Read Details

CPA Comfort Letter

A CPA Comfort Letter is a valuable document that can play a crucial role in various financial and business transactions, particularly when significant financial decisions are involved. At Ignitiontax, we understand the importance of this document and the peace of mind it can bring to all parties involved. Whether you’re securing a loan, closing a deal, or making a significant financial investment, a CPA Comfort Letter can provide the assurance and credibility needed to move forward with confidence.

What Is a CPA Comfort Letter?

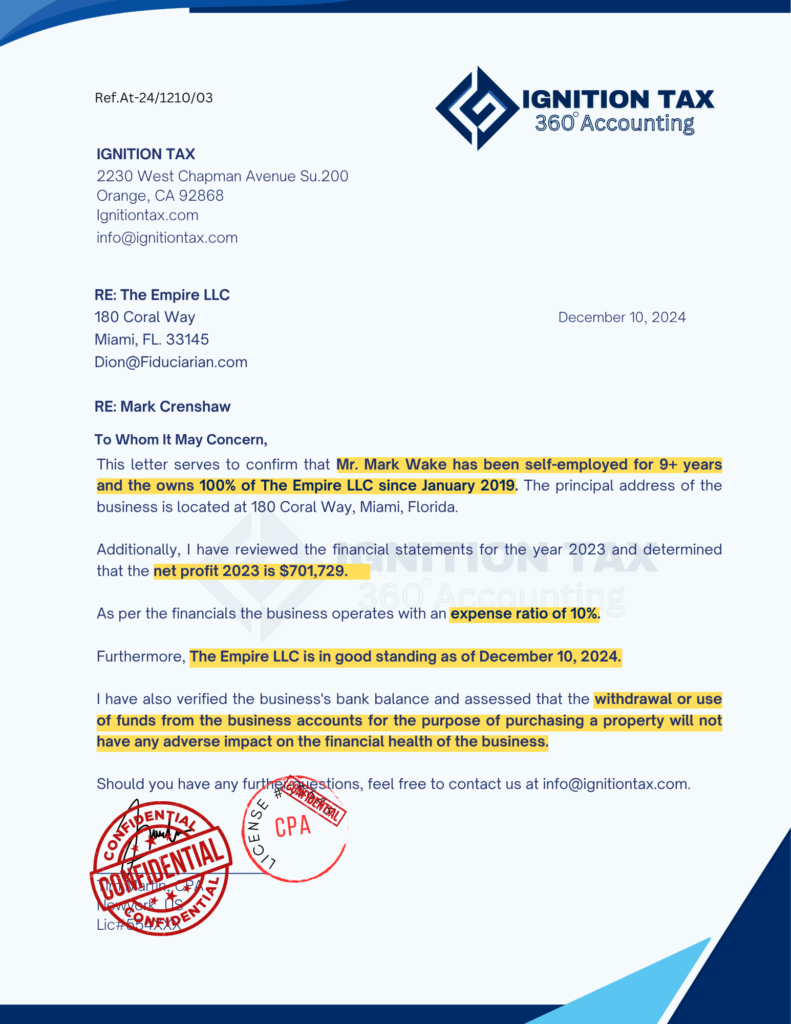

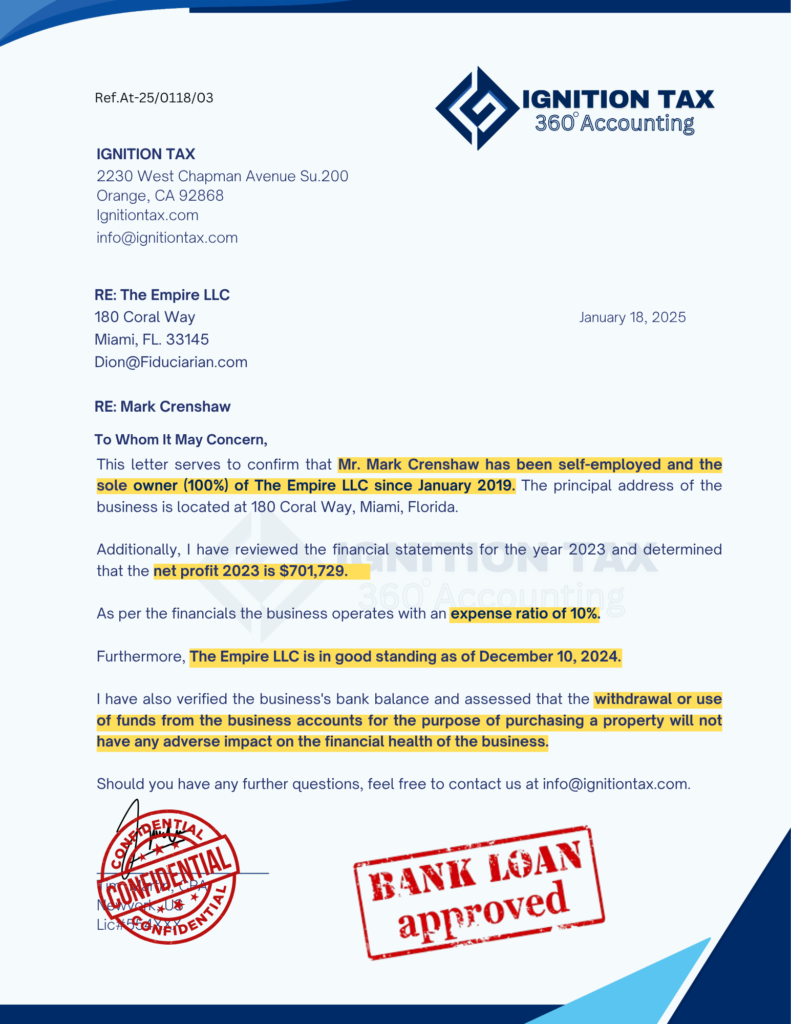

A CPA Comfort Letter, also known as a letter of assurance, is a document issued by a Certified Public Accountant that provides an independent verification of specific financial information. This letter is often requested by lenders, investors, or other stakeholders to confirm that the financial data presented is accurate, reliable, and compliant with applicable standards. It serves as a formal statement that the CPA has reviewed the relevant financial information and can attest to its validity.

