CPA Letter for Mortgage Lender

96% Approval Rate

If you are in process of loan & lender requires CPA letter to verify your status, Income or self employment then you are in the right place.

Our Services Plan

- CPA Letter

CPA Letter for Self Employed or Business owners needs a CPA letter for mortgage lender

$295

Service includes

- Licensed CPA letter for Mortgage Lender

- Certified by a tax authority

- Approved by all over US Lenders

- 06 Hours Express Delivery

- Unlimited Revisions till the Loan Approval

- 96% lender approval rate as of Today

Letter includes

- Income Verification

- Self Employment Verification

- Ownership Percentage

- Rental Appartment Letter

- Comfort Letter/ Mortgage Letter

- CPA Letter (Plus)

CPA Letter Plus for Business Partners, Self Employed Individuals need a CPA letter for Mortgage lender

$495

Services includes

- Licensed CPA letter for Mortgage Lender

- Approved by all over US Lenders

- 02 Hours Urgent Delivery

- Unlimited Revisions till the Loan Approval

- 96% lender approval rate as of Today

- Financial Statement Verification on Letterhead

Letter includes

- Financial Statement Verification

- Self Employment Income Verification

- Use of Business Funds

- Expense Ratio

- Third Party Verification

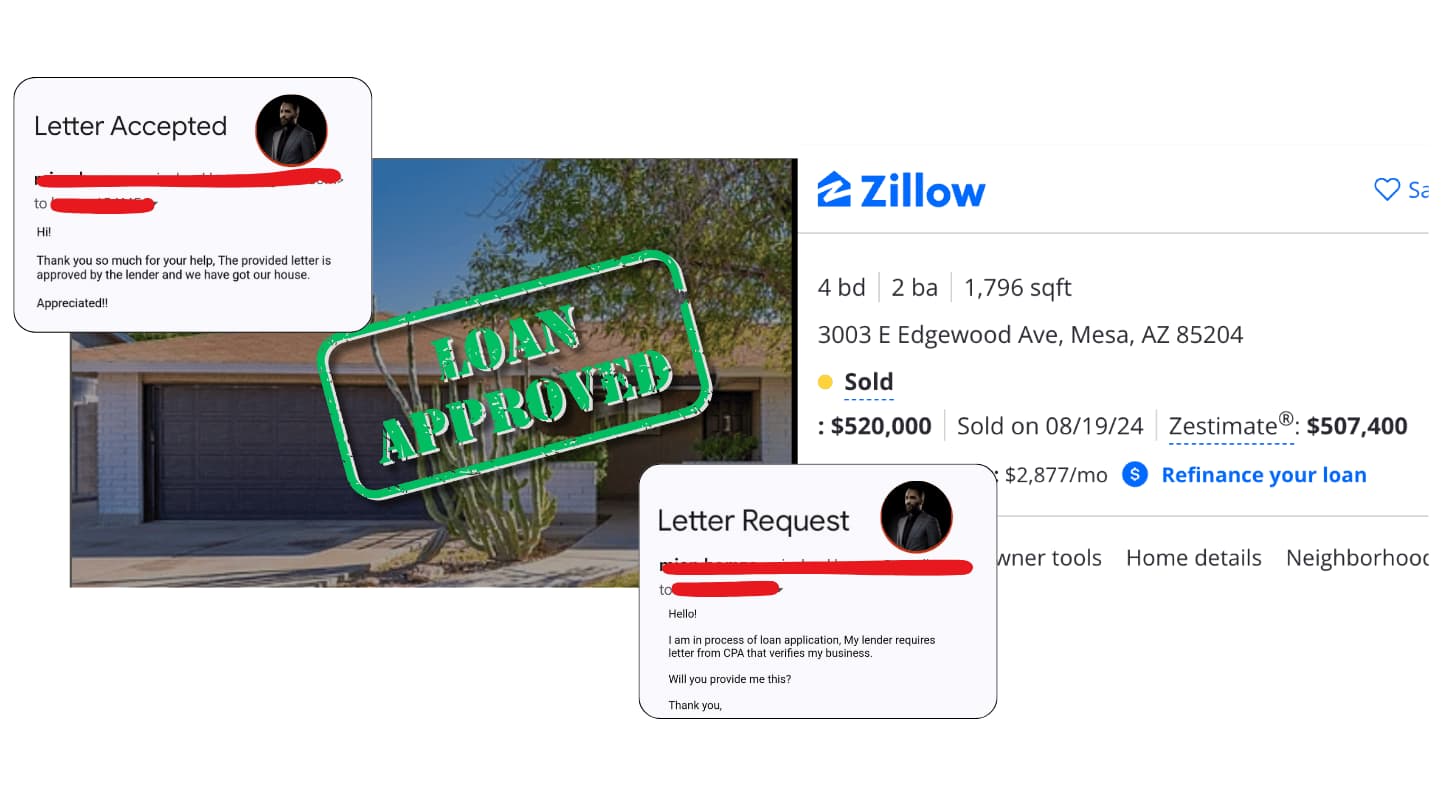

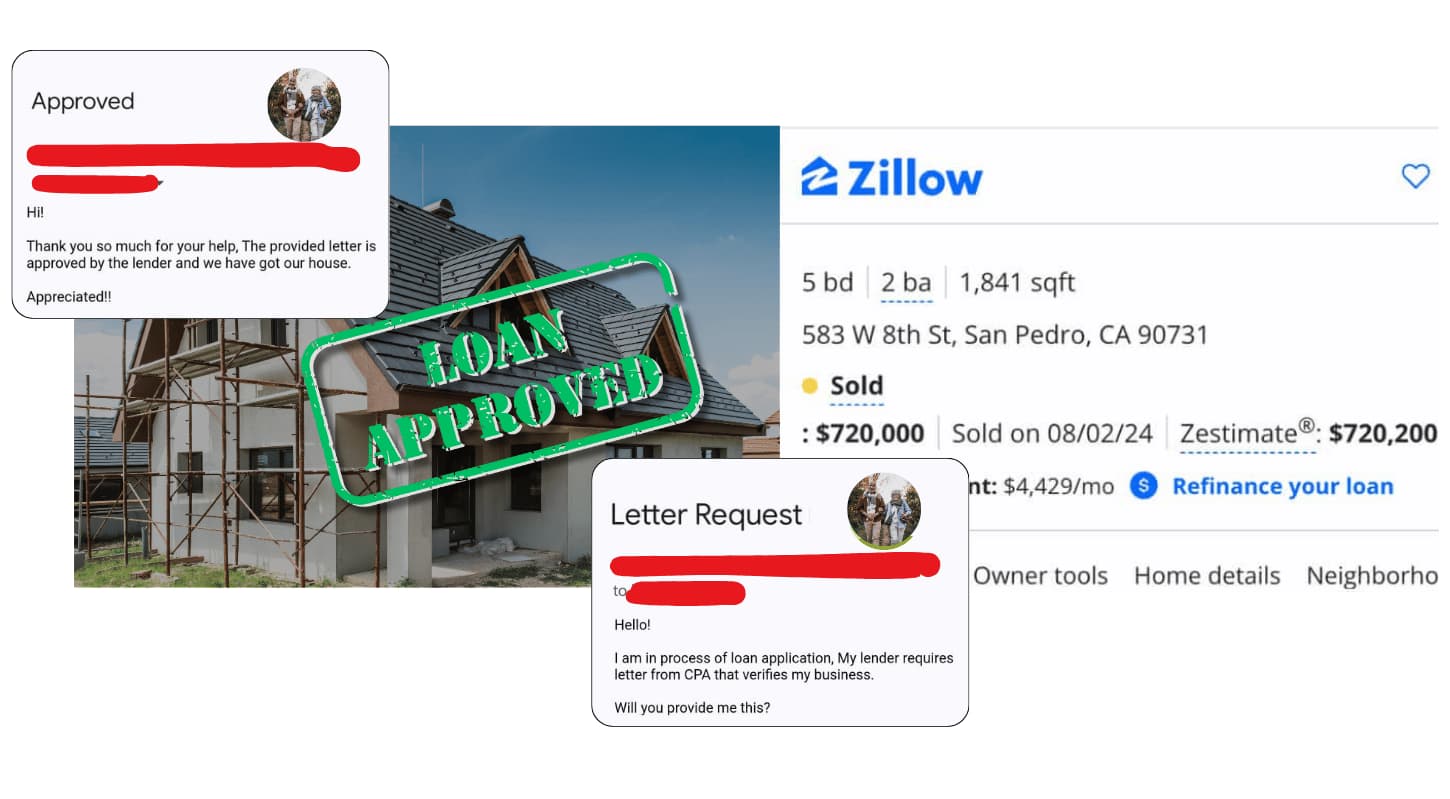

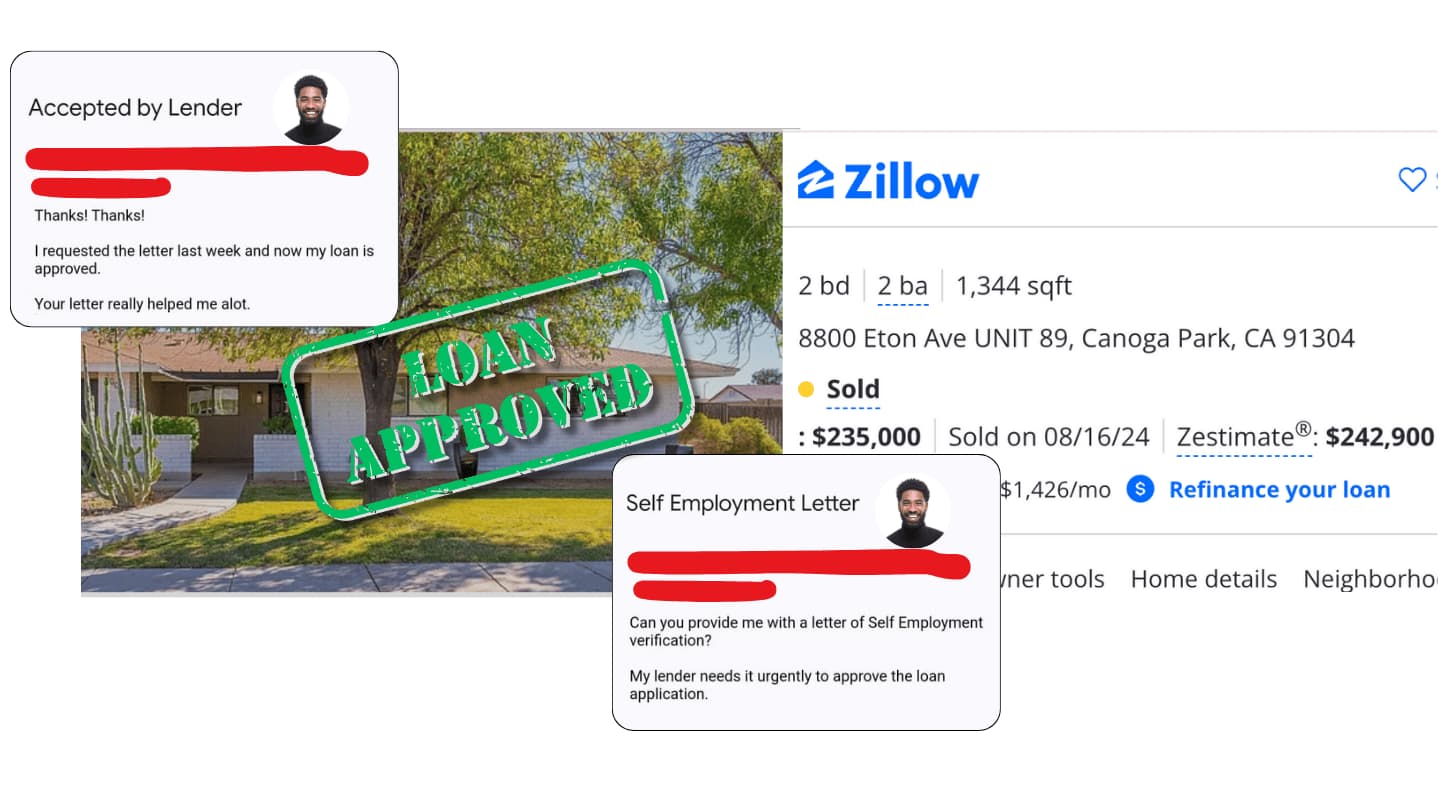

Recent Loan Approvals

If you’re business owner, Employed or self-employed and have talked to mortgage lenders, bankers, landlords, renting or buying a home, they might have request you for a letter from your CPA to confirm or estimate your income. Below Find out what CPA letters are and how CPA letter services can help you.

Types of Letters

CPA Letter for a Mortgage

A CPA letter for a mortgage verifies a borrower’s financial information. This letter is mostly requested by lenders to confirm the accuracy of an individual’s income, assets, and financial health at the time of applying for a mortgage loan.

CPA Letter of Income Verification

A CPA Letter confirms an individual’s or Business income at the time of applying for loans, mortgages, or rental properties. It is requested by the lender to verify the applicant’s monthly or yearly income. This sort of letter assures the lender about the repayment of the loan. Mostly requested for self-employed individuals or those with irregular income streams.

CPA Letter to Verify Self-Employment

A CPA letter to certify an applicant individual’s self-employment status and income. This letter is mostly requested by lenders and landlords. The main purpose is to assure the income and the stability of a self-employed person’s business.

CPA Letter for Rental Apartment

It is a letter provided by a Certified Public Accountant (CPA) to verify a tenant’s financial status, usually required by landlords or property managers during the rental application process. This letter confirms the tenant’s income, employment status, etc.

CPA Comfort Letter

A CPA comfort letter that confirms certain financial or accounting positions of an individual or business. It is used in multiple situations, such as at the time of mortgage loan, Yearly audits, or during business transactions. The letter offers a level of comfort and assurance to third parties, typically lenders or investors, by providing a validation of financial information.

CPA Letter for Withdrawal of Business Funds

A CPA letter for the withdrawal of business funds is a statement that CPA mentioned on the letter along with the business details. The purpose of this letter confirms to the lender that withdrawal of funds from a business will not negatively affect the business operations or stability.

