CPA Apartment Letter in Just 2 Hours!

- No Bank Statement Required

- No Tax Return Required

Letter Verifies

- Business Details or Employment Verification

- Employment status and monthly/yearly income

- Any Other statement by Tenant/Landlord

- Letter Validation to Tenant/Landlord Provided

100% Approval or Get Refund

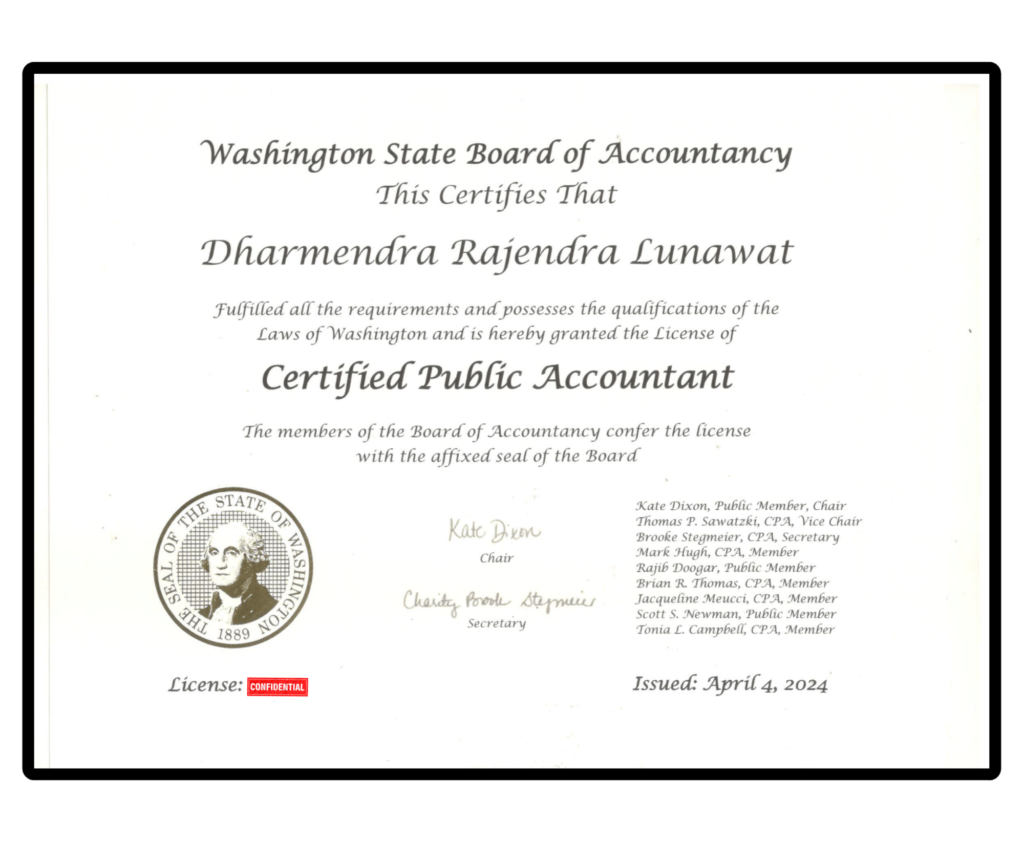

Licensed CPA

- No Bank Stat. Req.

- No Tax Return Req.

Letter Verifies

- Business Details or Employment Verification

- Employment status and monthly/yearly income

- Any Other statement by Tenant/Landlord

- Letter Validation to Tenant/Landlord Provided

Licensed CPA

- No Bank Stat. Req.

- No Tax Return Req.

Letter Verifies

- Business Details or Employment Verification

- Employment status and monthly/yearly income

- Any Other statement by Tenant/Landlord

- Letter Validation to Tenant/Landlord Provided

100% Approval or Get Refund

How it works

-

1

Request Letter

Click the "Request" button to place your order easily.

-

2

Checkout

Complete the process to confirm your order.

-

3

Submit Details

Fill out the form after checkout and get live CPA portal access.

-

4

Order Confirmation

You are all done, CPA will write your letter in 2 hours.

100% Letter Approvals

CPA Letter Request

We are in process of getting rental apartment in newyork city and my landlord demands CPA letter that verifies my details.

- Employment Status

- Years of employment

- Certify my monthly income

- Confirms my yearly approx. income

- CPA Reviewed my tax return (W-2 & 1099)

Letter Request

We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

- Name of the Business

- Self-employment for a minimum of 2 years

- Applicant's Ownership Percentage

- Verification of Yearly Income ($280,000)

- Confirmation that the CPA has reviewed the financial statements for the previous year.

Letter Request

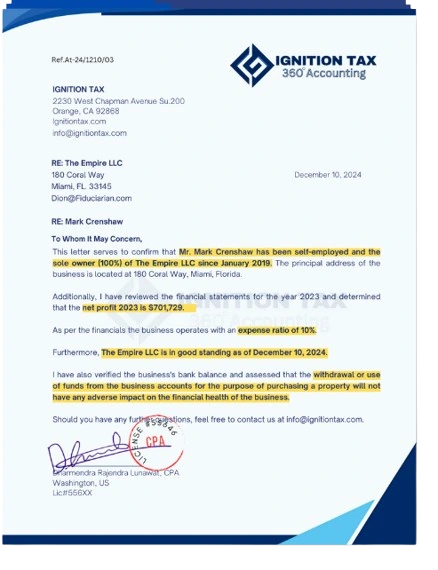

Our lenders require a letter that verifies the business expense ratio, which is 15%. Additionally, the letter should state that “the use of business funds does not have any adverse impact on the business”.We are currently in the process of fulfilling a request for our tenant, who requires a letter to verify the following details for housing purposes:

Our CPA-provided letters has an exceptional 100% approval rate. To date, we have successfully delivered over 1,100 letters, ensuring seamless approvals for our clients every time.

Why Choose Us for Your CPA Verified Letters?

As we are US Licensed CPA, we’re committed to making the process easy, reliable, and stress-free for you.

CPA take the time to create letters customized to your unique situation and prepared just for you.

Direct verification to your Lenders or Loan Officers.

Fast Delivery in Just 2 Hours.

Guaranteed Approval or Your Money Back.

How does it works

After purchase, you’ll receive the Letter Request Form. Complete and submit it as per your requirments, and the CPA will begin preparing your letter.

100% Approval or Get Refund

What CPA Letter Certify to Lenders/Loan Officers

Financial Position

- The Income for the year 2023 is $450,000

- Business operates on expense ratio of 15%

- CPA has reviewed the business financials or Tax Returns

- Use of Business Funds will not have any adverse impact on business operations

Business Ownership

- Mr. ABC owns 100% of AB Consulting LLC

- AB Consulting LLC is active from Jan 2023

- Mr. ABC Self Employed from 2 Years

- Business is Active on the location (Address)

Exployment Verification

- Mr. Jack working as a Chef since 2021

- CPA has reviewed the contract of his job

- Mr. Jack has hourly wage of $2,000

- Mr. Jack Yearly gross income $105,000