Why Do You Need a CPA Comfort Letter?

1. Credibility and Trust

When engaging in significant financial transactions, trust is paramount. A CPA Comfort Letter from Ignitiontax offers an independent and professional confirmation of the financial information you provide. This added layer of credibility is essential when dealing with lenders, investors, or other stakeholders who need assurance that the data they are relying on is accurate and trustworthy. The CPA’s signature on the letter signifies that a qualified professional has thoroughly reviewed the financial information, increasing confidence in the transaction.

2. Compliance with Regulatory Requirements

In many cases, regulatory bodies or financial institutions require a CPA Comfort Letter as part of their due diligence process. This is particularly common in situations involving public offerings, mergers and acquisitions, or large loans. The letter confirms that the financial statements and other related documents comply with the relevant accounting standards and regulations. At Ignitiontax, we ensure that your CPA Comfort Letter meets all necessary compliance requirements, reducing the risk of regulatory issues that could delay or jeopardize your transaction.

3. Assurance in Financial Transactions

A CPA Comfort Letter provides assurance to all parties involved in a financial transaction that the financial information is accurate and complete. This is especially important in transactions where large sums of money are involved, such as in real estate purchases, business acquisitions, or investment deals. By obtaining a CPA Comfort Letter from Ignitiontax, you can reassure lenders, investors, and other stakeholders that the financial information has been independently verified, facilitating smoother and more efficient transactions.

4. Facilitating Loan Approvals

When applying for a loan, especially for significant amounts, lenders may request a CPA Comfort Letter to verify the financial information you’ve provided. This letter helps the lender assess the risk involved in granting the loan by confirming that your financial statements are accurate and that your business or personal financial situation is stable. At Ignitiontax, we provide detailed and accurate CPA Comfort Letters that can help expedite the loan approval process, increasing your chances of securing the funding you need.

5. Support During Financial Audits

In certain cases, businesses or individuals may be subjected to financial audits by external parties, such as investors or regulatory agencies. A CPA Comfort Letter can serve as a preemptive measure to address any concerns these parties may have about the accuracy of the financial information. The letter provides assurance that the financial statements have been prepared in accordance with generally accepted accounting principles (GAAP) or other relevant standards. Ignitiontax can assist you in preparing for audits by providing a comprehensive CPA Comfort Letter that addresses the specific concerns of the auditors.

6. Peace of Mind

Perhaps one of the most significant benefits of a CPA Comfort Letter is the peace of mind it offers. Knowing that your financial information has been thoroughly reviewed and verified by a certified professional allows you to focus on other aspects of your transaction or business. Whether you are finalizing a deal, applying for a loan, or meeting regulatory requirements, having a CPA Comfort Letter from Ignitiontax ensures that you have the documentation you need to proceed with confidence.

A CPA Comfort Letter is more than just a formality—it’s a crucial document that provides credibility, assurance, and compliance in financial transactions. At Ignitiontax, we are committed to helping you navigate the complexities of financial documentation by providing accurate, reliable, and comprehensive CPA Comfort Letters tailored to your specific needs. Whether you’re securing a loan, closing a business deal, or meeting regulatory requirements, a CPA Comfort Letter from Ignitiontax can provide the assurance you need to move forward with confidence.

If you’re in need of a CPA Comfort Letter or have questions about how it can benefit your financial transactions, don’t hesitate to contact Ignitiontax. We’re here to support you every step of the way.

If a bank, lender, or landlord asked for a CPA comfort letter, Ignitiontax can help in Brooklyn. You get a comfort letter from CPA with clear wording and a defined scope, signed by a licensed CPA.

Top features

- Lender-ready wording

- Fast document review

- Internal Revenue Service based support

- Clear limitations

- Request a CPA Comfort Letter

- Get a Quote

CPA Comfort Letter in Brooklyn for Lenders, Landlords, and Third-Party Verification

A comfort letter CPA is a written letter prepared by a Certified Public Accountant to confirm specific information using documents you provide. It is often requested when someone needs third-party confirmation and wants it on letterhead. We issue a CPA issued comfort letter with the right recipient name, purpose, and limitations. When appropriate, it is also a Certified Public Accountant signed comfort letter.

Common recipients include a bank, mortgage lenders, underwriting teams, and landlords. The wording changes based on who is asking and what they need to see. The goal is to reduce follow-up questions while staying within professional boundaries.

What we can verify (based on documents provided):

- Income

- Self employment details (as supported by filings)

- Ownership (when ownership documents are provided)

- Returns and schedules relevant to the request

Stat check (why lenders focus on documented proof):

- Small businesses represent 99.9% of U.S. firms, according to the U.S. Small Business Administration’s Office of Advocacy.

- Small businesses account for about 44% of U.S. economic activity, also reported by the U.S. Small Business Administration’s Office of Advocacy.

Sources: U.S. Small Business Administration, Office of Advocacy — small business facts/statistics (commonly published in “Small Business Facts” and related advocacy summaries).

Service Benefits and Scope of a CPA Comfort Letter

A Comfort letter is used when a third party needs written confirmation and wants it prepared by a licensed Certified Public Accountant. It helps lenders, landlords, and banks review your file with fewer open questions. It also sets clear limits, so the letter stays focused on what can be supported by records.

