meet IRS and AICPA verification standards.

They are accepted nationwide by banks, landlords, mortgage lenders, and business creditors as formal proof of income.

Q4: Is the letter valid for mortgage or business loan approval?

Yes.

A CPA letter for self employed is recognized by lenders during loan and mortgage underwriting.

It confirms your income verification, self-employment status, and financial stability — helping streamline your approval process.

Each letter from Ignition Tax is designed to meet official compliance standards while protecting your privacy.

It’s professional, verifiable, and accepted across the United States for every major financial application.

Contact Ignition Tax

At Ignition Tax, we make it simple for self-employed professionals to get verified financial documentation quickly and securely.

Whether you’re applying for a mortgage, loan, or apartment lease, our licensed Certified Public Accountants (CPA) are ready to assist.

We proudly serve clients across the United States with dedicated CPA services in major cities such as Brooklyn, New York (NY), Los Angeles (CA), Houston (TX), Miami (FL), and Chicago (IL) — ensuring localized expertise and compliance with state-level verification requirements.

Request a CPA Letter for Self Employed Now

Start your request online or by phone.

Submit your financial documentation, and one of our licensed CPAs will review your case within hours.

Every CPA Letter for Self Employed is prepared under AICPA and IRS (Internal Revenue Service) verification standards.

City-Based Local Schema Opportunity Example:

CPA Letter for Self Employed in New York, brooklyn, and Nationwide — verified by Ignition Tax, a licensed U.S. accounting firm.

Schedule a Call with a Certified Public Accountant

If you prefer to discuss your case before submission, you can schedule a one-on-one consultation with a Certified Public Accountant.

During the call, we’ll explain the verification process, discuss required documents, and confirm turnaround times.

All calls are confidential and handled by licensed professionals.

We prioritize accuracy, trust, and compliance, ensuring your CPA letter meets both financial and legal documentation standards.

Schedule a Consultation:

📅 Available: Monday–Friday

🕒 Time: 9:00 AM – 6:00 PM (EST)

H3: Email and Support Hours

For document submission or support inquiries, contact us directly at:

📧 info@ignitiontax.com

📞 (640) 400-1076

Support Hours:

Monday–Friday: 9:00 AM – 6:00 PM (EST)

Saturday: 10:00 AM – 2:00 PM (EST)

Sunday: Closed

We ensure secure document handling, end-to-end data confidentiality, and compliance with privacy law across all communication channels.

Related CPA Services at Ignition Tax

Our expertise goes beyond income verification.

Ignition Tax provides a full range of professional CPA services for self-employed individuals and small businesses nationwide.

Each service is backed by proper credentials, transparency, and ethical accounting practices.

Tax Preparation Service for Self Employed

We provide accurate tax preparation and filing services designed for freelancers, independent contractors, and small-business owners.

Our CPAs ensure compliance with IRS tax regulations, identifying eligible deductions, managing expenses, and optimizing your tax strategy.

Business Management Consulting

Our business management consulting service helps entrepreneurs structure, organize, and scale operations effectively.

We analyze your financial statements, improve cost management, and strengthen your business documentation for future loans or investments.

Accountant Reference Letters

We prepare accountant reference letters confirming business performance, operational stability, or professional standing for self-employed clients.

These letters support visa applications, partnerships, and credit evaluations, ensuring a reliable professional reference when needed.

CPA Letter for Loan or Mortgage Borrowers

For individuals applying for personal loans, mortgages, or refinancing, we provide verified CPA letters confirming income, business ownership, and self-employment stability.

Each letter aligns with bank and lender verification requirements to support fast, compliant approval.

At Ignition Tax, our commitment remains clear — accurate verification, professional integrity, and nationwide accessibility.

From CPA letters to tax compliance, we help self-employed individuals present clear, credible, and verifiable financial information wherever required.