CPA Letter for Use of Business Funds

A CPA letter for the use of business funds is also a statement that certifies the bank or lender that use of business funds will not harm or affect the business.

CPA letter to lenders and third party verifications

A CPA letter is required by lenders or other third parties to confirm the accuracy of financials of a borrower or client, especially when applying for loans, mortgages, or other financial transactions.

CPA Letter for Financial Statement Verification

A CPA letter to validate the accuracy and completeness of a client’s financial statements, such as profit and loss statements and balance sheets. This letter is required for businesses seeking to reassure investors, lenders, or other stakeholders of the reliability of their financial records.

CPA Employment Verification

A CPA letter confirms an individual’s employment status and income. This letter is commonly requested by employers, lenders, or other entities that need to verify a person’s employment status and income level.

CPA Letter of Business Existence

A CPA letter of business existence is an official document issued by a Certified Public Accountant (CPA) that confirms the existence and operational status of a business. CPA verifying the business name, address, ownership on the letterhead. It can be requested by banks, lenders, or other entities to verify that a business is legally registered and active on the location.

CPA Letter for Business Assets

A CPA letter verifies and details a business’s assets. It’s commonly needed for securing loans, attracting investors, or during mergers and acquisitions. The letter confirms the value and existence of assets like equipment, inventory, real estate, and intellectual property.

Information Required on a CPA Letter

While every CPA letter is unique, most of the letters include the details like Name, Address, Business nature of the applicant.

CPA Letterhead

A valid CPA letterhead contains the details like name, address, License,Company Logo of the active Certified Public Accountant.

Applicant’s Name

It includes the full legal name of the Person who is requesting this letter.

Applicant’s Business Name & Address

The details of the business are required to be mentioned on the CPA letterhead to Certify the business, Income, ownership percentage, etc.

In the case of Sole Proprietor, applicant name and address will be mentioned on the letter.

Applicant Contact Details

The contact of the applicant is to be mentioned on the letterhead to keep in record of the Certified Public Accountant and third party.

Percentage of Ownership

Percentage of ownership shows how much of a company or asset someone owns. It indicates their share of control over the company’s equity, usually given as a percentage of the total.

Example: Emily owns 40% of a small tech startup, meaning she has a 40% stake in the company. This percentage gives her a corresponding share of the company’s profits, voting rights, etc.

Nature of Business

The CPA letters describe the nature of a business, what a company does and its primary activities. It outlines the core operations, products, or services that define the business.

Example: A bakery’s nature of business is to bake and sell fresh bread and pastries, serving local customers with a focus on high-quality, homemade baked goods.

Number of Years the Applicant Has Been in Business

The CPA letter should include the exact number of years or the date since the applicant has been working or owned the business.

Example: Mr. John Doe Smith has been in business as the sole proprietor since 07, July 2021.

Employment Status (For Employed)

The lender requested the applicant to provide a letter to verify the Employment status and Income of the Applicant.

Example: Mr. David worked as Director of Finance at Abc Marketing, Inc.

Time Since the CPA has Prepared the Client’s Tax Returns

This statement is requested by the lender to specify from how long the CPA has been preparing the applicant’s tax returns.

Example: Mr. Eric Holland, CPA has prepared and Filed the tax return of “Applicant” for the year 2023..

Statement Certify The CPA has Reviewed The Applicant’s Tax Returns or Financial

Statement as per Lender Requirement

This statement on CPA letters is requested by the lender at the time of loan process. It verifies that CPA has reviewed the Financials or Tax Return of the applicant.

CPA Signature

CPA letter must have a signature from Licensed CPA whether independent or working for an accountancy firm.

Licence Credentials

The letter can not be considered as validated until the CPA complete name, Licence number and address mentioned on the letter.

FAQs

What’s a CPA letter? +

Google A CPA letter is a document from a Certified Public Accountant that confirms your financial status or details. It’s often needed to reassure lenders or landlords about your financial reliability..

How much will a CPA letter cost? +

A CPA letter for a mortgage costs $295 for standard service or $495 for urgent requests. Both options include unlimited revisions until your loan is approved.

What’s included in a CPA letter for the self-employed? +

It covers income verification, self-employment status, and ownership percentage. For business partners, it also includes financial statement verification and details on how business funds are used.

How quickly can I get a CPA letter? +

If you go for standard service, you’ll receive your letter in 6 hours. Need it faster? The urgent option delivers in just 2 hours.

Why do lenders need a CPA letter? +

Lenders use CPA letters to verify that you have a stable income and are financially sound enough to repay a loan.

Where can I get a CPA letter? +

You can get a CPA letter from your current CPA or through Ignition Tax. They can provide the verification you need based on your financial documents.