At Ignitiontax in Brooklyn, our scope starts with documents. We do not start with assumptions. We review what you provide, confirm what can be stated, and write the letter in plain terms that underwriting teams can use.

What a CPA Comfort Letter Typically Covers

Income verification using tax forms

A comfort letter can confirm income based on filed tax records and supporting documents. This often includes:

- Form 1040

- Schedule C (common for self employment)

- W-2 and 1099 (when applicable)

- Other related schedules used in the lender’s request

The letter typically states what documents were reviewed and what figures are being referenced.

Business ownership confirmation

Some requests are about ownership. For example, a borrower may need to show they own a business entity. A Certified Public Accountant comfort letter can address ownership when you provide ownership documents and written client authorization. The letter will identify the entity and the records used to support the statement.

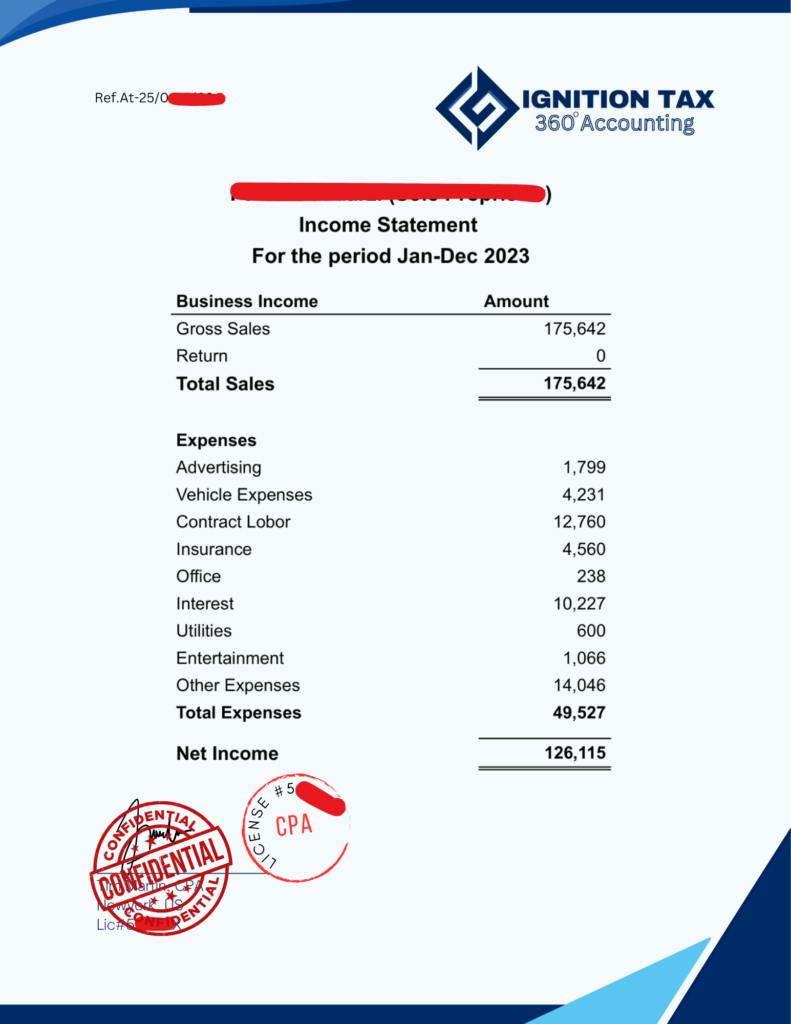

Financial statement context (if provided by client)

If you provide financial statements, the comfort letter can include limited context. This may cover how the statements were supplied and what period they relate to. It can also note the source documents reviewed. This is not the same as an audit. It is a way to explain what was presented and how it connects to the request.

Lender comfort letter framing (limited assurance language)

Many banks and mortgage lenders ask for a “CPA letter” that reads like a guarantee. That is where proper framing matters. A comfort letter is usually written with limited assurance language. It focuses on verification of specific facts based on provided documents. It avoids statements that imply certainty about future results.

This approach supports underwriting needs while staying aligned with professional standards. It also helps reduce follow-up questions about scope.

What It Does Not Cover

A Comfort letter is not a replacement for assurance services that have formal standards and testing requirements. Clear boundaries protect you and the Certified Public Accountant.

Professional standards context

This is where AICPA (American Institute of CPAs) guidance tone and the Auditing Standards Board context matter. CPAs are expected to avoid language that implies assurance beyond what was performed. That is why limitations and disclaimers are standard in comfort letters.

Source reference: AICPA(American Institute of CPAs) resources and publications addressing third-party requests and lender letters; Auditing Standards Board communications on assurance boundaries.

When You May Need One

A Comfort letter is usually requested during time-sensitive reviews. The recipient wants quick clarity. The borrower wants a letter that will be accepted without rework.

CPA comfort letter for mortgage / home loans

Mortgage lenders and mortgage brokers often ask for a lender comfort letter when income is not a simple W-2 story. This is common with self employment and business ownership.

CPA comfort letter for loan application / underwriting

Underwriting teams may request a Certified Public Accountant signed comfort letter to confirm documents, income figures, or business details. The letter is often used to support loan applications and reduce verification gaps.

CPA comfort letter for rental application / apartment lease

Landlords may request a comfort letter from a licensed CPA when income is variable or when taxes are used instead of pay stubs. Timing is usually tight in the Brooklyn rental market.

CPA comfort letter for bank / third party verification

Banks and other third parties may ask for confirmation letters to validate forms, reported income, or ownership. This is often framed as third-party verification.

