CPA Letter For Home Loan

When applying for a home loan, especially if you are self-employed or own a business, lenders often require additional documentation to verify your income and financial stability. One such document is a CPA (Certified Public Accountant) letter. At Ignitiontax, we understand the importance of securing a home loan and the role a CPA letter plays in the approval process. This letter is not just a formality but a critical piece of evidence that can significantly impact your loan application’s success.

What Is a CPA Letter?

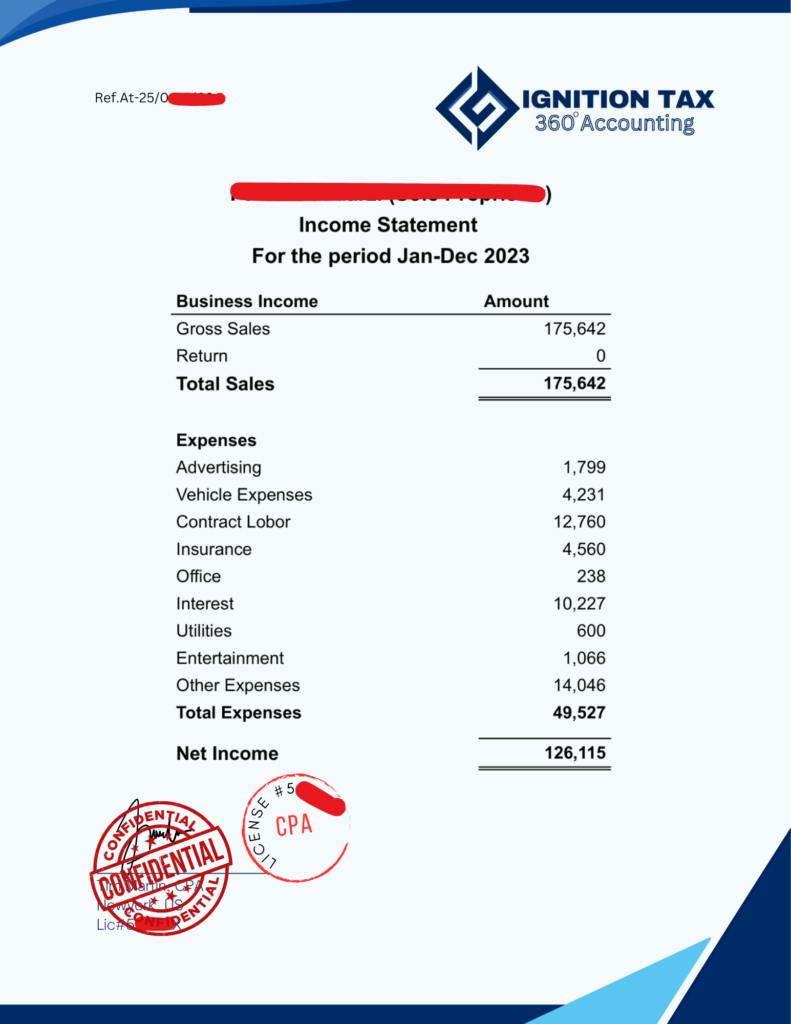

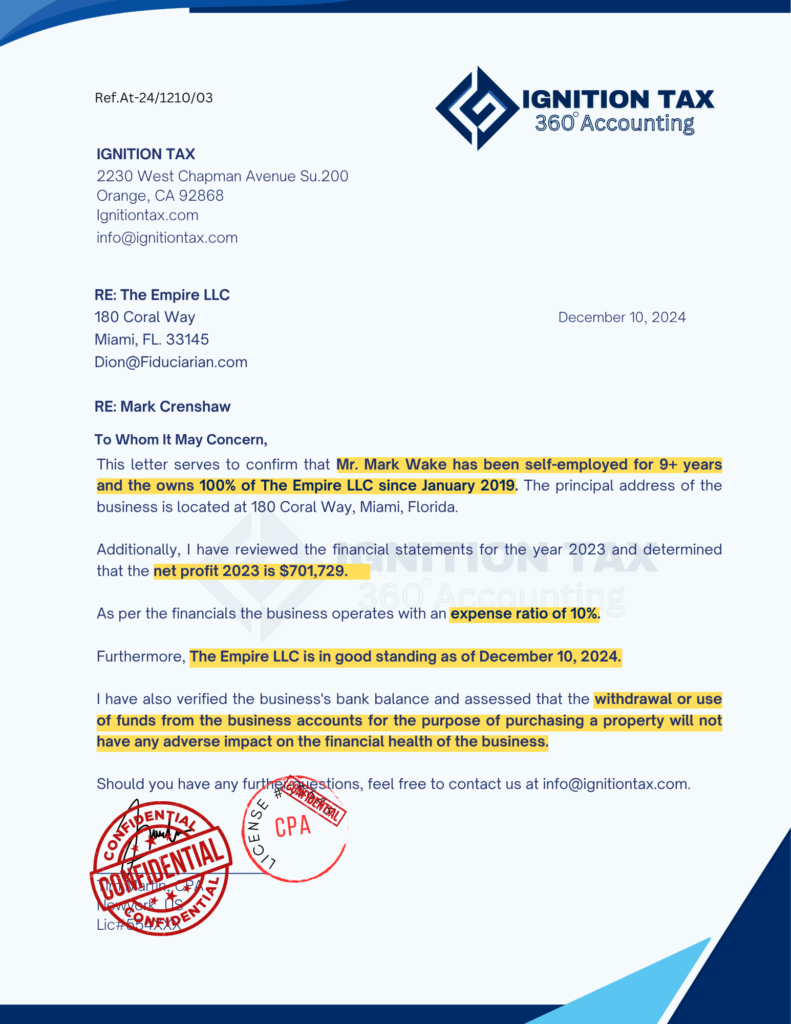

A CPA letter is a document provided by a Certified Public Accountant that verifies the financial information of a borrower. It typically includes details about your income, business operations, and overall financial health. For self-employed individuals or business owners, this letter serves as a substitute for the standard employment verification documents that salaried employees would typically provide, such as W-2 forms or pay stubs.

Why Do Lenders Require a CPA Letter?

1. Income Verification Lenders need to ensure that you have a consistent and reliable income to repay the loan. For salaried employees, this verification is straightforward, but for self-employed individuals, income can fluctuate and may be derived from multiple sources. A CPA letter from Ignitiontax provides a professional and accurate verification of your income, demonstrating to the lender that your reported earnings are consistent with your financial records.

2. Financial Stability Lenders assess your ability to repay the loan over time. They want to ensure that your financial situation is stable and that you are not overextended. The CPA letter details your business’s financial health, including any liabilities or financial obligations that may impact your ability to repay the loan. At Ignitiontax, we ensure that the letter accurately reflects your financial stability, giving lenders confidence in your ability to meet your mortgage obligations.