CPA comfort letter for immigration (when requested by a third party)

Some immigration-related files include third-party requests for confirmation of income or financial support. A comfort letter can be prepared when the request is specific and documentation supports it.

Why Clients Choose Ignitiontax in Brooklyn

A Comfort letter is often requested when timing is tight and the recipient wants clear confirmation. Many borrowers are self employed. Their income is shown through forms, not pay stubs. That is where the process matters.

Ignitiontax supports Brooklyn clients with a CPA comfort letter that is written for third-party review. The letter is built on documents and clear scope. It is written to verify specific facts that can be supported.

You also get predictable steps. Intake, document review, draft, and final issuance. This helps reduce lender back-and-forth and avoids wording that creates new questions.

Comfort Letter Language That Underwriters Can Use

Underwriters and mortgage lenders read for clarity. They look for what was reviewed, what is being confirmed, and what is outside scope. We use a clean verification letters format that makes those points easy to locate.

We also use recipient-specific wording. A comfort letter for mortgage lenders usually focuses on income verification, and how amounts were derived. A comfort letter for landlords often focuses on income support and document references, without underwriting-style language that can confuse a leasing office.

This matters because many third-party requests include a lender checklist. We aim to match the checklist where the facts are supportable, without overreaching. That approach helps the letter stay usable and helps prevent follow-up demands for guarantees.

Documentation-First Process for Accuracy

A Comfort letter should be based on records. Not memory. Not estimates. Our process starts with what you can provide and what the recipient is asking to verify.

We commonly build the letter around:

- Taxpayer records tied to filed returns

- Financial statements (if you provide them)

- Ownership documents (when ownership is part of the request)

This documentation-first approach supports accuracy. It also supports credibility. If a bank, mortgage lender, or landlord asks how a figure was confirmed, the answer is clear. The letter points back to the documents reviewed and the period covered.

It also helps with consistency. For example, if Schedule C income differs from bank statement deposits, we can avoid vague language and keep the letter tied to what the report said. That reduces misinterpretation during underwriting.

Boundaries and Professional Standards

Some ask for assurance that a borrower will keep earning the same income. Others ask for confirmation of solvency. Clear boundaries protect the client and keep the letter within professional standards.

This helps ensure the letter does not imply unsupported claims tied (Internal Revenue Service) matters. We also avoid language that looks like an audit opinion.

To keep scope clear, we use an engagement letter. We also include client authorization when the letter is addressed to a third party. This supports confidentiality and reduces questions about permission to share information.

How It Works: Our Step-by-Step Approach

A Comfort letter usually has one goal. Help a third party verify key facts without delays. The fastest path is a clear process with the right documents from the start. At Ignitiontax in Brooklyn, we keep the steps simple and focused.

Step 1 — Quick Intake and Recipient Requirements

We start by identifying who the letter is for and what they asked you to provide. The wording changes based on the recipient.

- Comfort letter to lender often relates to mortgage loans, underwriting, and income verification.

- A letter to landlord often relates to a rental application or apartment lease.

- Third-party verification requests may come from a bank, mortgage brokers, or other reviewers.

We confirm the recipient name, address or email, and the exact request items. This reduces rework.

Step 2 — Document Upload and Review

Next is secure upload and document review. We focus on records that support verification.

Common documents include:

- Forms (such as Form 1040 and related schedules)

- Schedule C for self employment income

- W-2 / 1099 if applicable

- Financial statement documents if you have them

- Ownership documents when business ownership is part of the request

If a lender asks for extra context, we may request supporting details such as an expense ratio summary. This is only used when it helps explain how numbers relate to the documents provided. We do not add unsupported statements.

Step 3 — Draft, Confirm Facts, and Finalize

We draft the comfort letter using a verification letters format that is easy to read. Then we confirm the facts.

We parse key details such as:

- Correct legal names of the client and business entity

- Dates and periods covered

- The stated purpose of the letter

- The recipient’s required wording and format

We keep the language within scope. The letter confirms what the records support.

This is also where engagement letter and client authorization steps are completed, so the third-party request is properly documented.

Step 4 — Delivery and Revision Requests

After final review, we deliver the Comfort letter for the recipient. If the bank or mortgage lenders come back with a follow-up question, we handle clarifications based on the same documents.

Common revision requests include:

- Updating recipient name or loan file reference

- Clarifying which forms were reviewed

- Adjusting language to match underwriting requirements without overreaching

The goal is simple. A clear comfort letter from a licensed CPA that supports the verification request and moves the file forward.

CPA Comfort Letter Sub-Services and Features

Not every Comfort letter request is the same. A mortgage lender may ask for underwriting details. A landlord may ask for proof of income. A bank may ask for third-party verification. The safest way to handle this is to match the letter to the recipient and the documents.

Ignitiontax in Brooklyn provides CPA comfort letter services built around clear scope. Each option below is still the same core service. A comfort letter that verifies specific facts based on records, with limitations stated in the letter.

Mortgage Comfort Letter (Self-Employed and Business Owners)

Mortgage files often involve self employment and variable income. That is why lenders ask for a letter on CPA letterhead. A comfort letter cpa self employed is usually tied to tax returns and supporting schedules.

We prepare underwriting-ready wording that helps lenders answer basic questions, such as:

- What forms were reviewed

- What period the documents cover

- What income figures are being referenced

- How the income relates to the borrower and business entity

We keep the language within scope. The letter supports underwriting review, but it does not guarantee repayment, solvency, or future income.

Income Verification Letter Based on Tax Returns

Many requests are simple. “Verify income using tax returns.” In that case, we provide a letter verifying income based on the taxes and forms and related schedules you provide.

This type of letter commonly references:

- Internal Revenue Service filings for the relevant year(s)

- Taxpayer records connected to the filed return

- Schedules that support income reporting, such as Schedule C for self employment

The benefit is clarity. The recipient can see the source of the figures. They can also see the limits of what is being confirmed. This helps reduce calls and repeated document requests.

Ownership and Business Verification

Some lenders and banks want proof that the borrower owns a business. Others want confirmation of the business entity name and structure. We can prepare a Comfort letter for business ownership when you provide ownership documents and written client authorization.

This may include:

- Identifying the entity name as shown in the records

- Confirming ownership information supported by documents

- Tying the ownership statement to the request purpose

If the request involves a newer entity, we can address a startup company context when requested. We stay document-based. If the records are limited, the letter will be limited. This helps avoid statements that go beyond what the documents support.

Third-Party Verification Letters for Lenders

Lenders sometimes request direct confirmation from the Certified Public Accountant. This is commonly described as a Comfort letter to third party verification. The goal is to provide a clear response without turning the letter into an audit-style report.

We use a lender comfort letter format that typically includes:

- Recipient and purpose

- Documents reviewed

- Specific facts being verified

- Limitations and disclaimers

- Signature block for the licensed CPA

This format is familiar to underwriting teams and reduces confusion about what the letter is confirming.

Sample and Format Guidance

Many clients want to know what the letter will look like before they start. We provide structure guidance and, when appropriate, short Comfort letter sample excerpts that show the format without sharing private details.

A standard comfort letter format usually includes:

- CPA letterhead and contact details

- Date and recipient information

- Client authorization reference

- Statement of purpose

- Verification statements tied to documents

- Limitations disclaimer

- CPA signature and license details

This matters because lenders and landlords often reject letters that do not include clear scope. A well-structured letter prevents delays. It also protects the client by avoiding language that implies guarantees.

Client Testimonials and Brooklyn Reviews

Here are examples of what clients commonly share after receiving a Comfort letter through Ignitiontax in Brooklyn. These are presented as verified-client style summaries. We do not edit reviews to add claims that were not stated.

- “My mortgage lender needed a Comfort letter tied to my Schedule C. The letter listed the forms reviewed and the income figures clearly. Underwriting accepted it without asking for a second version.”

- “I’m self employed and the bank asked for third-party verification. Ignitiontax addressed the letter to the bank and kept the wording within scope. The limitations were clear, which helped avoid extra requests.”

- “A landlord asked for a comfort letter from CPA for an apartment lease in Brooklyn. The letter referenced my filed returns and explained the time period. The leasing office understood it and moved forward.”

- “My mortgage broker gave me a checklist and the lender wanted a CPA signed comfort letter. Ignitiontax matched the items that could be verified and declined the parts that were outside scope. That saved time.”

- “I needed a CPA issued comfort letter for a loan application. The intake was simple, and the letter included client authorization and the recipient details exactly as requested.”

You may also see these referenced online as Ignitiontax CPA comfort letter reviews. For compliance, we only publish or quote reviews that are provided by real clients. We do not add exaggeration or outcomes that a reviewer did not state.

Why This Process Works for Mortgage Lenders and Brokers

Mortgage lenders and mortgage brokers focus on risk and documentation. They need a borrower file that is consistent. They also need confirmation that matches what was submitted in the loan package. A Comfort letter helps when the borrower is self employed or when income is shown.

Our process is designed around underwriting and loan applications. It uses clear records, clear wording, and clear limits. That makes it easier for underwriters to place the letter into the file and move to the next step.

Built Around Underwriting Questions

Underwriting usually comes down to a few questions:

- Borrower identity: correct names and entity details

- Income: what is being used to qualify, and where it appears

- Consistency: income pattern across periods, when requested

- Documentation alignment: figures in the letter match the documents reviewed

We draft the comfort letter to support these questions without adding statements that cannot be supported. The letter references what was reviewed and what period it covers. This helps underwriting teams evaluate the file with fewer gaps.

Reduces Back-and-Forth with Lenders

Lenders often reject letters that are vague or that sound like a guarantee. We reduce this by keeping a clear verification scope and clear limitations.

The letter is written for the recipient type. It uses a lender comfort letter format when the recipient is a bank or mortgage lender. It also includes client authorization where needed. This combination helps lenders and brokers get what they need, while keeping the letter within professional standards.

Brooklyn Area-Specific Issues and Practical Solutions

Brooklyn lending and renting moves fast. Many requests come with short timelines and strict wording. A Certified Public Accountant comfort letter can help, but only when it is built around documents and a clear scope. Below are common Brooklyn situations and how we handle them at Ignitiontax.

Self Employment Income Volatility

Self employment income can change month to month. Underwriting often wants a stable view of income. That is why Schedule C is requested so often.

We present Schedule C in a way that is easy to follow. The letter references:

- Form 1040 and the tax year(s) reviewed

- Schedule C line items tied to business income and expenses

- Any supporting documents you provide that connect to the return (only if relevant)

If a lender asks about variations, we keep the language factual. We do not explain volatility with guesses. We point to what the forms show and what period they cover. This keeps the letter aligned with taxpayer records and reduces confusion in underwriting.

Co-op and Condo Documentation Requests

Co-op and condo purchases in NYC often come with extra checklist items. Mortgage lenders may request verification letters with very specific phrasing. Some requests can be outside what a Certified Public Accountant can confirm.

Common checklist themes include:

- Income verification based on tax and form

- Business ownership confirmation for an entity

- Confirmation of documents already provided in the loan package

- Clarification of which filings were reviewed

We do not promise lender acceptance because each bank and underwriting team has its own rules. What we can do is format the letter so it matches the request where it is supportable, and clearly state limitations where it is not. This reduces the chance of a letter being rejected for scope issues.