3. Credibility and Accuracy Self-employed borrowers often have complex financial situations, with income coming from various sources and business expenses that may affect net income. A CPA letter adds credibility to your loan application by confirming that a qualified professional has reviewed your financial information. Ignitiontax provides a detailed and accurate assessment of your financial situation, helping to reduce the lender’s risk and increase your chances of loan approval.

4. Compliance with Lender Requirements Different lenders have specific requirements for documentation, particularly for self-employed borrowers. A CPA letter is often a mandatory requirement. It demonstrates that you are proactive in providing the necessary documentation, which can streamline the loan approval process. Ignitiontax is familiar with these requirements and ensures that the CPA letter meets the lender’s expectations, making your application process smoother.

5. Support During the Loan Process The home loan application process can be complex, and having the right documentation is crucial. A CPA letter can make a significant difference in how your application is perceived by the lender. At Ignitiontax, we support you throughout this process, providing not only the CPA letter but also guidance on how to present your financial situation in the best possible light.

Securing a home loan is a significant financial milestone, and having the proper documentation is essential for success. For self-employed individuals or business owners, a CPA letter is more than just a formality; it’s a vital document that can make or break your loan application. Ignitiontax is committed to helping you navigate this process by providing accurate, credible, and comprehensive CPA letters that meet lender requirements and enhance your chances of securing a home loan.

Whether you are just starting the loan application process or need assistance with documentation, Ignitiontax is here to help. Contact us today to learn more about how we can support you in achieving your homeownership goals.