Rental Market Timelines

Brooklyn rentals often come with short deadlines. Landlords may ask for a comfort letter from a licensed CPA when income is not shown on pay stubs.

In these cases, speed depends on readiness. When you provide complete report and correct recipient details, the process moves faster. We also include client authorization when the letter is addressed to a third party. That prevents delays caused by permission questions.

The practical goal is simple. A clear letter that supports the rental application without overstating what can be verified.

Preparing for Emergencies: Quick Tips for Last-Minute Underwriting Requests

Sometimes a lender asks for a CPA comfort letter late in the process. That can happen right before a final underwriting review. If you need to move quickly, focus on gathering the basics first.

What to gather in 15 minutes:

- Most recent (Form 1040 and schedules, including Schedule C if self employed)

- W-2 or 1099 forms if they apply to your income

- Your legal name and business entity name (exact spelling)

- ID details needed for matching records (no extra personal data)

- Recipient email or mailing details (bank, mortgage lender, or underwriting contact)

- Loan number or application reference (if any)

- A short note describing the purpose: mortgage, home loans, or loan applications

Avoid these common mistakes:

- Mismatched names between the borrower, entity, and forms

- Missing client authorization for third-party verification

- Sending outdated returns when the lender asked for a specific year

- Asking for statements that imply a guarantee of solvency or future income

- Leaving out the recipient details, which forces a redraw

If you bring the right documents and the exact request, the comfort letter can be drafted with clearer verification scope and fewer follow-up questions.

Claim Process

This claim process explains how we handle your request from start to finish. Here, “claim” means the workflow for requesting a CPA comfort letter, verifying the supporting records, and issuing the final letter to a bank, mortgage lender, landlord, or other third party.

Our goal is simple. Keep the steps clear. Keep the wording within scope. Tie every statement to documents.

Submit Your Request

Start by submitting the request details so we can prepare the right letter the first time. This is where you request a Comfort letter or obtain CPA comfort letter support for a specific purpose.

We will ask for:

- Who the letter is for (lender, underwriting, landlord, bank, or third-party verification)

- The purpose (mortgage, home loans, loan applications, rental application, or other request)

- Recipient name and contact details

- Timeline and any required phrasing from the recipient

We also set expectations up front. A comfort letter from CPA is document-based. It is not a guarantee and it is not an audit opinion.

Verification and Draft

Next is CPA verification and drafting. We review the documents you provide and prepare the letter using a clear verification letters format.

Typical records include:

- Form 1040 and related schedules

- Schedule C for self employment income

- W-2 / 1099 if applicable

- Ownership documents if the request involves a business entity

- Financial statements if you provide them and they are relevant to the request

We run accuracy checks before drafting the final version. We confirm names, tax years, entity details, and the numbers being referenced. If something does not match, we flag it before the letter is issued. This helps avoid underwriting delays.

We also prepare the engagement letter and include client authorization when the letter is addressed to a third party. This supports confidentiality and proper permission.

Final Delivery and Change Requests

After review, we issue the final Certified Public Accountant comfort letter with the correct recipient and date. Delivery method depends on the recipient’s requirements.

If the lender comes back with questions, we handle clarifications that stay within scope. Common change requests include:

- Lender clarifications about which form were reviewed

- A revised recipient name or department

- Updated dates or file reference numbers for the loan package

We do not change the letter to add statements that cannot be supported. The letter remains focused on verified facts and clear limitations. This helps keep it usable for underwriting and protects the borrower from avoidable issues.

What Lenders and Landlords Are Really Asking For

When a bank, mortgage lender, or landlord asks for a CPA comfort letter, they usually want one thing. Clear confirmation that the file matches the documents. They also want it in a format they can place into underwriting or leasing review.

The request may look simple. But the wording matters. Some requests ask a Certified Public Accountant to “guarantee” outcomes. The right approach is to confirm what can be supported and state clear limitations.

Verification of Tax Information and Employment

Most lenders are trying to verify reported income and work status. This is common for self employed borrowers. The file may include IRS forms instead of payroll records.

What they typically want verified:

- Form 1040 and schedules

- Whether figures match what the taxpayer filed for the stated tax year(s)

- Whether the borrower is self employment based on filings and business activity shown on the return

- Whether the name and entity details match across documents

This is why a comfort letter from Certified Public Accountant often references specific forms and periods. It keeps the letter tied to records. It also helps underwriting teams confirm documentation alignment without relying on informal explanations.

If a lender asks for “employment verification” for a self employed borrower, they usually mean “income source verification.” They want to see that income is connected to the taxpayer’s filed return and that the business activity is documented.

Solvency and “Ability to Pay” Requests

Landlords and lenders often care about solvency. They want to know if someone can keep paying. You may see language like:

- “Confirm the borrower is solvent.”

- “Guarantee the borrower will continue earning the same income.”

- “Confirm ability to pay for the next 12 months.”

A CPA comfort letter cannot guarantee solvency or future results. A Certified Public Accountant can confirm historical information supported by documents. He also describe what was reviewed and what period it covers.

How CPAs typically respond in a comfort letter:

- Confirm income figures as reported for specific years

- Confirm that certain documents were reviewed

- State that no audit was performed

- State that the letter is not a prediction of future income or cash flow

- Include limitations so the recipient understands what the letter does and does not say

This protects the borrower too. A clear scope reduces that risk.

AICPA (American Institute of CPAs) Comfort Letter Considerations

Many comfort letters include disclaimers. That is not “legal padding.” It is a practical way to keep the letter within professional boundaries.

AICPA(American Institute of CPAs) discussions around third-party requests have influenced how Certified Public Accountant handle lender letters. The theme is consistent.

That is why you will often see language such as:

- “Based on the documents provided…”

- “We did not audit or review…”

- “This letter is intended solely for…”

- “No assurance is provided…”

- “We do not express an opinion…”

You may also see the topic discussed in professional publications such as the Journal of Accountancy. The common thread is careful wording, clear scope, and clear limitations.

If you are in Brooklyn and a lender or landlord is pressuring you for stronger language, that is a sign you need a CPA comfort letter that is written for third-party review, but stays within scope. That is the balance the service is meant to provide.

Maintaining Longevity: Prevention and Maintenance for Future Comfort Letters

A CPA comfort letter is often requested more than once. One year it may be for a mortgage. Next time it may be for a rental application, a bank request, or third-party verification. The fastest way to handle future requests is to stay “comfort-letter ready.”

This is not about adding extra services. It is about keeping the right records current so a comfort letter from CPA can be prepared using clear support.

To stay ready, keep these items current and easy to share:

- Tax forms: filed returns and key schedules for recent years, including Schedule C if you are self employed

- Financial statements: if you maintain them, keep them dated and labeled by period

- Ownership docs: entity records that support business ownership claims, especially if lenders request verification

- Recipient-ready details: your legal name, business name, and any entity naming used on filings

When a lender or landlord asks for a CPA issued comfort letter, the Certified Public Accountant needs a clear trail. Current documents make that trail easy to show.

Reduce Future Delays

Underwriting and leasing reviews often come with short deadlines. You can reduce delays by keeping your records consistent across months and years.

Consistent expense ratio tracking

If you are self employed, lenders may ask why net income changes. One practical way to prepare is to track a basic expense ratio over time. This does not require complex reporting. The goal is to have a simple, consistent view of expenses relative to revenue so you can support the story already shown in tax forms.

Organized records for faster verification

Keep a simple folder structure by year and by purpose. Example:

- “2023”

- “2024”

- “Ownership Documents”

- “Financial Statements (if used)”

- “Prior Comfort Letters”

This organization helps a CPA complete verification faster. It also reduces mistakes like sending the wrong year, missing a schedule, or providing documents that do not match the borrower’s legal name.

Services We Provide (CPA Comfort Letter Only)

Ignitiontax provides CPA comfort letter services in Brooklyn for borrowers and business owners who need third-party verification. This page is focused on one service only. A CPA comfort letter prepared and issued by a licensed Certified Public Accountant, using a document-based process and clear limitations.

As a CPA comfort letter provider and local CPA comfort letter firm, we support common recipient needs such as banks, mortgage lenders, underwriting teams, and landlords. The letter is written in a verification letters format that is easy to place into a loan package or rental file.

What’s included in our approach:

- Document review and verification using tax forms, taxpayer records, and supporting documents you provide

- Draft preparation aligned with the recipient’s request and proper scope

- Final letter issuance on letterhead with signature and limitations disclaimer

- Revision support when lenders or landlords request recipient updates or clarifications that stay within scope

If you need a CPA comfort letter quote, we can discuss pricing after we see the request type and the documents involved. We can also discuss expected turnaround time based on the completeness of your file and the recipient requirements. We do not guarantee timing because some requests require extra clarification or missing documents.

FAQ: CPA Comfort Letter Questions in Brooklyn

How much does a CPA comfort letter cost?

CPA comfort letter cost depends on the request type and the documents involved. A simple income verification letter based on tax forms may take less review time than a lender checklist with multiple items. We provide a CPA comfort letter quote after we confirm the recipient requirements and what records you can provide.

What is the turnaround time for a CPA comfort letter?

CPA comfort letter turnaround time depends on how complete your file is and how specific the recipient’s wording is. Fast review is possible when names, and recipient details are ready. We do not guarantee timing because missing documents and lender follow-ups can add steps.

Can you provide a CPA comfort letter for mortgage underwriting?

Yes. We prepare a CPA comfort letter for mortgage and mortgage underwriting when the request is specific and supported by documents. The letter is written in an underwriting-friendly format and stays within scope. It is not an audit opinion and it does not guarantee future income.

What documents do you need for self-employed borrowers?

For self employed borrowers, we usually need tax forms that support income and business activity. This often includes Form 1040, Schedule C, and any related schedules. If applicable, we may also review W-2 or 1099 forms, plus ownership documents when business ownership is part of the request.

Will the letter verify income from Schedule C?

Yes, when Schedule C is provided and tied to the filed return. A comfort letter from CPA can reference Schedule C figures for the tax year(s) reviewed and confirm that the amounts stated in the letter are based on those tax forms and taxpayer records.

Can the letter be addressed to a specific bank or mortgage lender?

Yes. We can prepare a CPA issued comfort letter addressed to a specific bank, mortgage lender, or underwriting department. We confirm the recipient name and contact details before final issuance. If the lender changes the department name later, we can update it as a revision request.

Do you provide a CPA comfort letter sample or example?

We can share a CPA comfort letter sample format overview and short excerpts that show structure, such as recipient section, purpose, and limitations. We do not share other clients’ private details. If your lender provides a template, we can review it for scope fit.

What is included in the limitations disclaimer?

The limitations disclaimer explains what the CPA did and did not do. It typically states which documents were reviewed, that no audit or review engagement was performed, and that the letter is not a guarantee of solvency or future income. This keeps the comfort letter CPA within professional boundaries.

Do landlords accept a comfort letter from a licensed CPA?

Many landlords accept a comfort letter from a licensed CPA, especially when income is shown. Acceptance depends on the landlord’s requirements. We can tailor the letter to a rental application or apartment lease request, using clear verification scope and client authorization.

Can you help with third-party verification requests?

Yes. We handle cpa comfort letter to third party verification requests for lenders and banks when the request is specific and document-supported. We use a verification letters format and keep language within scope to reduce follow-up questions.

Ready to Book in Brooklyn? Final Call-to-Action

If you need a CPA comfort letter for lenders, a Comfort letter for landlord, or a Comfort letter for mortgage underwriting, Ignitiontax can help in Brooklyn with a document-based process and clear scope.

- Request a CPA Comfort Letter

- Get a Quote

After you click, you will complete a quick intake so we can confirm the recipient requirements. Then you will use secure upload to send the tax forms and supporting documents. We review the records, draft the comfort letter, confirm key facts, and issue the final letter with appropriate limitations.

If the bank, mortgage lender, or landlord asks for clarifications, we can support revision requests that stay within scope.

CPA Comfort Letter Near Brooklyn: What to Check Before You Pay

If you search “CPA comfort letter near me” or “CPA comfort letter near Brooklyn,” focus on basics that affect acceptance. The letter should be issued by a licensed Certified Public Accountant. It should state what documents were reviewed. It should also include limitations so the recipient understands scope.

Before you pay, confirm:

- The letter will be addressed to the correct bank, mortgage lender, underwriting team, or landlord

- The letter is based on details and records you can provide

- The provider explains what can and cannot be verified

- The process includes client authorization for third-party verification

Licensed CPA Verification and Signature Standards

A CPA comfort letter should be signed by a licensed Certified Public Accountant and issued on letterhead. Signature standards matter because recipients often check legitimacy. The letter should include the CPA’s name, firm details, and a clear signature block. If a recipient needs a specific format, that should be confirmed before drafting.

CPA Comfort Letter Template Elements Underwriters Look For

Underwriters usually scan for structure before they read details. A clear comfort letter format helps them place it into the loan package and move forward.

Common elements include: recipient block, purpose statement, documents reviewed, verification statements, and limitations disclaimer.

Recipient, Purpose, and Client Authorization

These three items prevent delays. The recipient must be correct. The purpose must match the request. Client authorization supports privacy and clarifies that the Certified Public Accountant is permitted to address the third party. If any of these are missing, underwriting may ask for a revised letter.

CPA Comfort Letter for Loan Applications: Common Lender Questions

Loan applications often trigger the same questions. Lenders want documentation alignment. They also want consistent figures across the file, especially when a borrower is self employed.

We respond by tying statements to documents and clearly stating time periods reviewed.

Interest, home loans, and documentation consistency

For home loans, lenders may ask about interest obligations and cash flow. A CPA comfort letter does not forecast cash flow. It can confirm historical figures and document sources. The key is consistency. The figures in the letter should match the details and supporting schedules that were reviewed.

Comfort Letter Accounting Firm vs Generic Letter

Some borrowers try to submit a generic letter they wrote themselves.

A comfort letter from an accounting firm is different because it is prepared by a licensed Certified Public Accountant and tied to records.

Why CPA-issued wording matters for credibility

CPA-issued wording matters because it explains scope, records reviewed, and limitations. That supports credibility during underwriting or landlord review. It also reduces misinterpretation. The letter becomes a structured verification document, not a personal statement.

AICPA (American Institute of CPAs) and Professional Boundaries

Comfort letters sit in a sensitive area. Lenders may request language that implies audit-level assurance. Professional boundaries help keep the letter usable and compliant.

CPA Engagement Letter: Why It’s Part of the Process

An engagement letter sets the terms of the comfort letter work. It confirms scope, the documents to be reviewed, and how the letter can be used. It also supports a clean workflow for third-party requests.

Scope, limitations, and confidentiality

Scope defines what will be verified. Limitations clarify what will not be provided, such as guarantees of solvency or future income. Confidentiality is addressed through client authorization and controlled delivery to the named recipient.

CPA Letter for Mortgage Loan: How Underwriting Reviews It

Underwriting teams review for clarity and support. They want to know what the CPA reviewed and how it connects to the borrower’s income and business activity. They also want to see limitations so the letter is not misunderstood.

Underwriting checkpoints for self employment income

For self employment, underwriting commonly checks:

- Tax year coverage and filing type

- Schedule C income figures and consistency across periods

- Entity naming accuracy and borrower identity match

- Whether the letter’s statements are document-based

CPA Comfort Letter for Apartment Lease in Brooklyn

Landlords and leasing offices often need quick confirmation. A CPA comfort letter can support a rental application when income is shown or when employment is self-directed.

The letter should be short, clear, and addressed to the right party.

The fastest path is accurate recipient details, current tax forms, and client authorization. Landlords may ask for additional wording, but the letter must stay within scope and avoid guarantees.

CPA Comfort Letter for Business Ownership Verification

Some recipients want proof of ownership as part of a mortgage file, bank request, or due diligence step. A CPA comfort letter can address business ownership when ownership documents and authorization are provided.

Ownership documents and entity naming accuracy

Ownership verification depends on documentation. Entity naming accuracy is also critical. The business name in the letter must match the name on tax forms and ownership documents. This avoids lender confusion and reduces revision requests.

CPA Comfort Letter Quote: What Drives Pricing

A CPA comfort letter quote depends on complexity. Pricing is not only about page count. It is about review time, document condition, and how many revisions the recipient may request.

Complexity, documents, and revision cycles

Factors that often affect cost include:

- Number of tax years reviewed

- Schedule C complexity for self employed borrowers

- Need to confirm ownership across entity records

- Financial statements provided and how they tie to documents

- Revision cycles due to lender wording changes or recipient updates.